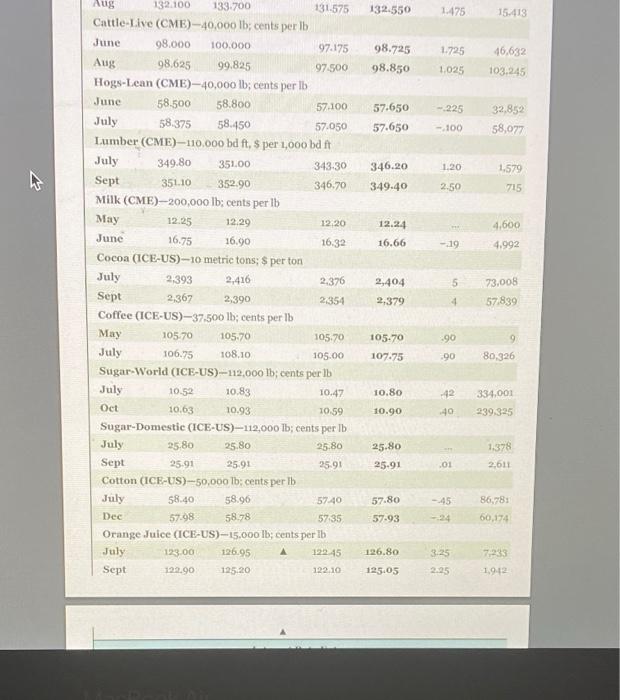

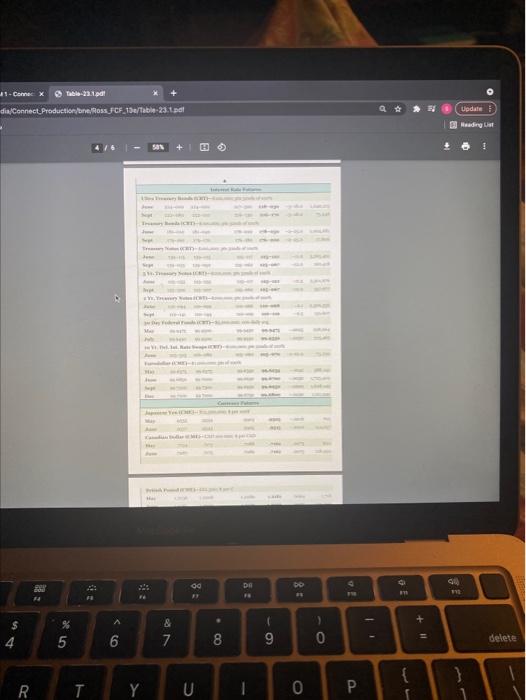

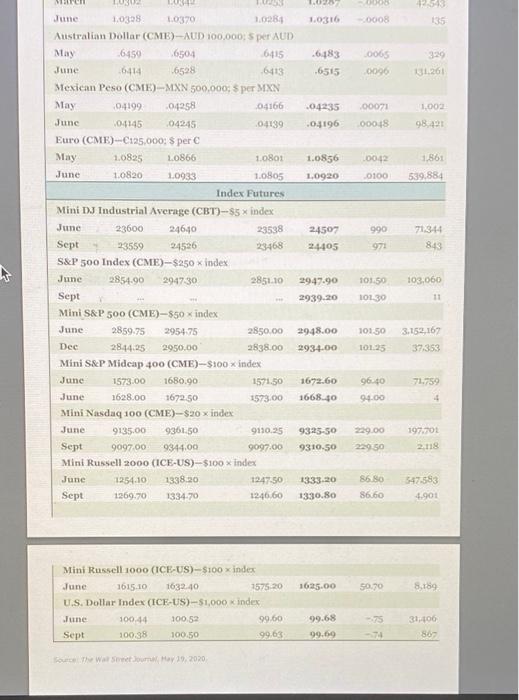

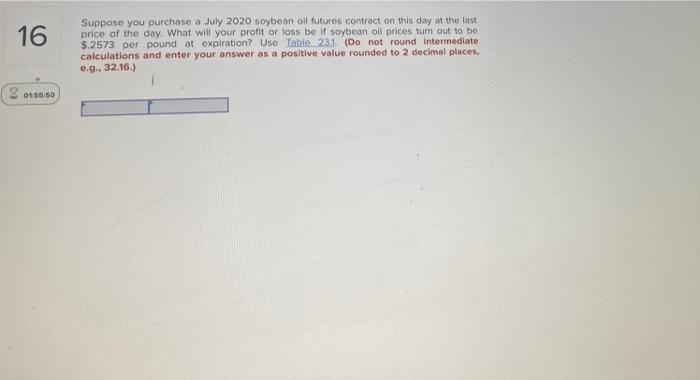

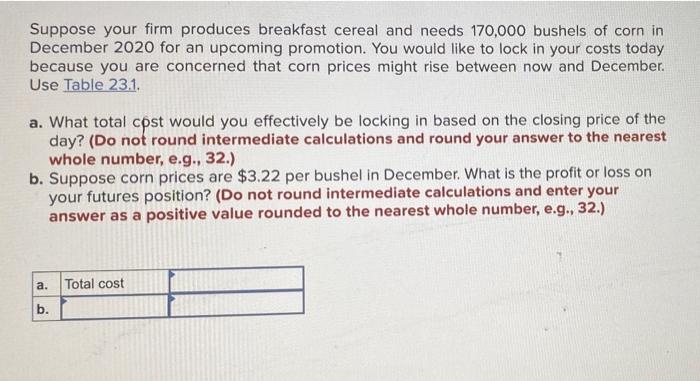

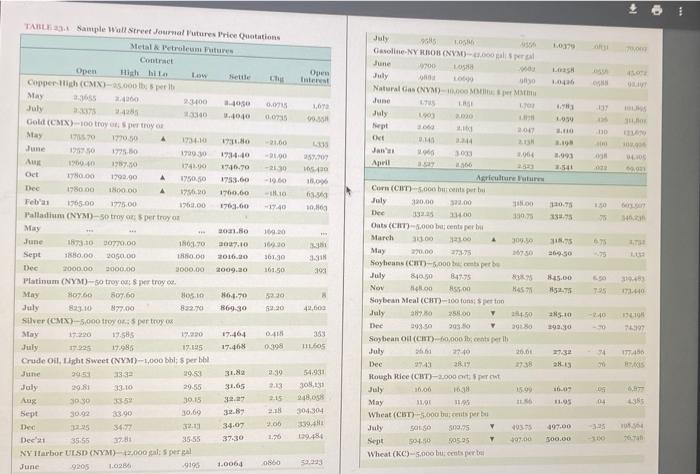

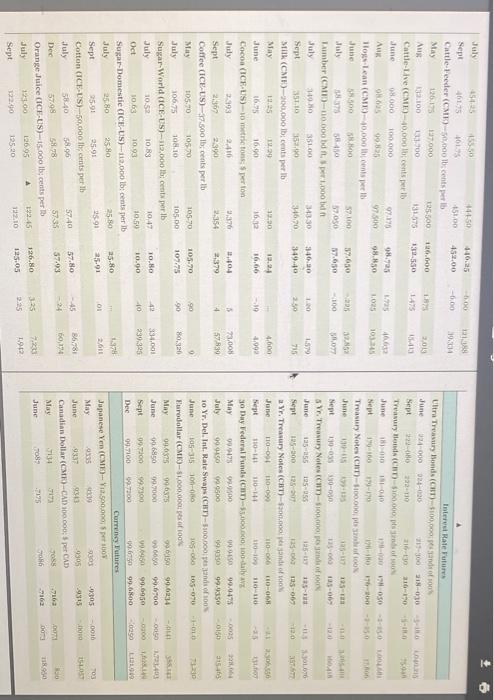

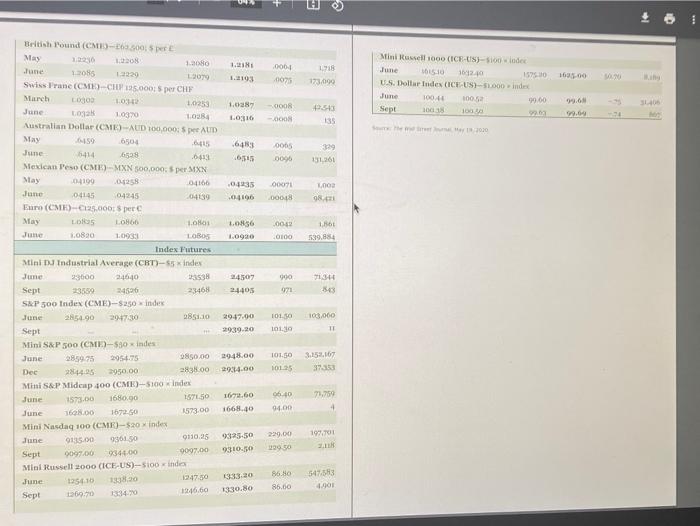

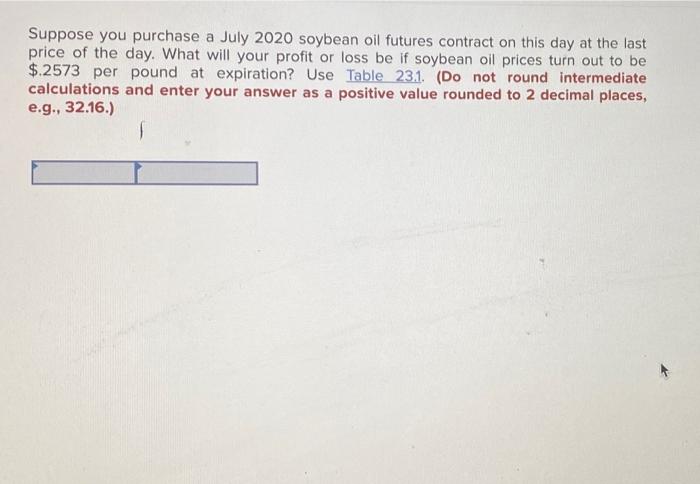

ed 7 Suppose your firm produces breakfast cereal and needs 170,000 bushels of com in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December Use Table 231 8 01:57:13 a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose corn prices are $3.22 per bushel in December. What is the profit or loss on your futures position? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. Total cost b. 1 ceton.com Media Connection 15/ THE 10 TE 2: 83 * + W 5 4 1 0 % 5 delete 6 7 9 8 ) E R 0 U T Y G . J D L K return Questo-A1- Sucation.com/Media Conversion, 14/ 7-35.100 metus 13 HI a 8: 81 . + $ 4 A 6 & 7 1 0 8 9 delete 3 5 { E R T Y 0 P U D G F H K J L return ? B N CV . X shift - 132.550 1475 15.413 1.725 98.725 98.850 46.632 103.245 1.025 - 225 57.650 57.650 32.852 58,077 -100 346.20 1.20 1,579 715 349.40 2.50 May 4,600 12.24 16.66 -19 4.992 5 132.100 133.700 131.575 Cattle-Live (CME)-40,000 lb, cents per lb June 98.000 100.000 97.175 Aug 98.625 99.825 97-500 Hogs-Lean (CME)-40,000 lb; cents per lb June 58.500 58.800 57.100 July 58.375 58.450 57.050 Lumber (CME)-110,000 bd ft $ per 1,000 bd July 349.80 351.00 343-30 Sept 351.10 352,90 346,70 Milk (CME)-200,000 lb: cents per lb 12.25 12.29 12:20 June 16.75 16.90 16:32 Cocoa (ICE-US)-10 metric tons: $ per ton July 2.393 2,416 2.376 Sept 2,367 2,390 2354 Coffee (ICE-US)-37.500 lb, cents per lb May 105-70 105.70 105.70 July 106.75 108.10 105.00 Sugar-World (ICE-US)-112,000 lb; cents per lb July 10.52 10.83 10.47 Oct 10,63 10.93 10.59 Sugar-Domestic (ICE-US)-112,000 lb; cents per lb July 25.80 25.80 25.80 Sept 25.91 25.91 25.91 Cotton (ICE-US)---50,000 lb: cents per lb July 58.40 58.96 57.40 Dec 57-98 58.78 57:35 Orange Juice (ICE-US)--15.000 lb; cents per lb July 123.00 126.95 A 122.45 Sept 122.90 125.20 122.10 2,404 2,379 73.008 57.839 4 90 105.70 107.75 90 80 326 10.80 -42 334,001 10.90 40 239.325 25.80 1,378 25.91 .01 2,611 - 45 57.80 57.93 86,783 60,174 126.80 3.25 7233 125.05 2.25 1,9-12 11-Connecx Tabi-23.1.pdf dia/Connect Production/brossFCF 150/table-23.pd Update Heading DA oo E : e + + $ 4 & 7 ) 0 5 6 8 9 delete } R T 0 cm 1.0 008 0008 1.0316 135 26.183 .6515 .0065 0006 329 136261 1,002 04235 0.4196 00071 00018 98.421 1.0856 1.0920 0042 0100 1.861 539.884 990 LO 1.0328 1.0370 1.0284 Australian Dollar (CME)-AUD 100,000 per AUD May 6459 6504 6415 June 6114 6528 .6413 Mexican Peso (CME)- MXN 500,000: S per MXN May 04199 04258 04166 June 104145 04245 04139 Euro (CME)-C125,000: $ per May 1.0825 2.0866 1080: June 1.0820 1.0933 1.0805 Index Futures Mini DJ Industrial Average (CBT) --$5 x index June 23600 24640 23538 Sept 23559 24526 23468 S&P 500 Index (CME)--$250 x index June 2854,90 294730 2851.10 Sept Mini S&P 500 (CME)-$50 x index June 2859.75 295475 2850.00 Dec 28.04.25 2950.00 2838.00 Mini S&P Midcap 400 (CME)-$100 x index June 1573.00 1680.90 1571.50 June 1628.00 1672.50 1573.00 Mini Nasdaq 100 (CME)-$20 x index June 9135.00 9361.50 9110.25 Sept 9097.00 9344,00 9097.00 Mini Russell 2000 (ICE-US)-$100 x Index June 1254.10 1338.90 1247-50 Sept 1269.70 1334.70 1246.60 24507 24405 71314 843 971 101.50 103,060 2947.90 2939.20 10130 29-48.00 2934.00 101.50 101.25 3.163, 167 37.353 71.759 1672.60 1668.40 96.00 94.00 197701 9325-50 9310.50 229.00 229 50 2118 86. So 133320 1330.80 547583 4.901 86.60 1625.00 50.70 8.789 Mini Russell 1000 (ICE-US)-$100 x index June 1615.10 1632.40 7575 20 U.S. Dollar Index (ICE-US)-$1,000 index June 100.44 100.52 99.60 Sept 100.38 100.50 99.63 99.68 99.69 31,00 86- Wat Hay 19, 2020 16 Suppose you purchase a July 2020 soybean oil futuros contract on this day at the last price of the day. What will your profit or loss be if soybean oil prices turn out to be $.2573 per pound at expiration? Uso Table 231. (Do not round Intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, 0.9., 32.16.) 8:58:50 Suppose your firm produces breakfast cereal and needs 170,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December Use Table 23.1. a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose corn prices are $3.22 per bushel in December. What is the profit or loss on your futures position? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. Total cost b. 1.030 O Interest SH 104 July 4. LOT 0.35 00 3.10 3. 1993 WOS 338 257.70 30 10.09 1.50 10.00 110.75 1373 75 02 TABLE Sample Wall Street Journal Futures Price Quotations Metal Petroleum iures Contre Open High the Copper (CMX)-Sooth May 3665 2460 23400 14050 27 40 Gold (CX)-100 tro, purtro May 171570 30. 21.00 June 1950 17.30 17200 1934.40 -1.90 A 1767.00 17.00 1940.70 -2139 Oct 780,00 1792.90 A 1750.50 1753.60 Dec 178000 180000 A 1956.30 170,60 -10 Febas 1765.00 1775.00 1763.00 1703.60 17:40 Palladium (NYM)-50 try or per troy May 2001.8 09.0 June 1873:10 0770.00 110.70 30.10 16:10 Sept 1680.00 2050.00 100 2016.10 36130 Dec 2000.00 0000.00 3000.00 2009.10 101.50 Platinum (NYM)--50 troys per troy 87.60 0.60 305.10 16.4.70 July 823.10 877.00 82270 86930 6220 Silver (CMX)-5.000 tror perto ox May 1200 19.585 17.220 17.464 0.41 July 17.925 17.985 17.195 17.468 Crude Oil Light Sweet (NYM)-1,000 bhl: Sper bal June 1332 29.53 31.Na 3:19 July 2981 33.10 29.55 31.65 20 Aug 30 30 3555 30.15 32.27 2.15 Sept 30.92 2.1.1 33.00 30.60 3.8 Dec 32-35 3.00 347 2.1 34.07 Dec 21 35:55 7. 3730 NY Harbor USD (NYM) 2,000 a 5 pergal June 9205 9195 1.0064 July poh 105 Gasoline NY ROSNYM) - June 700 LO July 000 bo Natural Gas (NVM)0 MM June . July DO Tept 2007 ONE 3.10 Jan 303 1.064 April Agriculture Corn (CH)-5.000 burents put bu July 320.00 32.00 18.00 Dee 14.00 307 Oats (CT-8.000 b center March 30 4 309.50 May 270.00 2725 Soybeans (CHD)-5,000 per te July 840.50 84735 Nov H. 55.00 84578 Soybean Meal (CRT)-100 fonso July 25.00 2030 29280 Soybean Oil (CHT-0.000 lb, center July 27-40 26.01 Dee 943 21 28 Rough Rice (CWT)-2.000 ot perut July 16,00 16:38 15.99 May 11.9 Wheat (CIT).-5.000 busenitspur bu July SOLSO 50025 03. Sept 5044.50 9055 19:00 Wheat (KC)-5.000 bucets per 393 3-45.00 2. T95 31948 1140 May 42.000 -240 25.10 39330 134191 2397 353 111.605 0395 314 17:40 2 6,97 355 54,931 308,231 248.05 304304 1960 19.30 11.95 2 0564 497.00 500.00 50293 6 14 446.35 152.00 1211 -0.00 10.000 132.500 2013 17 1473 08.05 9.85 1.725 103145 650 57.650 5.07 340.00 10 1.579 715 349.40 2:50 12.2.4 16,66 4,600 4,098 -10 July 4500 155.50 1450 Sept 151.00 Cattle Feeder (CM50.000 lb-cents perb May 26.175 197000 195.500 AR 100 11.00 131575 Cattle Live CM-40,000 lbcents perib June 0.000 100.000 9817 Aux 99305 9700 To lean (CM) 10,000 cents per June 38.500 38.800 52.00 8375 5840 57.000 Lumber (CMD) -110.000 1.000 bdn July 10. 351.00 34330 Sept 351.10 353,10 34620 Milk (CM)00.000 lb, cents per lb May 12.29 12.30 June 16.95 16.00 16.12 Cocon (ICE-LIS) -10 metric tons: perton July 23,993 2416 9,376 Sept 2.354 Coffee (ICE-US) 37.500 lb, cents per lb May 105.70 10570 105-90 July 106.75 108.10 105.00 Sugar World (ICE-US)-113,000 lbcnt perb July 10:52 10,83 10:47 Oct 10.63 10.93 10.50 Sugar Domestie CICE-US)-11.000 lb: cents per lb July 25 80 25.80 Sept 25.91 45.91 Cotton (ICE-US) -50,000 lb, cents perih July 58.40 57.40 Dec 57.98 5.78 Orange Juice (TCE-US)-15.000 lb, cents per lb 12695 19245 Sept 122/10 19520 Totest Rate us Ultra Tratty Bonds (CT) $100.000 to June 13-000 024-026 1-08-030 Sept 2220 16-10-10 Taury Honda CRT) -100.000 June 1010 1000 1100 19160 19- 1960-1-150 Treasury Notes (CRT)-5100.000 June 133 13-17125- 11 Nept 130-035 0-000 126 103-06 syr, Treasury Notes CH-5100.000 photo June 195-055 125- 125- 076 Sept 195-300 125-0103-007 20 a Yr. Treasury Notes (CBT)-5300.000 and of June 110-1110-09 100006 ID-061 -1.56 Sept 110-141 110-14 110-10 110110 - yo Day Federal Funds (CRT)-53.000.000, 100-daily AVE May 09/17 99.000 000 99.0475 July 99 950 9500 119.9350 99.9350 3156 10 Yr. Del. Int. Rate Swaps (CH-5100.000 perando June 10535 10000 105-050 105-070 -FOLD Eurodollar (CMI)-51.000.000 May 09.0575 99.6375 98615090.6334 - June 90.650 99.000 6630 90.000 - 00501210 Sept 99 7100 9.7100 0.950 99.6950 0100 Dec 99.7100 -0.6799.6800 19 Currency Futures Japanese Yen (CME-YI.500.000, pets May -9305 --003 0 June 0337 930 9305 15-10 Canadian Dollar (CM)-CAD 100.000 per CAD May 9134 -716 . June 003 -7175 108 16 11.10. 2,379 23.00H 5830 4 235 105.70 107.75 90 80,320 10.30 42 354.00 239.385 10.00 -10 25.80 25.01 1.378 2611 30 -45 57.80 573 36.78 0,194 5735 -24 . 086 26 No 13.00 7,20 1.92 125.05 2015 13210 & 12079 0064 0075 1.718 173.099 16100 Mini Russell 1600 (ICE-US-Solodec June BIO 10240 15750 US Dollar Index (ICE-US)-51000 index June 100.4 1005 90.00 Sept 1001 1000 9968 - 3406 0008 -1000 545 135 7030 645 .0005 0096 329 131,261 LOO 00071 00018 1.86 June 0100 British Pound (CMS): May 109 20 20 1.28 12085 229 1.2193 Swiss Franc (CMD-CHF 125.000 per CHF March 300 1.0253 1.03 June L02 10370 1.0384 10:16 Australian Dollar (CMO) AUD 100,000: SAUD May 6504 June 5414 6538 .6413 Mexican Peso (CMB) - MXN 500,000 per MXN May 04199 04160 .0.3235 June 04145 04245 04196 Euro (CM)-25.000 perc May LOGOS L0866 Los 1.0836 1,0820 1.0933 LOBOS 1.0990 Index Futures til DJ Industrial Average (CRT)-$5 index June 23600 24640 13538 24507 Sept 24526 23468 24405 S&P 500 Index (CME)-$250 index June 2854.90 29-17:30 285110 29.47.00 Sept 2939.20 Mini S&P 500 (CME)-580 indes June 285975 2956.75 850.00 29:48.00 Dec 2844.25 3950.00 2835.00 29:14.00 Mini S&P Mideap 400 (CME)-5100 Index June 1573.00 1680.90 12.60 157150 June 1698.00 1672:50 1573.00 1668.40 Mini Nasdaq 100 (CMR)-520 index June 9135.00 936150 0110.25 9325-30 Sept 9097.00 934000 900700 9310.50 Mini Russell 2000 (ICE-US)-510oinde June 135410 1947.50 1333.20 0.0 1946.60 71344 900 971 103.000 10130 101.30 101.50 1025 3.152.167 37353 06:40 94.00 7,759 4 229.00 129.50 19TOI SLR 13.30 86.10 85.00 547.583 4401 1830.80 Sept Suppose you purchase a July 2020 soybean oil futures contract on this day at the last price of the day. What will your profit or loss be if soybean oil prices turn out to be $.2573 per pound at expiration? Use Table 23.1. (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) . ed 7 Suppose your firm produces breakfast cereal and needs 170,000 bushels of com in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December Use Table 231 8 01:57:13 a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose corn prices are $3.22 per bushel in December. What is the profit or loss on your futures position? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. Total cost b. 1 ceton.com Media Connection 15/ THE 10 TE 2: 83 * + W 5 4 1 0 % 5 delete 6 7 9 8 ) E R 0 U T Y G . J D L K return Questo-A1- Sucation.com/Media Conversion, 14/ 7-35.100 metus 13 HI a 8: 81 . + $ 4 A 6 & 7 1 0 8 9 delete 3 5 { E R T Y 0 P U D G F H K J L return ? B N CV . X shift - 132.550 1475 15.413 1.725 98.725 98.850 46.632 103.245 1.025 - 225 57.650 57.650 32.852 58,077 -100 346.20 1.20 1,579 715 349.40 2.50 May 4,600 12.24 16.66 -19 4.992 5 132.100 133.700 131.575 Cattle-Live (CME)-40,000 lb, cents per lb June 98.000 100.000 97.175 Aug 98.625 99.825 97-500 Hogs-Lean (CME)-40,000 lb; cents per lb June 58.500 58.800 57.100 July 58.375 58.450 57.050 Lumber (CME)-110,000 bd ft $ per 1,000 bd July 349.80 351.00 343-30 Sept 351.10 352,90 346,70 Milk (CME)-200,000 lb: cents per lb 12.25 12.29 12:20 June 16.75 16.90 16:32 Cocoa (ICE-US)-10 metric tons: $ per ton July 2.393 2,416 2.376 Sept 2,367 2,390 2354 Coffee (ICE-US)-37.500 lb, cents per lb May 105-70 105.70 105.70 July 106.75 108.10 105.00 Sugar-World (ICE-US)-112,000 lb; cents per lb July 10.52 10.83 10.47 Oct 10,63 10.93 10.59 Sugar-Domestic (ICE-US)-112,000 lb; cents per lb July 25.80 25.80 25.80 Sept 25.91 25.91 25.91 Cotton (ICE-US)---50,000 lb: cents per lb July 58.40 58.96 57.40 Dec 57-98 58.78 57:35 Orange Juice (ICE-US)--15.000 lb; cents per lb July 123.00 126.95 A 122.45 Sept 122.90 125.20 122.10 2,404 2,379 73.008 57.839 4 90 105.70 107.75 90 80 326 10.80 -42 334,001 10.90 40 239.325 25.80 1,378 25.91 .01 2,611 - 45 57.80 57.93 86,783 60,174 126.80 3.25 7233 125.05 2.25 1,9-12 11-Connecx Tabi-23.1.pdf dia/Connect Production/brossFCF 150/table-23.pd Update Heading DA oo E : e + + $ 4 & 7 ) 0 5 6 8 9 delete } R T 0 cm 1.0 008 0008 1.0316 135 26.183 .6515 .0065 0006 329 136261 1,002 04235 0.4196 00071 00018 98.421 1.0856 1.0920 0042 0100 1.861 539.884 990 LO 1.0328 1.0370 1.0284 Australian Dollar (CME)-AUD 100,000 per AUD May 6459 6504 6415 June 6114 6528 .6413 Mexican Peso (CME)- MXN 500,000: S per MXN May 04199 04258 04166 June 104145 04245 04139 Euro (CME)-C125,000: $ per May 1.0825 2.0866 1080: June 1.0820 1.0933 1.0805 Index Futures Mini DJ Industrial Average (CBT) --$5 x index June 23600 24640 23538 Sept 23559 24526 23468 S&P 500 Index (CME)--$250 x index June 2854,90 294730 2851.10 Sept Mini S&P 500 (CME)-$50 x index June 2859.75 295475 2850.00 Dec 28.04.25 2950.00 2838.00 Mini S&P Midcap 400 (CME)-$100 x index June 1573.00 1680.90 1571.50 June 1628.00 1672.50 1573.00 Mini Nasdaq 100 (CME)-$20 x index June 9135.00 9361.50 9110.25 Sept 9097.00 9344,00 9097.00 Mini Russell 2000 (ICE-US)-$100 x Index June 1254.10 1338.90 1247-50 Sept 1269.70 1334.70 1246.60 24507 24405 71314 843 971 101.50 103,060 2947.90 2939.20 10130 29-48.00 2934.00 101.50 101.25 3.163, 167 37.353 71.759 1672.60 1668.40 96.00 94.00 197701 9325-50 9310.50 229.00 229 50 2118 86. So 133320 1330.80 547583 4.901 86.60 1625.00 50.70 8.789 Mini Russell 1000 (ICE-US)-$100 x index June 1615.10 1632.40 7575 20 U.S. Dollar Index (ICE-US)-$1,000 index June 100.44 100.52 99.60 Sept 100.38 100.50 99.63 99.68 99.69 31,00 86- Wat Hay 19, 2020 16 Suppose you purchase a July 2020 soybean oil futuros contract on this day at the last price of the day. What will your profit or loss be if soybean oil prices turn out to be $.2573 per pound at expiration? Uso Table 231. (Do not round Intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, 0.9., 32.16.) 8:58:50 Suppose your firm produces breakfast cereal and needs 170,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December Use Table 23.1. a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Suppose corn prices are $3.22 per bushel in December. What is the profit or loss on your futures position? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) a. Total cost b. 1.030 O Interest SH 104 July 4. LOT 0.35 00 3.10 3. 1993 WOS 338 257.70 30 10.09 1.50 10.00 110.75 1373 75 02 TABLE Sample Wall Street Journal Futures Price Quotations Metal Petroleum iures Contre Open High the Copper (CMX)-Sooth May 3665 2460 23400 14050 27 40 Gold (CX)-100 tro, purtro May 171570 30. 21.00 June 1950 17.30 17200 1934.40 -1.90 A 1767.00 17.00 1940.70 -2139 Oct 780,00 1792.90 A 1750.50 1753.60 Dec 178000 180000 A 1956.30 170,60 -10 Febas 1765.00 1775.00 1763.00 1703.60 17:40 Palladium (NYM)-50 try or per troy May 2001.8 09.0 June 1873:10 0770.00 110.70 30.10 16:10 Sept 1680.00 2050.00 100 2016.10 36130 Dec 2000.00 0000.00 3000.00 2009.10 101.50 Platinum (NYM)--50 troys per troy 87.60 0.60 305.10 16.4.70 July 823.10 877.00 82270 86930 6220 Silver (CMX)-5.000 tror perto ox May 1200 19.585 17.220 17.464 0.41 July 17.925 17.985 17.195 17.468 Crude Oil Light Sweet (NYM)-1,000 bhl: Sper bal June 1332 29.53 31.Na 3:19 July 2981 33.10 29.55 31.65 20 Aug 30 30 3555 30.15 32.27 2.15 Sept 30.92 2.1.1 33.00 30.60 3.8 Dec 32-35 3.00 347 2.1 34.07 Dec 21 35:55 7. 3730 NY Harbor USD (NYM) 2,000 a 5 pergal June 9205 9195 1.0064 July poh 105 Gasoline NY ROSNYM) - June 700 LO July 000 bo Natural Gas (NVM)0 MM June . July DO Tept 2007 ONE 3.10 Jan 303 1.064 April Agriculture Corn (CH)-5.000 burents put bu July 320.00 32.00 18.00 Dee 14.00 307 Oats (CT-8.000 b center March 30 4 309.50 May 270.00 2725 Soybeans (CHD)-5,000 per te July 840.50 84735 Nov H. 55.00 84578 Soybean Meal (CRT)-100 fonso July 25.00 2030 29280 Soybean Oil (CHT-0.000 lb, center July 27-40 26.01 Dee 943 21 28 Rough Rice (CWT)-2.000 ot perut July 16,00 16:38 15.99 May 11.9 Wheat (CIT).-5.000 busenitspur bu July SOLSO 50025 03. Sept 5044.50 9055 19:00 Wheat (KC)-5.000 bucets per 393 3-45.00 2. T95 31948 1140 May 42.000 -240 25.10 39330 134191 2397 353 111.605 0395 314 17:40 2 6,97 355 54,931 308,231 248.05 304304 1960 19.30 11.95 2 0564 497.00 500.00 50293 6 14 446.35 152.00 1211 -0.00 10.000 132.500 2013 17 1473 08.05 9.85 1.725 103145 650 57.650 5.07 340.00 10 1.579 715 349.40 2:50 12.2.4 16,66 4,600 4,098 -10 July 4500 155.50 1450 Sept 151.00 Cattle Feeder (CM50.000 lb-cents perb May 26.175 197000 195.500 AR 100 11.00 131575 Cattle Live CM-40,000 lbcents perib June 0.000 100.000 9817 Aux 99305 9700 To lean (CM) 10,000 cents per June 38.500 38.800 52.00 8375 5840 57.000 Lumber (CMD) -110.000 1.000 bdn July 10. 351.00 34330 Sept 351.10 353,10 34620 Milk (CM)00.000 lb, cents per lb May 12.29 12.30 June 16.95 16.00 16.12 Cocon (ICE-LIS) -10 metric tons: perton July 23,993 2416 9,376 Sept 2.354 Coffee (ICE-US) 37.500 lb, cents per lb May 105.70 10570 105-90 July 106.75 108.10 105.00 Sugar World (ICE-US)-113,000 lbcnt perb July 10:52 10,83 10:47 Oct 10.63 10.93 10.50 Sugar Domestie CICE-US)-11.000 lb: cents per lb July 25 80 25.80 Sept 25.91 45.91 Cotton (ICE-US) -50,000 lb, cents perih July 58.40 57.40 Dec 57.98 5.78 Orange Juice (TCE-US)-15.000 lb, cents per lb 12695 19245 Sept 122/10 19520 Totest Rate us Ultra Tratty Bonds (CT) $100.000 to June 13-000 024-026 1-08-030 Sept 2220 16-10-10 Taury Honda CRT) -100.000 June 1010 1000 1100 19160 19- 1960-1-150 Treasury Notes (CRT)-5100.000 June 133 13-17125- 11 Nept 130-035 0-000 126 103-06 syr, Treasury Notes CH-5100.000 photo June 195-055 125- 125- 076 Sept 195-300 125-0103-007 20 a Yr. Treasury Notes (CBT)-5300.000 and of June 110-1110-09 100006 ID-061 -1.56 Sept 110-141 110-14 110-10 110110 - yo Day Federal Funds (CRT)-53.000.000, 100-daily AVE May 09/17 99.000 000 99.0475 July 99 950 9500 119.9350 99.9350 3156 10 Yr. Del. Int. Rate Swaps (CH-5100.000 perando June 10535 10000 105-050 105-070 -FOLD Eurodollar (CMI)-51.000.000 May 09.0575 99.6375 98615090.6334 - June 90.650 99.000 6630 90.000 - 00501210 Sept 99 7100 9.7100 0.950 99.6950 0100 Dec 99.7100 -0.6799.6800 19 Currency Futures Japanese Yen (CME-YI.500.000, pets May -9305 --003 0 June 0337 930 9305 15-10 Canadian Dollar (CM)-CAD 100.000 per CAD May 9134 -716 . June 003 -7175 108 16 11.10. 2,379 23.00H 5830 4 235 105.70 107.75 90 80,320 10.30 42 354.00 239.385 10.00 -10 25.80 25.01 1.378 2611 30 -45 57.80 573 36.78 0,194 5735 -24 . 086 26 No 13.00 7,20 1.92 125.05 2015 13210 & 12079 0064 0075 1.718 173.099 16100 Mini Russell 1600 (ICE-US-Solodec June BIO 10240 15750 US Dollar Index (ICE-US)-51000 index June 100.4 1005 90.00 Sept 1001 1000 9968 - 3406 0008 -1000 545 135 7030 645 .0005 0096 329 131,261 LOO 00071 00018 1.86 June 0100 British Pound (CMS): May 109 20 20 1.28 12085 229 1.2193 Swiss Franc (CMD-CHF 125.000 per CHF March 300 1.0253 1.03 June L02 10370 1.0384 10:16 Australian Dollar (CMO) AUD 100,000: SAUD May 6504 June 5414 6538 .6413 Mexican Peso (CMB) - MXN 500,000 per MXN May 04199 04160 .0.3235 June 04145 04245 04196 Euro (CM)-25.000 perc May LOGOS L0866 Los 1.0836 1,0820 1.0933 LOBOS 1.0990 Index Futures til DJ Industrial Average (CRT)-$5 index June 23600 24640 13538 24507 Sept 24526 23468 24405 S&P 500 Index (CME)-$250 index June 2854.90 29-17:30 285110 29.47.00 Sept 2939.20 Mini S&P 500 (CME)-580 indes June 285975 2956.75 850.00 29:48.00 Dec 2844.25 3950.00 2835.00 29:14.00 Mini S&P Mideap 400 (CME)-5100 Index June 1573.00 1680.90 12.60 157150 June 1698.00 1672:50 1573.00 1668.40 Mini Nasdaq 100 (CMR)-520 index June 9135.00 936150 0110.25 9325-30 Sept 9097.00 934000 900700 9310.50 Mini Russell 2000 (ICE-US)-510oinde June 135410 1947.50 1333.20 0.0 1946.60 71344 900 971 103.000 10130 101.30 101.50 1025 3.152.167 37353 06:40 94.00 7,759 4 229.00 129.50 19TOI SLR 13.30 86.10 85.00 547.583 4401 1830.80 Sept Suppose you purchase a July 2020 soybean oil futures contract on this day at the last price of the day. What will your profit or loss be if soybean oil prices turn out to be $.2573 per pound at expiration? Use Table 23.1. (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.)