Question

EDGAR: BJ's Wholesale Club Holdings, Incorporated (ticker: BJ) Visit www.sec.gov/edgar and search for the BJ's Wholesale annual report (10-K) for the year ended February

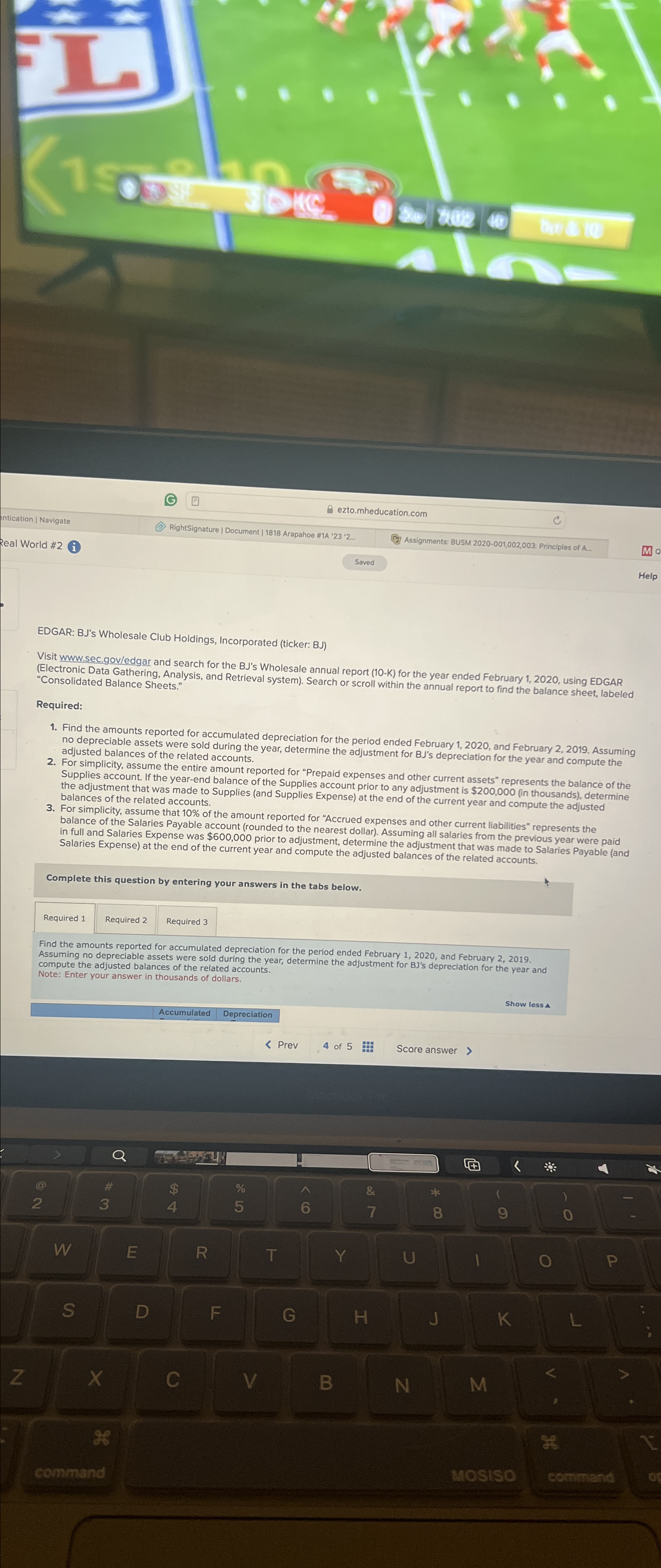

EDGAR: BJ's Wholesale Club Holdings, Incorporated (ticker: BJ)\ Visit \ www.sec.gov/edgar and search for the BJ's Wholesale annual report (10-K) for the year ended February 1, 2020, using EDGAR "Consolidated Bathering, Analysis, and Retrieval system). Search or scroll within the annual report to find the balance sheet, labeled\ Required:\ Find the amounts reported for accumulated depreciation for the period ended February 1,2020 , and February 2. 2019. Assuming no depreciable assets were sold during the year, determine the adjustment for BJ's depreciation for the year and compute the\ For simplicity, assume of the related accounts the adjustment that was made to Supplies (and Supplies account prior to any adjustment is

$200,000(in thousands), determine balances of the related accounts. in full and Salaries Expense was

$60 account (rounded to the nearest dollar). Assuming all salaries from liabilities" represents the Salaries Expense) at the end of the current year to adjustment, determine the adjustment that was made to Salaries Payable (and\ Complete this question by entering your answers in the tabs below.\ Required 1\ Required 3\ Find the amounts reported for accumulated depreciation for the period ended February 1, 2020, and February 2, 2019 compute the adjusted balances of the related during the year, determine the adjustment for BJ's depreciation for the year and Note: Enter your answer in thousands of dollars.\ (Accumulated Depreciation\ Show less 4\ >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started