Question

Edwin Electronics (EE) has a factory for assembling TVs. EE outsources the TV screen to a supplier, but are considering bringing screen production in-house. Uncertainty

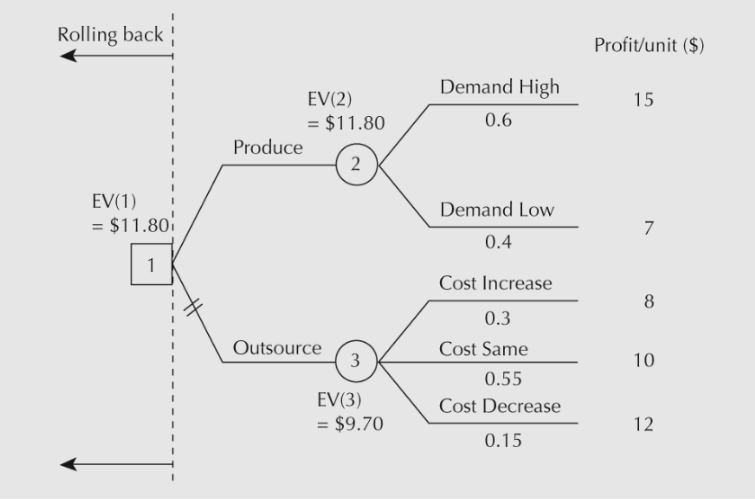

Edwin Electronics (EE) has a factory for assembling TVs. EE outsources the TV screen to a supplier, but are considering bringing screen production in-house. Uncertainty in demand for the companys TVs has an important bearing on the decision. If the future demand is low, outsourcing seems to be the reasonable option in order to save production costs. On the other hand, if the demand is high, it may be worthwhile to produce the screens on-site due to economies of scale. Probabilities of high demand and low demand futures are 0.6 and 0.4, respectively. Profits per unit are $10 for outsourced screens, $15 for high demand in-house produced screens, and $7 for low demand in-house produced screens.

Costs may increase (p= 0.3), decrease (p= 0.15), or remain the same (p= 0.55). The profits per unit would then be: $8 per screen if costs increase $10 per screen if costs remain the same $12 per screen if costs decrease

Modify the final decision tree of by using the following information: If EE decides to produce the screens in-house, and the high demand future happens, they may be tempted to increase production. Increasing production reduces the per unit costs and they expect the unit profits to increase to $18. This is risky because if they cannot sell all of the additional units produced, they will be stuck with excess inventory and the unit profit will be reduced to $13. The probability of not selling all of the additional units due to increased production is 0.55, and the probability of selling them all is 0.45. Redesign the decision tree, calculate the new EV of the decision to produce the screens in-house versus staying with outsourcing to the screen supplier, and make your recommendation.

Rolling back Profit/unit ($) Demand High 0.6 15 EV(2) = $11.80 Produce 2 N EV(1) = $11.80 Demand Low 0.4 7 1 8 8 Outsource Cost Increase 0.3 Cost Same 0.55 Cost Decrease 3 10 EV(3) = $9.70 12 0.15 Rolling back Profit/unit ($) Demand High 0.6 15 EV(2) = $11.80 Produce 2 N EV(1) = $11.80 Demand Low 0.4 7 1 8 8 Outsource Cost Increase 0.3 Cost Same 0.55 Cost Decrease 3 10 EV(3) = $9.70 12 0.15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started