Answered step by step

Verified Expert Solution

Question

1 Approved Answer

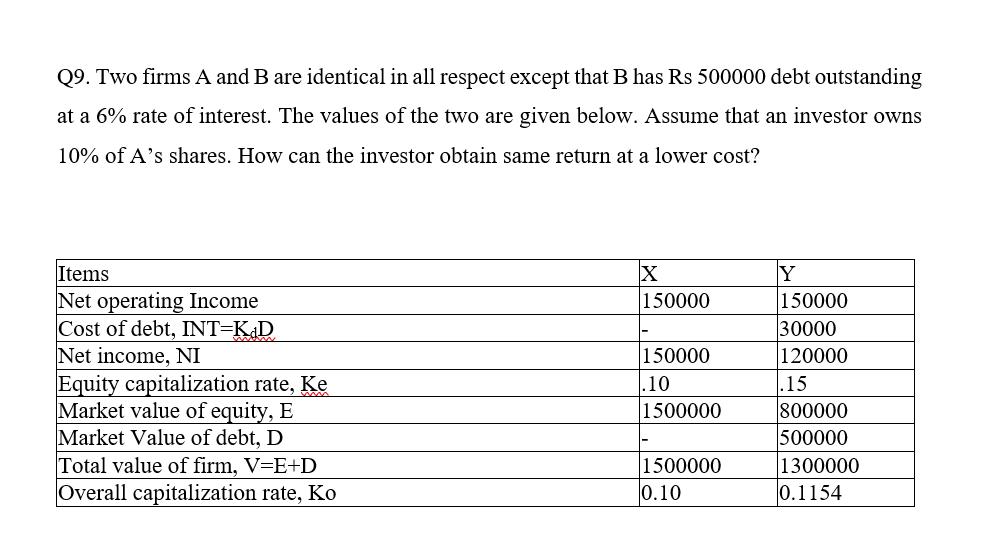

Q9. Two firms A and B are identical in all respect except that B has Rs 500000 debt outstanding at a 6% rate of

Q9. Two firms A and B are identical in all respect except that B has Rs 500000 debt outstanding at a 6% rate of interest. The values of the two are given below. Assume that an investor owns 10% of A's shares. How can the investor obtain same return at a lower cost? Items Net operating Income Cost of debt, INT=KdD Net income, NI Equity capitalization rate, Ke Market value of equity, E Market Value of debt, D Total value of firm, V=E+D Overall capitalization rate, Ko X 150000 150000 .10 1500000 1500000 0.10 Y 150000 30000 120000 .15 800000 500000 1300000 0.1154

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The question youve presented is based on the ModiglianiMiller theorem on capital structure which states that in an efficient market the value of a firm is unaffected by how that firm is financed irres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started