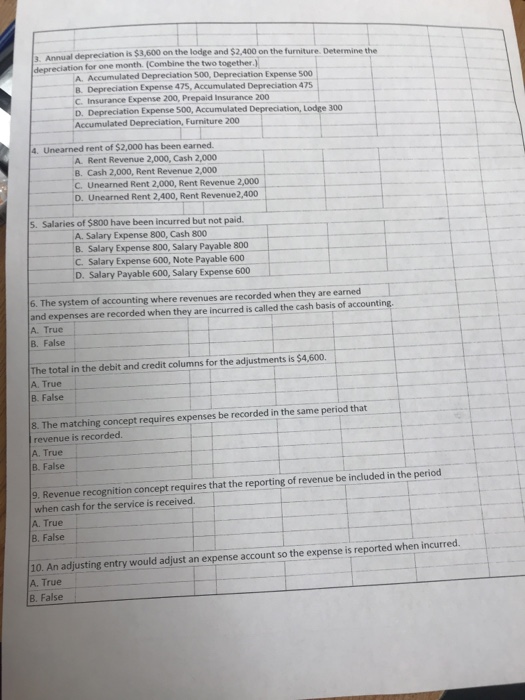

eciation is $3,600 on the lodge and $2,400 on the furniture. Determine the 3. Annual depre depreciation for one month. (Combine the two together.) Accumulated Depreciation 500, Depreciation Expense 500 8. Depreciation Expense 475, Accumulated Depreciation 475 C. Insurance Expense 200, Prepaid Insurance 200 D. Depreciation Expense 500, Accumulated Depreciation, Lodge 300 Accumulated Depreciation, Furniture 200 4. Unearned rent of $2,000 has been earned A Rent Revenue 2,000, Cash 2,000 8. Cash 2,000, Rent Revenue 2,000 C. Unearned Rent 2,000, Rent Revenue 2,000 D. Unearned Rent 2,400, Rent Revenue2,400 5. Salaries of $800 have been incurred but not paid. A. Salary Expense 800, Cash 800 B. Salary Expense 800, Salary Payable 800 C. Salary Expense 600, Note Payable 600 D. Salary Payable 600, Salary Expense 600 6. The system of accounting where revenues are recorded when they are earned and expenses are recorded when they are incurred is called the cash basis of accounting A. True B. False The total in the debit and credit columns for the adjustments is $4,600. A. True B. False 8. The matching concept requires expenses be recorded in the same period that revenue is recorded A. True B. False 9. Revenue recognition concept requires that the reporting of revenue be included in the period when cash for the service is received. A. True B. False 10. An adjusting entry would adjust an expense account so the expense is reported when incurred. A. True B. False eciation is $3,600 on the lodge and $2,400 on the furniture. Determine the 3. Annual depre depreciation for one month. (Combine the two together.) Accumulated Depreciation 500, Depreciation Expense 500 8. Depreciation Expense 475, Accumulated Depreciation 475 C. Insurance Expense 200, Prepaid Insurance 200 D. Depreciation Expense 500, Accumulated Depreciation, Lodge 300 Accumulated Depreciation, Furniture 200 4. Unearned rent of $2,000 has been earned A Rent Revenue 2,000, Cash 2,000 8. Cash 2,000, Rent Revenue 2,000 C. Unearned Rent 2,000, Rent Revenue 2,000 D. Unearned Rent 2,400, Rent Revenue2,400 5. Salaries of $800 have been incurred but not paid. A. Salary Expense 800, Cash 800 B. Salary Expense 800, Salary Payable 800 C. Salary Expense 600, Note Payable 600 D. Salary Payable 600, Salary Expense 600 6. The system of accounting where revenues are recorded when they are earned and expenses are recorded when they are incurred is called the cash basis of accounting A. True B. False The total in the debit and credit columns for the adjustments is $4,600. A. True B. False 8. The matching concept requires expenses be recorded in the same period that revenue is recorded A. True B. False 9. Revenue recognition concept requires that the reporting of revenue be included in the period when cash for the service is received. A. True B. False 10. An adjusting entry would adjust an expense account so the expense is reported when incurred. A. True B. False