Answered step by step

Verified Expert Solution

Question

1 Approved Answer

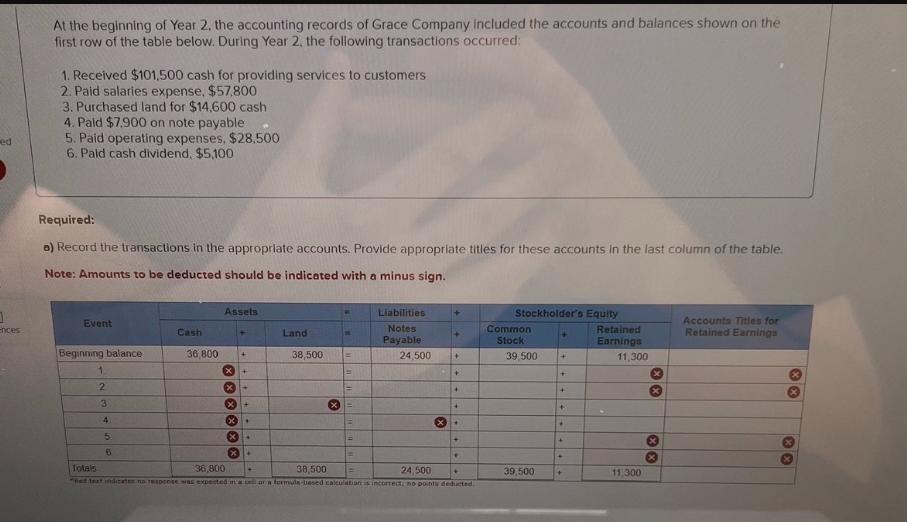

ed At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of

ed At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred: 1. Received $101,500 cash for providing services to customers 2. Paid salaries expense, $57,800. 3. Purchased land for $14,600 cash 4. Paid $7,900 on note payable 5. Paid operating expenses, $28,500 6. Pald cash dividend, $5,100 Required: a) Record the transactions in the appropriate accounts. Provide appropriate titles for these accounts in the last column of the table. Note: Amounts to be deducted should be indicated with a minus sign. Assets Liabilities Stockholder's Equity Event Accounts Titles for ences Notes Common Cash Land + Payable Stock Retained Earnings Retained Earnings Beginning balance 36,800 + 38,500 24,500 + 39,500 + 11,300 1 X+ + + 2 [ 3 4 5 6 Totals x+ = 4 = 4 36,800 38,500 24,500 + + + 39,500 + 11,300 + 4 + "hed text indicates no response was expected in a war a formula-besed calculation is incorrect no points deducted

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Received 101500 cash for providing services to customers Cash increases by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642dbfc61bcb_973564.pdf

180 KBs PDF File

6642dbfc61bcb_973564.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started