Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ed on 6 st Ben karaibu commenced business on 1 January 2005 and his financial year closes on 31 December. For the year ended

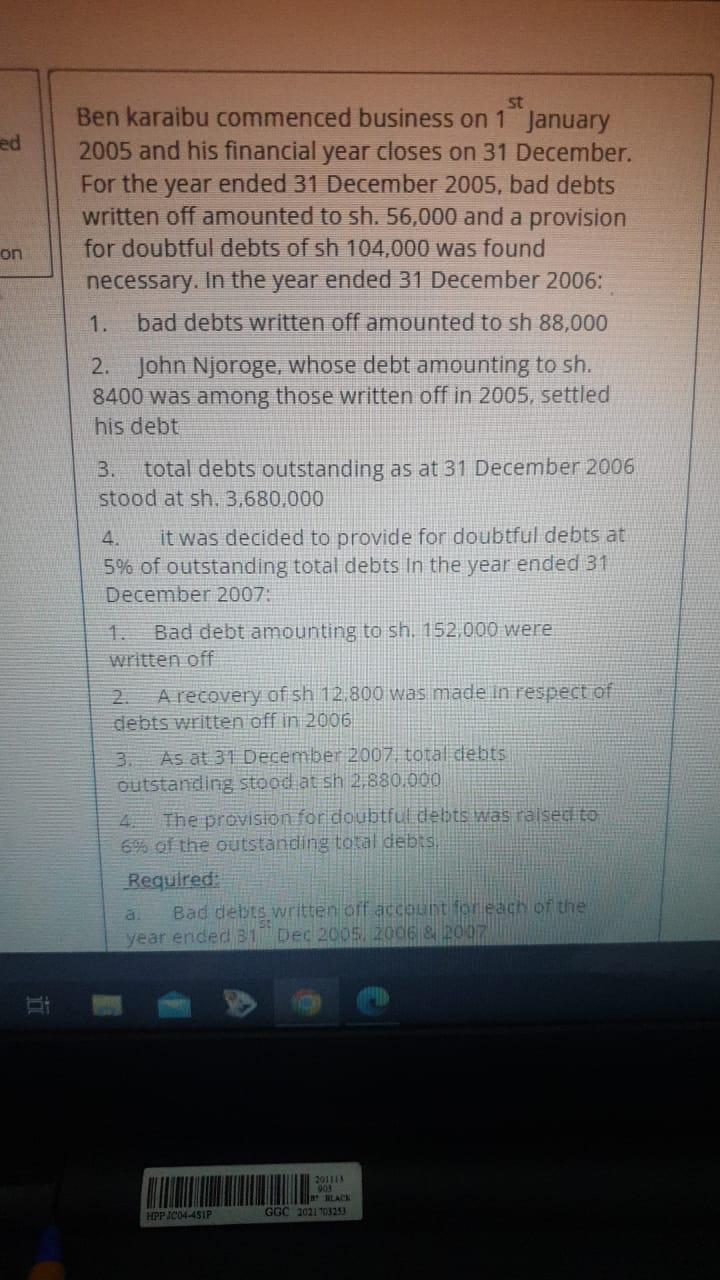

ed on 6 st Ben karaibu commenced business on 1 January 2005 and his financial year closes on 31 December. For the year ended 31 December 2005, bad debts written off amounted to sh. 56,000 and a provision for doubtful debts of sh 104,000 was found necessary. In the year ended 31 December 2006: bad debts written off amounted to sh 88,000 2. John Njoroge, whose debt amounting to sh. 8400 was among those written off in 2005, settled his debt 1. 3. total debts outstanding as at 31 December 2006 stood at sh. 3,680,000 4 it was decided to provide for doubtful debts at 5% of outstanding total debts in the year ended 31 December 2007: 1. Bad debt amounting to sh. 152,000 were written off 2 A recovery of sh 12.800 was made in respect of debts written off in 2006 3. As at 31 December 2007, total debts outstanding stood at sh 2,880.000 4 The provision for doubtful debts was raised to 6% of the outstanding total debts. Required: a. Bad debts written off account for each of the year ended 31 Dec 2005, 2006 & 2007 HPP JC04-451P 291143 BLACK GGC 1021703253 eclass.uonbi.ac.ke B 1. Bad debt amounting to sh. 152,000 were written off 2. A recovery of sh 12,800 was made in respect of debts written off in 2006 3. As at 31 December 2007, total debts outstanding stood at sh 2,880,000 4. The provision for doubtful debts was raised to 6% of the outstanding total debts. Required: a. Bad debts written off account for each of the year ended 31 Dec 2005, 2006 & 2007 b. Bad debts recovered account for each of the years ended 31 Dec 2005, 2006, 2007 1 C. Provision for doubtful debts account for each of the years ended 31 Dec 2005.2006 & 2007 d. Extracts from the profit and loss account for the years ended 31 Dec 2005, 2006 & 2007 st HPP 3004-451F Ber B 201ALE BLACK GGC 201108233

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started