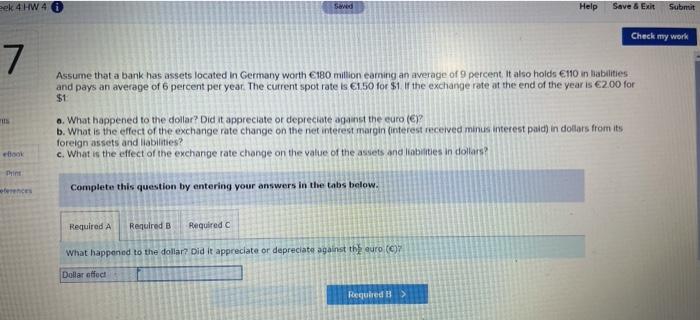

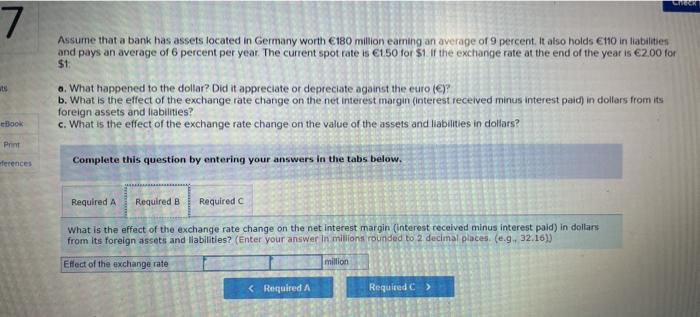

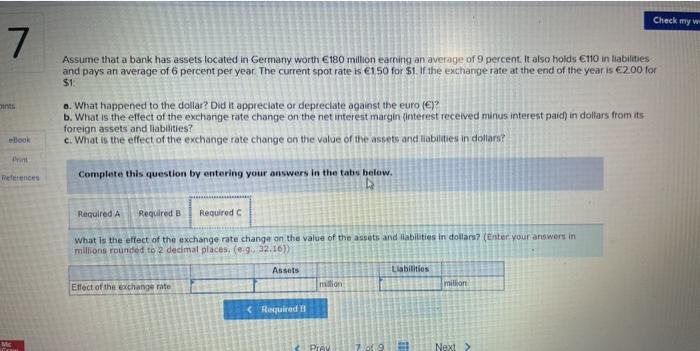

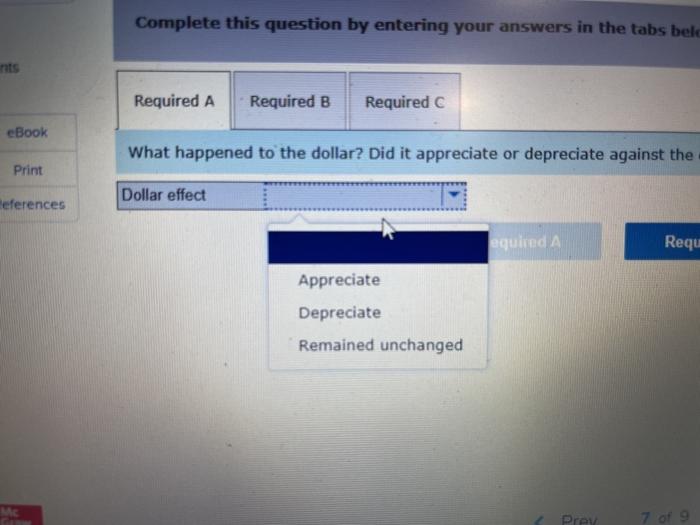

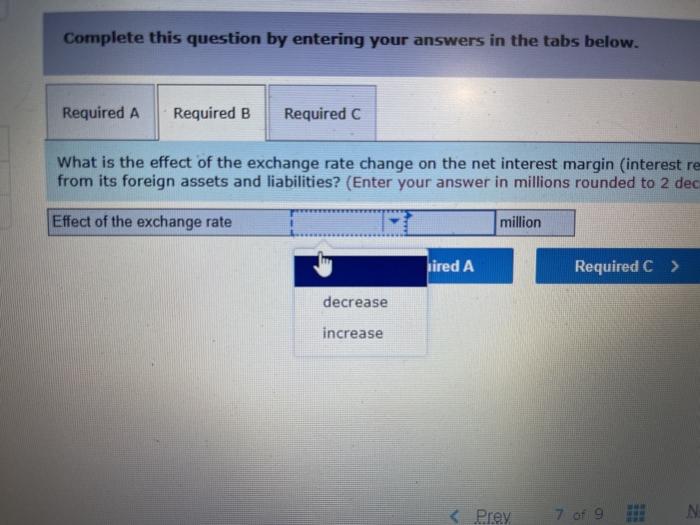

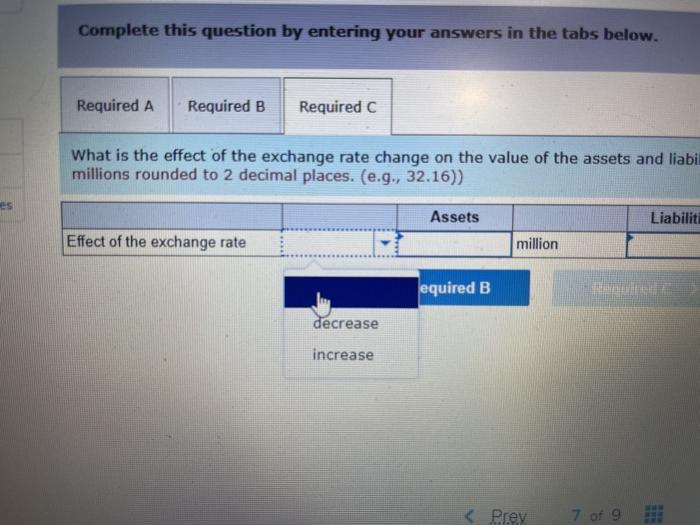

eek 4 HW 4 SW Help Save & Exit Submit Check my work 7 Assume that a bank has assets located in Germany worth 180 million earning an average of 9 percent. It also holds 110 in babilities and pays an average of 6 percent per year. The current spot rate is 1.50 for $1. If the exchange rate at the end of the year is 2.00 for $1 o. What happened to the dollar? Did it appreciate or depreciate against the euro ()? b. What is the effect of the exchange rate change on the net interest margin (interest received minus interest pald) in dollars from its foreign assets and liabilities? c. What is the effect of the exchange rate change on the value of the assets and liabities in dollars? co Pin Complete this question by entering your answers in the tabs below. Required A Required B Required What happened to the dollar? Did It appreciate or depreciate against the euro (0) Dollar effect Required GIRRE 7 Assume that a bank has assets located in Germany worth 180 million eating an average of 9 percent. It also holds eno in abilities and pays an average of 6 percent per year. The current spot rate is 150 for $1. If the exchange rate at the end of the year is 2.00 for $1 6. What happened to the dollar? Did it appreciate or depreciate against the euro ()? b. What is the effect of the exchange rate change on the net interest margin (interest received minus interest paid) in dollars from its foreign assets and liabilities? c. What is the effect of the exchange rate change on the value of the assets and liabilities in dollars? Book Print ferences Complete this question by entering your answers in the tabs below. Required A Required B Required What is the effect of the exchange rate change on the net interest margin (interest received minus interest paid) in dollars from its foreign assets and liabilities? (Enter your answer in million rounded to 2 decimal places (1.9. 32.16) Effect of the exchange rate million Check my w 7 Assume that a bank has assets located in Germany worth 180 million earning an average of 9 percent. It also holds 110 in liabilities and pays an average of 6 percent per year. The current spot rate is 150 for $1. If the exchange rate at the end of the year is 2.00 for $1 6. What happened to the dollar? Did it appreciate or depreciate against the euro ()? b. What is the effect of the exchange rate change on the net interest margin (interest received minus interest paid) in dollars from its foreign assets and liabilities? c. What is the effect of the exchange rate change on the value of the assets and liabilities in dollars? ins Book References Complete this question by entering your answers in the tabs below. Required A Required B Required c What is the effect of the exchange rate change on the value of the assets and liabilities in dollars? (Enter your answers in millions rounded to 2 decimal places, (eg 32.16)) Assets Liabilities Effect of the exchange rate million million Complete this question by entering your answers in the tabs bele nts Required A Required B Required c eBook What happened to the dollar? Did it appreciate or depreciate against the Print Dollar effect References equired A Requ Appreciate Depreciate Remained unchanged Prey 7 of 9 Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the effect of the exchange rate change on the net interest margin interest re from its foreign assets and liabilities? (Enter your answer in millions rounded to 2 dec Effect of the exchange rate million jired A Required C > decrease increase