Edit question

Short multiple choice questions, help please.

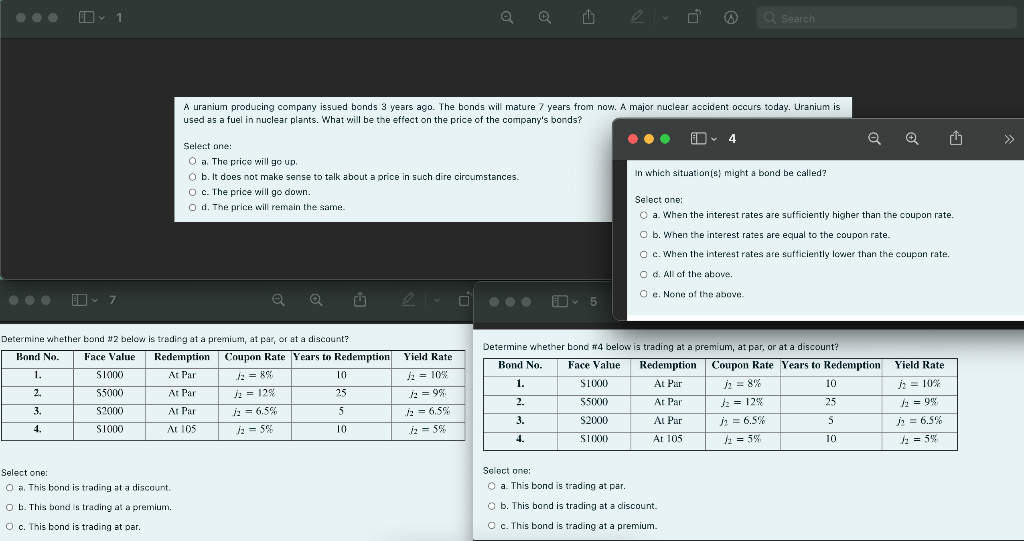

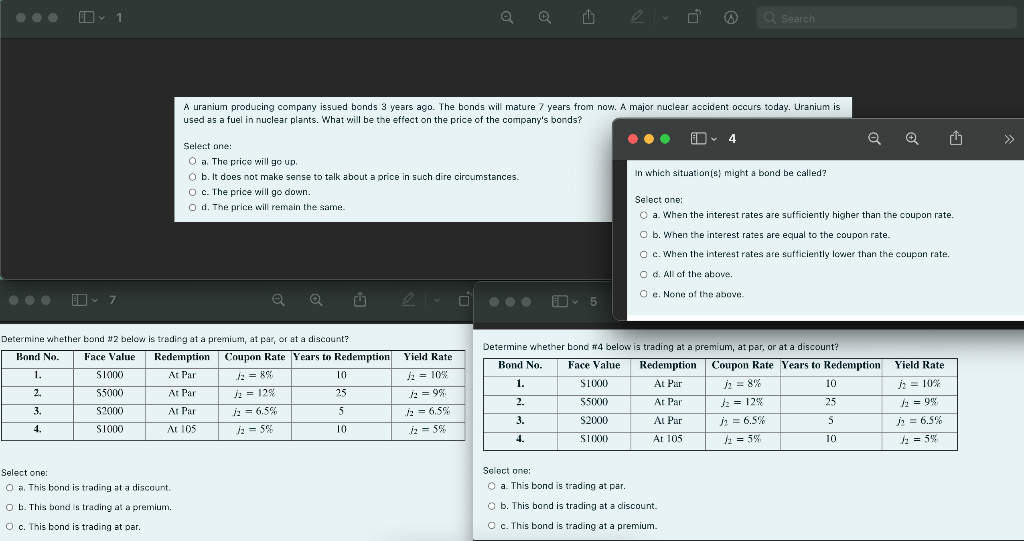

D1 Search A uranium producing company issued bonds 3 years ago. The bonds will mature 7 years from now. A major nuclear accident occurs today. Uranium is used as a fuel in nuclear plants. What will be the effect on the price of the company's bonds? ch >>> Select one: O a. The price will go up. O b. It does not make sense to talk about a price in such dire circumstances. O c. The price will go down O d. The price will remain the same In which situationis might a bond be called? Select one: O a. When the interest rates are sufficiently higher than the coupon rate O b. When the interest rates are equal to the coupon rate. O c. When the interest rates are sufficiently lower than the coupon rate. O d. All of the above. Q Q O e. None of the above 5 Yield Rate Determine whether bond #2 below is trading at a premium, at par, or at a discount? Bond No. Face Value Redemption Coupon Rate Years to Redemption Yield Rate 1. S1000 At Par 12 = 89 10 Jy = 10% 2. S5000 At Par js = 128 25 ja = 95 3. S2000 At Par 12 = 6.5% 5 12 = 6.5% 4. S1000 Ar 105 ja = 5% 10 z = 5% Determine whether bond #4 below is trading at a premium, at par, or at a discount? Bond No. Face Value Redemption Coupon Rate Years to Redemption 1. S1000 At Par 10 2. S5000 At Par J2 = 128 25 3. S2000 At Par = 6.5% S 4. S1000 At 105 12 = 5% 10 j2 = 10% /2 = 99 j? = 6.5% 12 = 55 Select one: O a. This bond is trading at a discount Select one: O a. This bond is trading at par. O b. This band is trading at a premium. O c. This bond is trading at par. O a O b. This bond is trading at a discount. O . This bond is trading at a premium. D1 Search A uranium producing company issued bonds 3 years ago. The bonds will mature 7 years from now. A major nuclear accident occurs today. Uranium is used as a fuel in nuclear plants. What will be the effect on the price of the company's bonds? ch >>> Select one: O a. The price will go up. O b. It does not make sense to talk about a price in such dire circumstances. O c. The price will go down O d. The price will remain the same In which situationis might a bond be called? Select one: O a. When the interest rates are sufficiently higher than the coupon rate O b. When the interest rates are equal to the coupon rate. O c. When the interest rates are sufficiently lower than the coupon rate. O d. All of the above. Q Q O e. None of the above 5 Yield Rate Determine whether bond #2 below is trading at a premium, at par, or at a discount? Bond No. Face Value Redemption Coupon Rate Years to Redemption Yield Rate 1. S1000 At Par 12 = 89 10 Jy = 10% 2. S5000 At Par js = 128 25 ja = 95 3. S2000 At Par 12 = 6.5% 5 12 = 6.5% 4. S1000 Ar 105 ja = 5% 10 z = 5% Determine whether bond #4 below is trading at a premium, at par, or at a discount? Bond No. Face Value Redemption Coupon Rate Years to Redemption 1. S1000 At Par 10 2. S5000 At Par J2 = 128 25 3. S2000 At Par = 6.5% S 4. S1000 At 105 12 = 5% 10 j2 = 10% /2 = 99 j? = 6.5% 12 = 55 Select one: O a. This bond is trading at a discount Select one: O a. This bond is trading at par. O b. This band is trading at a premium. O c. This bond is trading at par. O a O b. This bond is trading at a discount. O . This bond is trading at a premium