Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from customers owed to the company

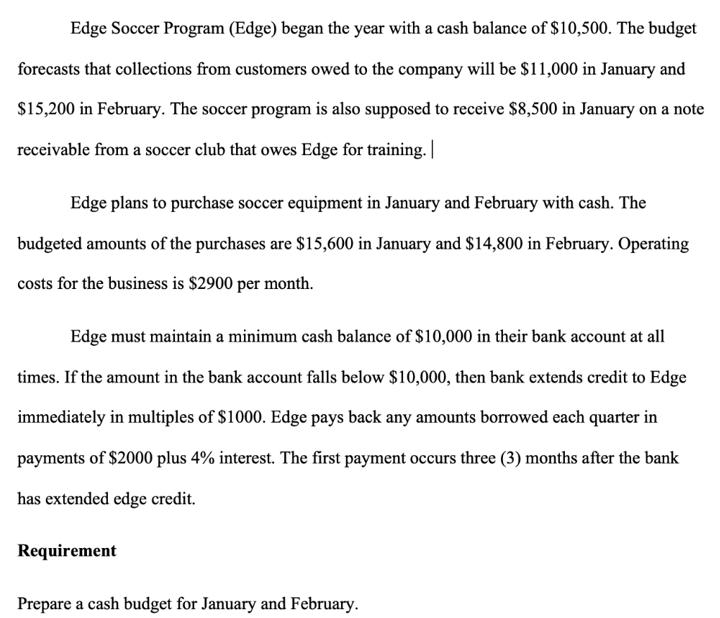

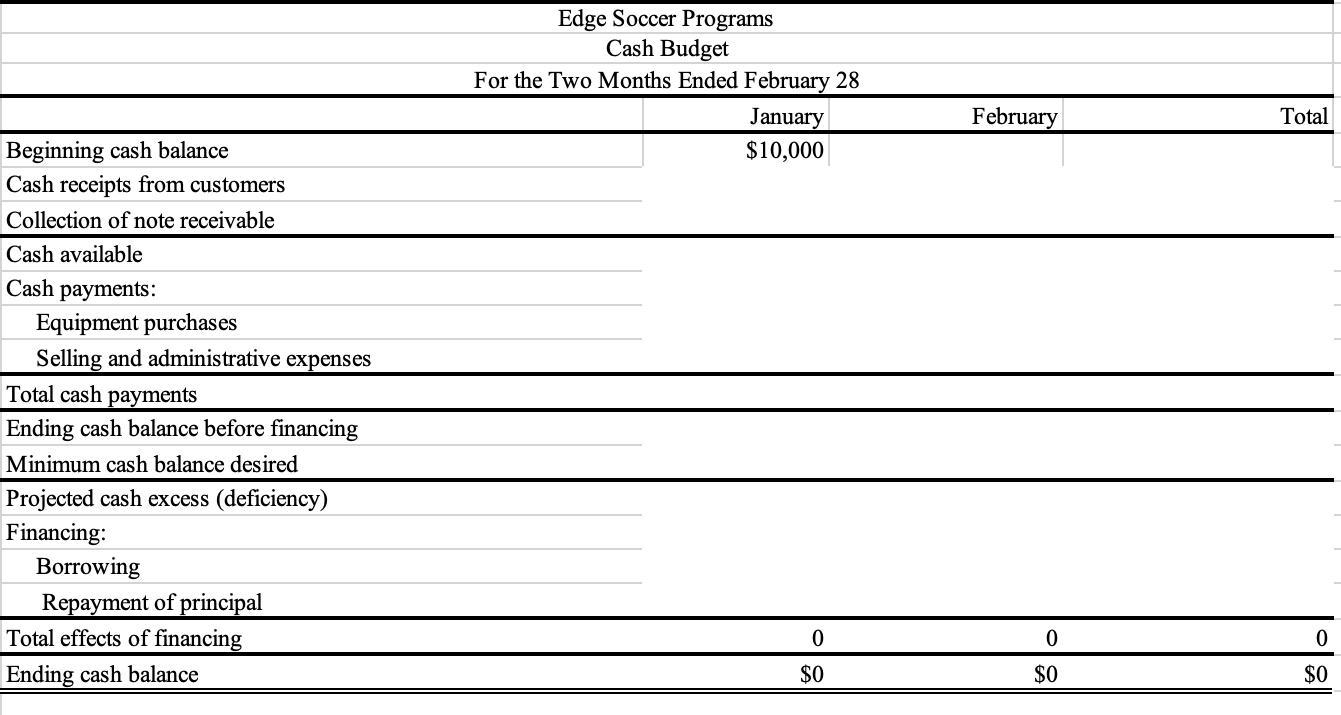

Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from customers owed to the company will be $11,000 in January and $15,200 in February. The soccer program is also supposed to receive $8,500 in January on a note receivable from a soccer club that owes Edge for training. | Edge plans to purchase soccer equipment in January and February with cash. The budgeted amounts of the purchases are $15,600 in January and $14,800 in February. Operating costs for the business is $2900 per month. Edge must maintain a minimum cash balance of $10,000 in their bank account at all times. If the amount in the bank account falls below $10,000, then bank extends credit to Edge immediately in multiples of $1000. Edge pays back any amounts borrowed each quarter in payments of $2000 plus 4% interest. The first payment occurs three (3) months after the bank has extended edge credit. Requirement Prepare a cash budget for January and February. Beginning cash balance Cash receipts from customers Collection of note receivable Cash available Cash payments: Equipment purchases Selling and administrative expenses Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (deficiency) Financing: Borrowing Repayment of principal Total effects of financing Ending cash balance Edge Soccer Programs Cash Budget For the Two Months Ended February 28 January $10,000 0 $0 February 0 $0 Total $0

Step by Step Solution

★★★★★

3.58 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Cash Budget for Edge Soccer Program for the Two Months Ended February 28 January Beginning cash balance 10500 Cash receipts from customers 11000 Colle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started