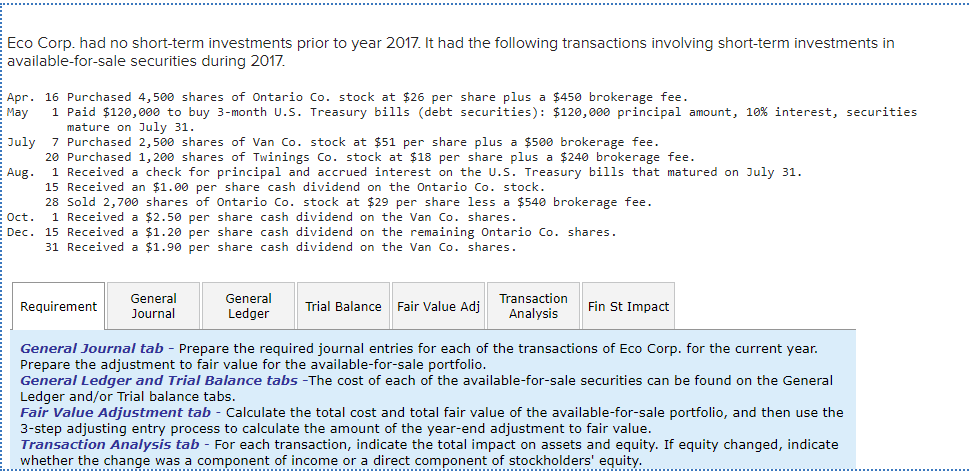

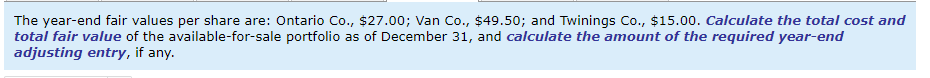

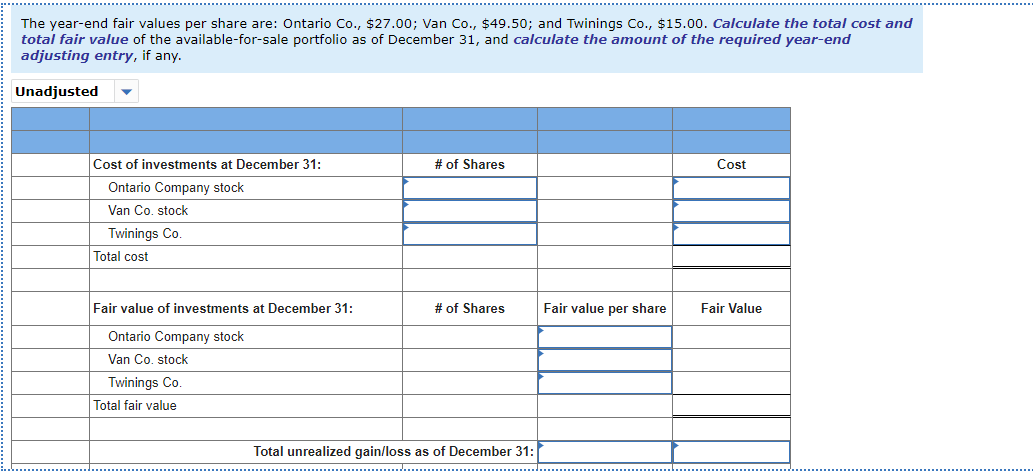

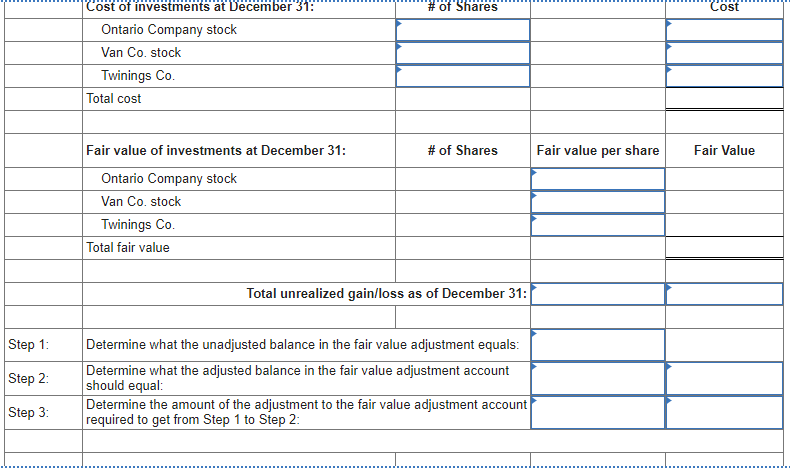

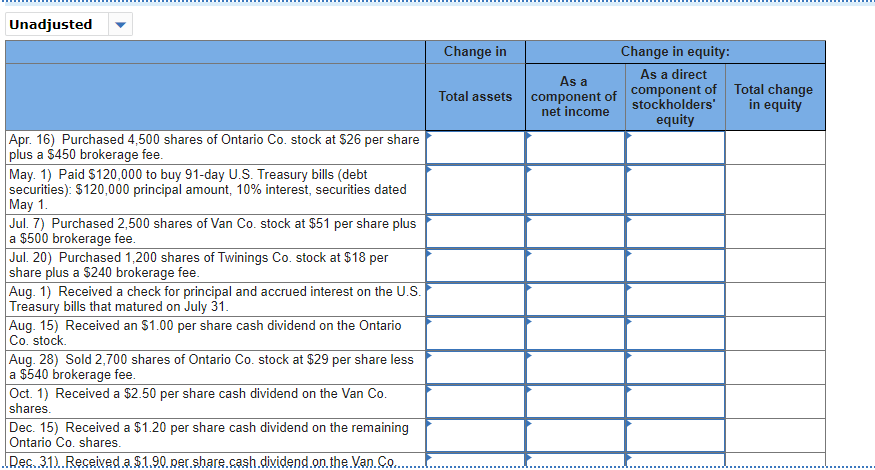

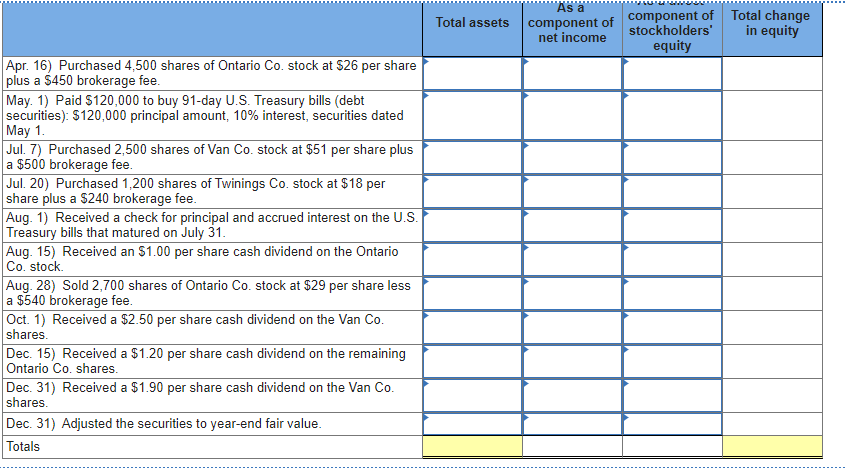

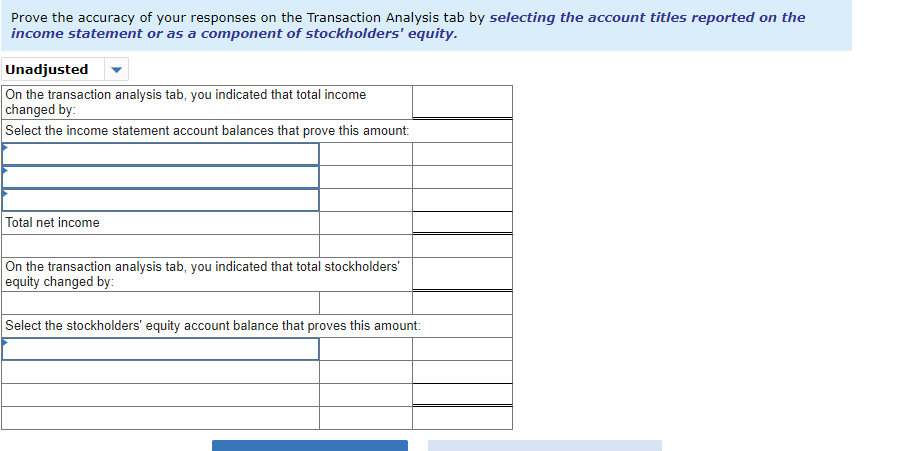

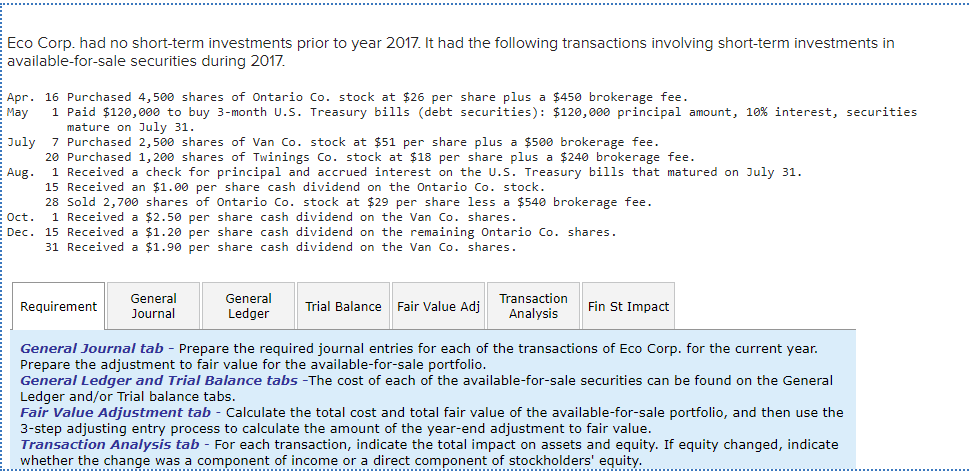

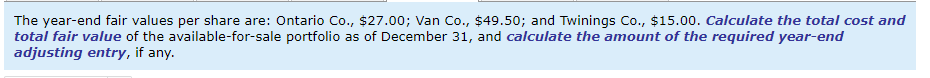

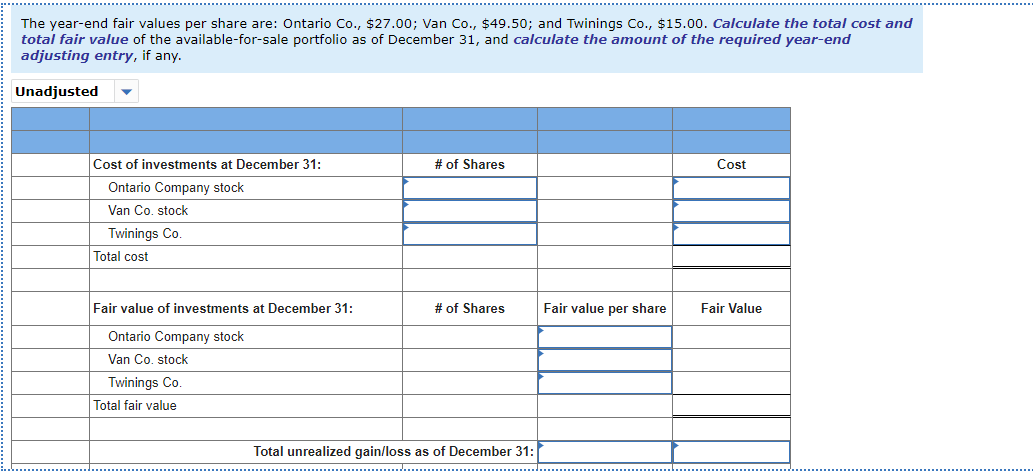

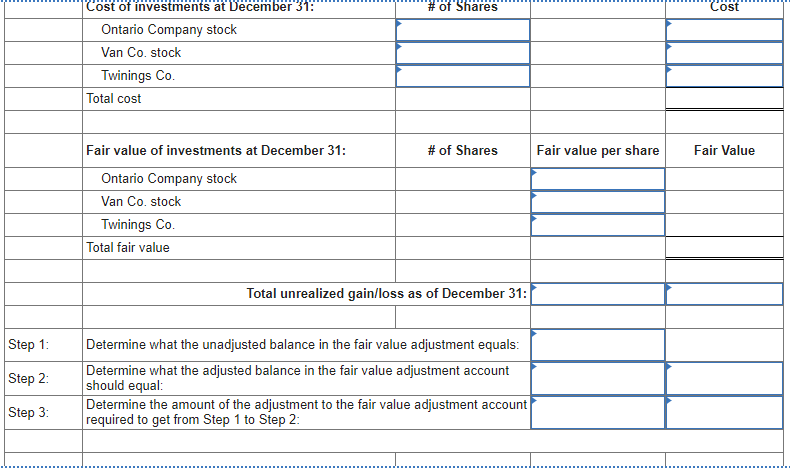

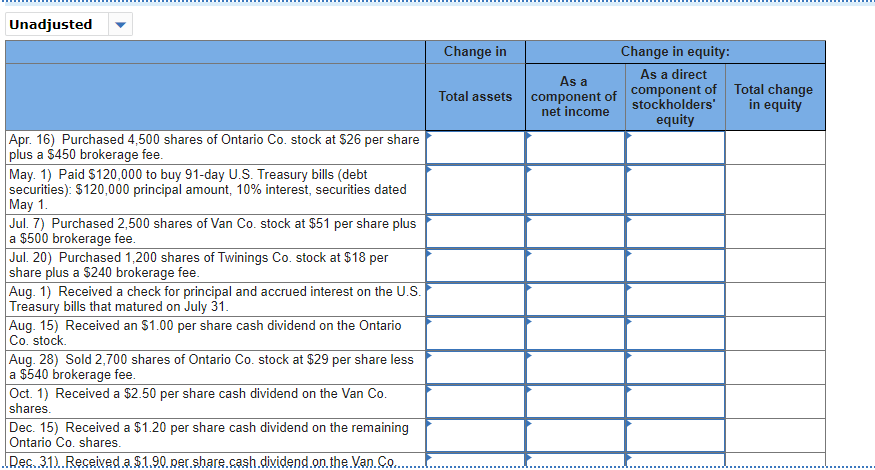

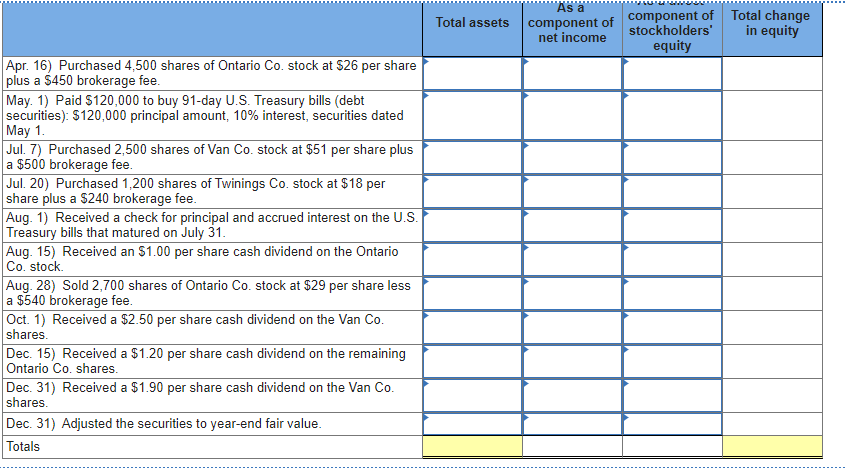

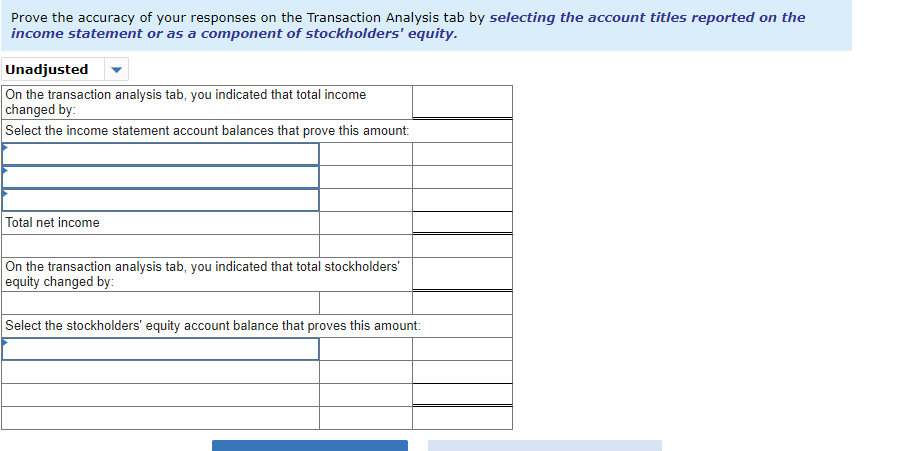

Eco Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017 Apr. 16 Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May 1 Paid $120,000 to buy 3-month u.s. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities mature on July 31. July 7 Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. 20 Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1 Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. 15 Received an $1.00 per share cash dividend on the Ontario Co. stock. 28 Sold 2,700 shares of Ontario Co. stock at $29 per share less a $540 brokerage fee. 1 Received a $2.50 per share cash dividend on the Van Co. shares. Dec. 15 Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. 31 Received a $1.90 per share cash dividend on the Van Co. shares. Oct. Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact General Journal tab - Prepare the required journal entries for each of the transactions of Eco Corp. for the current year. Prepare the adjustment to fair value for the available-for-sale portfolio. General Ledger and Trial Balance tabs -The cost of each of the available-for-sale securities can be found on the General Ledger and/or Trial balance tabs. Fair Value Adjustment tab - Calculate the total cost and total fair value of the available-for-sale portfolio, and then use the 3-step adjusting entry process to calculate the amount of the year-end adjustment to fair value. Transaction Analysis tab - For each transaction, indicate the total impact on assets and equity. If equity changed, indicate whether the change was a component of income or a direct component of stockholders' equity. The year-end fair values per share are: Ontario Co., $27.00; Van Co., $49.50; and Twinings Co., $15.00. Calculate the total cost and total fair value of the available-for-sale portfolio as of December 31, and calculate the amount of the required year-end adjusting entry, if any. The year-end fair values per share are: Ontario Co., $27.00; Van Co., $49.50; and Twinings Co., $15.00. Calculate the total cost and total fair value of the available-for-sale portfolio as of December 31, and calculate the amount of the required year-end adjusting entry, if any. Unadjusted # of Shares Cost Cost of investments at December 31: Ontario Company stock Van Co. stock Twinings Co. Total cost Fair value of investments at December 31: # of Shares Fair value per share Fair Value Ontario Company stock Van Co. stock Twinings Co. Total fair value Total unrealized gain/loss as of December 31: # of Shares Cost Cost of investments at December 31: Ontario Company stock Van Co. stock Twinings Co. Total cost Fair value of investments at December 31: # of Shares Fair value per share Fair Value Ontario Company stock Van Co. stock Twinings Co. Total fair value Total unrealized gain/loss as of December 31: Step 1: Step 2: Determine what the unadjusted balance in the fair value adjustment equals: Determine what the adjusted balance in the fair value adjustment account should equal: Determine the amount of the adjustment to the fair value adjustment account required to get from Step 1 to Step 2: Step 3: Unadjusted Change in Change in equity: As a As a direct component of component of Total change stockholders' net income in equity equity Total assets Apr. 16) Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May. 1) Paid $120,000 to buy 91-day U.S. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities dated May 1. Jul. 7) Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. Jul. 20) Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1) Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. Aug. 15) Received an $1.00 per share cash dividend on the Ontario Co. stock. Aug. 28) Sold 2,700 shares of Ontario Co stock at $29 per share less a $540 brokerage fee. Oct. 1) Received a $2.50 per share cash dividend on the Van Co. shares Dec. 15) Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. Res. 3.1).. Received a $1.90.Dec.share.cash dividend on the Van.Co........ Total assets As a component of net income component of Total change stockholders' in equity equity Apr. 16) Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May. 1) Paid $120,000 to buy 91-day U.S. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities dated May 1 Jul. 7) Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. Jul. 20) Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1) Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. Aug. 15) Received an $1.00 per share cash dividend on the Ontario Co. stock. Aug. 28) Sold 2,700 shares of Ontario Co. stock at $29 per share less a $540 brokerage fee. Oct. 1) Received a $2.50 per share cash dividend on the Van Co. shares Dec. 15) Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. Dec. 31) Received a $1.90 per share cash dividend on the Van Co. shares. Dec. 31) Adjusted the securities to year-end fair value. Totals Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the income statement or as a component of stockholders' equity. Unadjusted On the transaction analysis tab, you indicated that total income changed by: Select the income statement account balances that prove this amount: Total net income On the transaction analysis tab, you indicated that total stockholders' equity changed by: Select the stockholders' equity account balance that proves this amount: Eco Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017 Apr. 16 Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May 1 Paid $120,000 to buy 3-month u.s. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities mature on July 31. July 7 Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. 20 Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1 Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. 15 Received an $1.00 per share cash dividend on the Ontario Co. stock. 28 Sold 2,700 shares of Ontario Co. stock at $29 per share less a $540 brokerage fee. 1 Received a $2.50 per share cash dividend on the Van Co. shares. Dec. 15 Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. 31 Received a $1.90 per share cash dividend on the Van Co. shares. Oct. Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact General Journal tab - Prepare the required journal entries for each of the transactions of Eco Corp. for the current year. Prepare the adjustment to fair value for the available-for-sale portfolio. General Ledger and Trial Balance tabs -The cost of each of the available-for-sale securities can be found on the General Ledger and/or Trial balance tabs. Fair Value Adjustment tab - Calculate the total cost and total fair value of the available-for-sale portfolio, and then use the 3-step adjusting entry process to calculate the amount of the year-end adjustment to fair value. Transaction Analysis tab - For each transaction, indicate the total impact on assets and equity. If equity changed, indicate whether the change was a component of income or a direct component of stockholders' equity. The year-end fair values per share are: Ontario Co., $27.00; Van Co., $49.50; and Twinings Co., $15.00. Calculate the total cost and total fair value of the available-for-sale portfolio as of December 31, and calculate the amount of the required year-end adjusting entry, if any. The year-end fair values per share are: Ontario Co., $27.00; Van Co., $49.50; and Twinings Co., $15.00. Calculate the total cost and total fair value of the available-for-sale portfolio as of December 31, and calculate the amount of the required year-end adjusting entry, if any. Unadjusted # of Shares Cost Cost of investments at December 31: Ontario Company stock Van Co. stock Twinings Co. Total cost Fair value of investments at December 31: # of Shares Fair value per share Fair Value Ontario Company stock Van Co. stock Twinings Co. Total fair value Total unrealized gain/loss as of December 31: # of Shares Cost Cost of investments at December 31: Ontario Company stock Van Co. stock Twinings Co. Total cost Fair value of investments at December 31: # of Shares Fair value per share Fair Value Ontario Company stock Van Co. stock Twinings Co. Total fair value Total unrealized gain/loss as of December 31: Step 1: Step 2: Determine what the unadjusted balance in the fair value adjustment equals: Determine what the adjusted balance in the fair value adjustment account should equal: Determine the amount of the adjustment to the fair value adjustment account required to get from Step 1 to Step 2: Step 3: Unadjusted Change in Change in equity: As a As a direct component of component of Total change stockholders' net income in equity equity Total assets Apr. 16) Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May. 1) Paid $120,000 to buy 91-day U.S. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities dated May 1. Jul. 7) Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. Jul. 20) Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1) Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. Aug. 15) Received an $1.00 per share cash dividend on the Ontario Co. stock. Aug. 28) Sold 2,700 shares of Ontario Co stock at $29 per share less a $540 brokerage fee. Oct. 1) Received a $2.50 per share cash dividend on the Van Co. shares Dec. 15) Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. Res. 3.1).. Received a $1.90.Dec.share.cash dividend on the Van.Co........ Total assets As a component of net income component of Total change stockholders' in equity equity Apr. 16) Purchased 4,500 shares of Ontario Co. stock at $26 per share plus a $450 brokerage fee. May. 1) Paid $120,000 to buy 91-day U.S. Treasury bills (debt securities): $120,000 principal amount, 10% interest, securities dated May 1 Jul. 7) Purchased 2,500 shares of Van Co. stock at $51 per share plus a $500 brokerage fee. Jul. 20) Purchased 1,200 shares of Twinings Co. stock at $18 per share plus a $240 brokerage fee. Aug. 1) Received a check for principal and accrued interest on the U.S. Treasury bills that matured on July 31. Aug. 15) Received an $1.00 per share cash dividend on the Ontario Co. stock. Aug. 28) Sold 2,700 shares of Ontario Co. stock at $29 per share less a $540 brokerage fee. Oct. 1) Received a $2.50 per share cash dividend on the Van Co. shares Dec. 15) Received a $1.20 per share cash dividend on the remaining Ontario Co. shares. Dec. 31) Received a $1.90 per share cash dividend on the Van Co. shares. Dec. 31) Adjusted the securities to year-end fair value. Totals Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the income statement or as a component of stockholders' equity. Unadjusted On the transaction analysis tab, you indicated that total income changed by: Select the income statement account balances that prove this amount: Total net income On the transaction analysis tab, you indicated that total stockholders' equity changed by: Select the stockholders' equity account balance that proves this amount