Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Economics ___ A corporation receives a net $9, 300,000 as a result of an issue of $10,000,000 of 10% 20-year bonds: interest is paid semi-annually

Economics

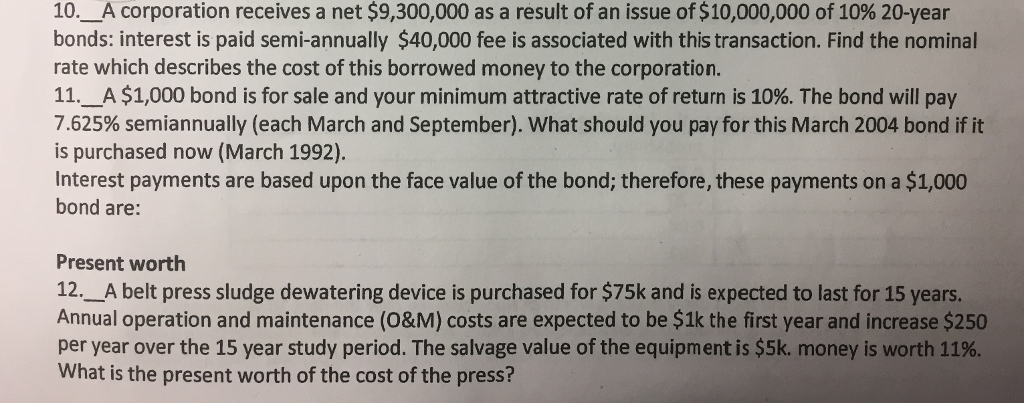

___ A corporation receives a net $9, 300,000 as a result of an issue of $10,000,000 of 10% 20-year bonds: interest is paid semi-annually $40,000 fee is associated with this transaction. Find the nominal rate which describes the cost of this borrowed money to the corporation. ___ A $1,000 bond is for sale and your minimum attractive rate of return is 10%. The bond will pay 7.625% semiannually (each March and September). What should you pay for this March 2004 bond if it is purchased now (March 1992). Interest payments are based upon the face value of the bond; therefore, these payments on a $1,000 bond are: ___ A belt press sludge dewatering device is purchased for $75k and is expected to last for 15 years. Annual operation and maintenance (O & M) costs are expected to be $1k the first year and increase $250 per year over the 15 year study period. The salvage value of the equipment is $5k. money is worth 11%. What is the present worth of the cost of the pressStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started