Answered step by step

Verified Expert Solution

Question

1 Approved Answer

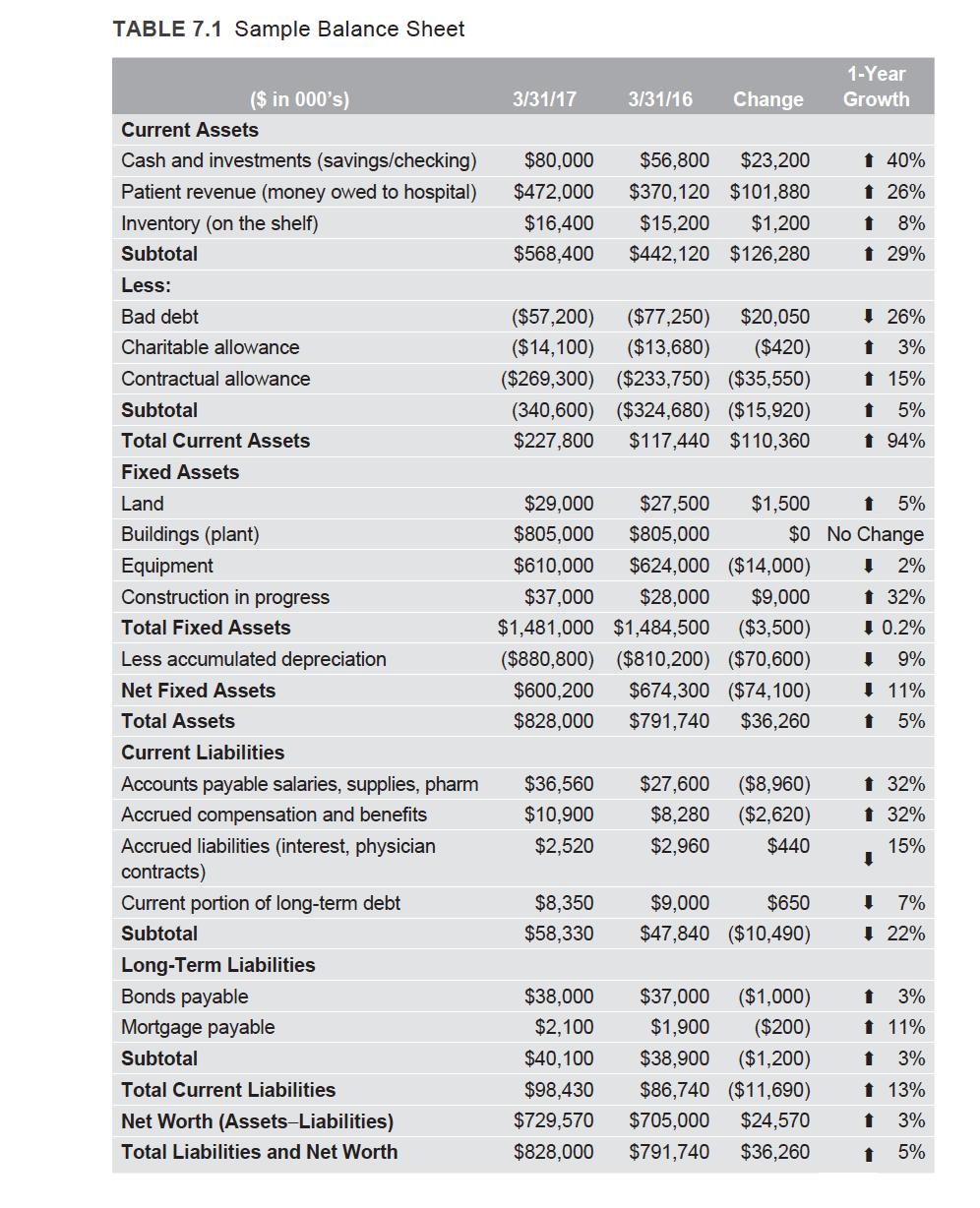

What are the underlying reasons driving this increase? Address three to four reasons and make sure to explain the causes of these driving forces. Table

What are the underlying reasons driving this increase?

- Address three to four reasons and make sure to explain the causes of these driving forces. Table 7.1 shows a considerable increase in assets from year to year.

TABLE 7.1 Sample Balance Sheet 1-Year ($ in 000's) 3/31/17 3/31/16 Change Growth Current Assets Cash and investments (savings/checking) $80,000 $56,800 $23,200 1 40% Patient revenue (money owed to hospital) $472,000 $370,120 $101,880 1 26% Inventory (on the shelf) $16,400 $15,200 $1,200 8% Subtotal $568,400 $442,120 $126,280 1 29% Less: Bad debt ($57,200) ($77,250) $20,050 I 26% Charitable allowance ($14,100) ($13,680) ($420) 3% Contractual allowance ($269,300) ($233,750) ($35,550) 1 15% 5% (340,600) ($324,680) ($15,920) $117,440 $110,360 Subtotal Total Current Assets $227,800 1 94% Fixed Assets Land $29,000 $27,500 $1,500 5% Buildings (plant) $805,000 $805,000 $0 No Change Equipment $610,000 $624,000 ($14,000) 2% Construction in progress $37,000 $28,000 $9,000 1 32% Total Fixed Assets $1,481,000 $1,484,500 ($3,500) 1 0.2% Less accumulated depreciation ($880,800) ($810,200) ($70,600) 9% Net Fixed Assets $600,200 $674,300 ($74,100) I 11% Total Assets $828,000 $791,740 $36,260 5% Current Liabilities Accounts payable salaries, supplies, pharm $36,560 $27,600 ($8,960) t 32% Accrued compensation and benefits $10,900 $8,280 ($2,620) t 32% Accrued liabilities (interest, physician contracts) $2,520 $2,960 $440 15% Current portion of long-term debt $8,350 $9,000 $650 7% Subtotal $58,330 $47,840 ($10,490) ! 22% Long-Term Liabilities Bonds payable $38,000 $37,000 ($1,000) 3% Mortgage payable $2,100 $1,900 ($200) 1 11% Subtotal $40,100 $38,900 ($1,200) 3% Total Current Liabilities $98,430 $86,740 ($11,690) 1 13% Net Worth (Assets-Liabilities) $729,570 $705,000 $24,570 3% Total Liabilities and Net Worth $828,000 $791,740 $36,260 5%

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Generally increasing assets are a sign that the company is growing but everyone can relate to the fact that there is much more behind the scenes than ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started