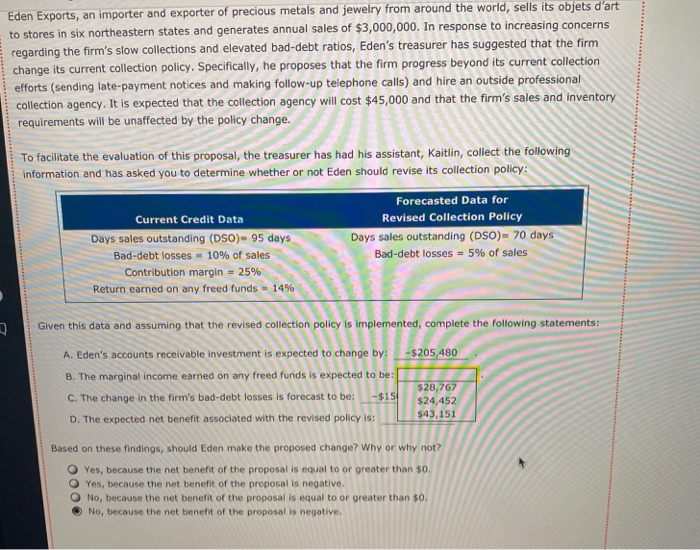

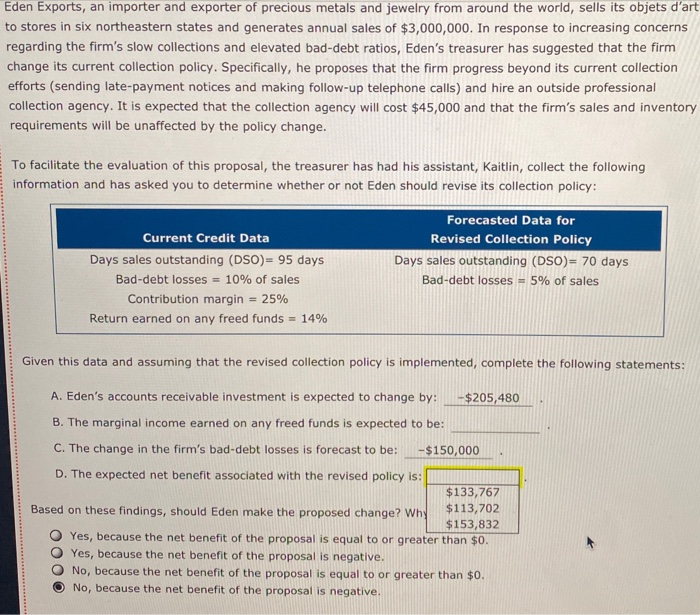

Eden Exports, an importer and exporter of precious metals and jewelry from around the world, sells its objets d'art to stores in six northeastern states and generates annual sales of $3,000,000. In response to increasing concerns regarding the firm's slow collections and elevated bad-debt ratios, Eden's treasurer has suggested that the firm change its current collection policy. Specifically, he proposes that the firm progress beyond its current collection efforts (sending late-payment notices and making follow-up telephone calls) and hire an outside professional collection agency. It is expected that the collection agency will cost $45,000 and that the firm's sales and inventory requirements will be unaffected by the policy change. To facilitate the evaluation of this proposal, the treasurer has had his assistant, Kaitlin, collect the following information and has asked you to determine whether or not Eden should revise its collection policy: Forecasted Data for Current Credit Data Revised Collection Policy Days sales outstanding (DSO)- 95 days Days sales outstanding (DSO)- 70 days Bad-debt losses - 10% of sales Bad-debt losses = 5% of sales Contribution margin = 25% Return earned on any freed funds -14% Given this data and assuming that the revised collection policy is implemented, complete the following statements: A. Eden's accounts receivable investment is expected to change by: -$205,480 B. The marginal income earned on any freed funds is expected to be: $28,767 C. The change in the firm's bad-debt losses is forecast to be: -$150 $24,452 D. The expected net benefit associated with the revised policy is: $43,151 Based on these findings, should Eden make the proposed change? Why or why not? Yes, because the net benefit of the proposal is equal to or greater than $0. Yes, because the net benefit of the proposal is negative. O No, because the net benefit of the proposal is equal to or greater than $0. No, because the net benefit of the proposal is negative. Eden Exports, an importer and exporter of precious metals and jewelry from around the world, sells its objets d'art to stores in six northeastern states and generates annual sales of $3,000,000. In response to increasing concerns regarding the firm's slow collections and elevated bad-debt ratios, Eden's treasurer has suggested that the firm change its current collection policy. Specifically, he proposes that the firm progress beyond its current collection efforts (sending late-payment notices and making follow-up telephone calls) and hire an outside professional collection agency. It is expected that the collection agency will cost $45,000 and that the firm's sales and inventory requirements will be unaffected by the policy change. To facilitate the evaluation of this proposal, the treasurer has had his assistant, Kaitlin, collect the following information and has asked you to determine whether or not Eden should revise its collection policy: Current Credit Data Days sales outstanding (DSO)= 95 days Bad-debt losses = 10% of sales Contribution margin = 25% Return earned on any freed funds = 14% Forecasted Data for Revised Collection Policy Days sales outstanding (DSO)= 70 days Bad-debt losses = 5% of sales Given this data and assuming that the revised collection policy is implemented, complete the following statements: A. Eden's accounts receivable investment is expected to change by: - $205,480 B. The marginal income earned on any freed funds is expected to be: C. The change in the firm's bad-debt losses is forecast to be: -$150,000 D. The expected net benefit associated with the revised policy is: $133,767 Based on these findings, should Eden make the proposed change? Why $113,702 $153,832 Yes, because the net benefit of the proposal is equal to or greater than $0. Yes, because the net benefit of the proposal is negative. No, because the net benefit of the proposal is equal to or greater than $0. No, because the net benefit of the proposal is negative.