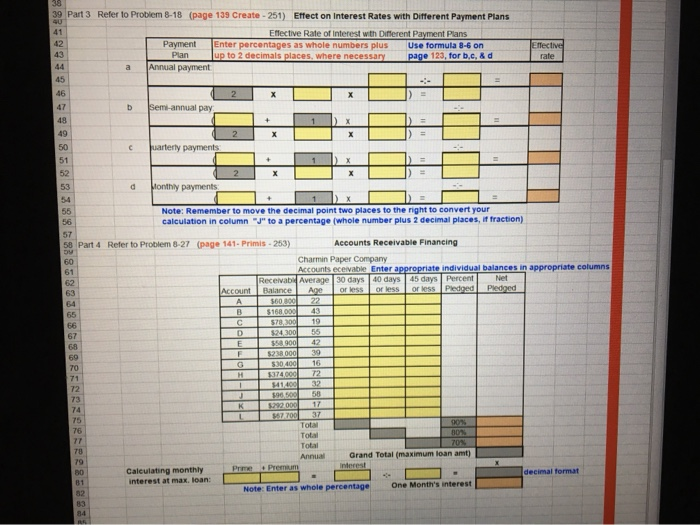

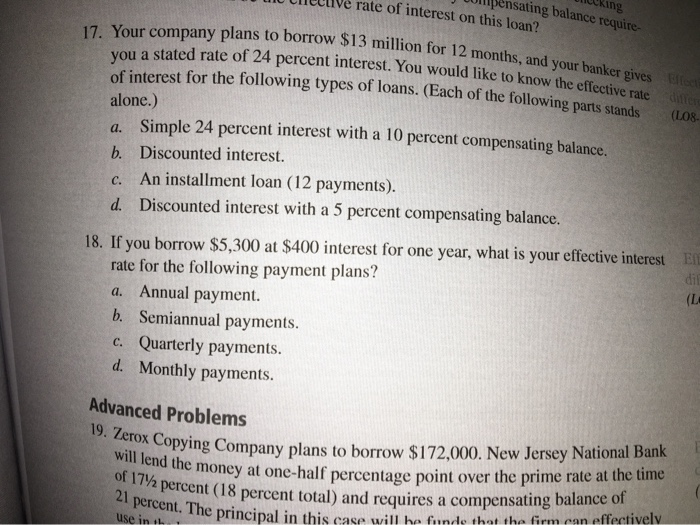

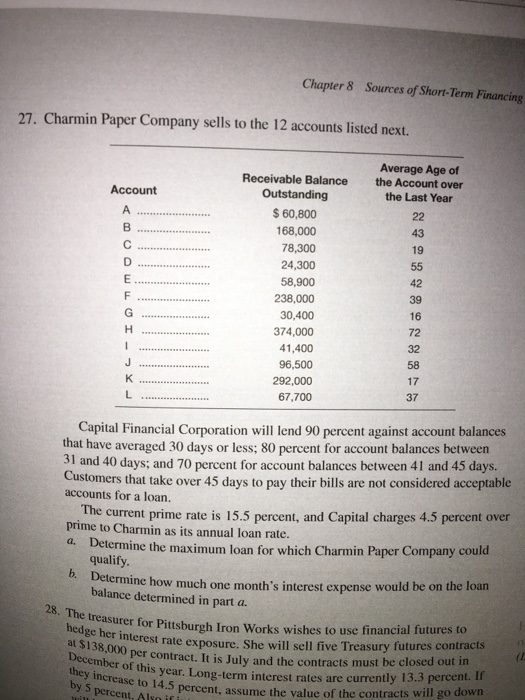

Effective rate b 39 39 Part 3 Refer to Problem 8-18 (page 139 Create - 251) Effect on Interest Rates with Different Payment Plans 41 Effective Rate of interest with Different Payment Plans 42 Payment Enter percentages as whole numbers plus Use formula 8-6 on 43 Plan up to 2 decimals places where necessary page 123, for b.c,&d a Annual payment 45 46 2. Semi-annual pay 48 1 49 X 50 c uarterly payments 51 52 53 d Monthly payments 54 Note: Remember to move the decimal point two places to the right to convert your calculation in column "J" to a percentage (whole number plus 2 decimal places, if fraction) 88 X 3 Age 58 Part 4 Refer to Problem 8-27 (page 141- Primis - 253) Accounts Receivable Financing 60 Charmin Paper Company 61 Accounts eceivable Enter appropriate individual balances in appropriate columns 62 ReceivabAverage 30 days 40 days 45 days Percent Net 63 Account Balance or less or less or less Pledged Pledged A 560.100 22 65 B $160.000 43 66 $78,300 19 67 D $24300 55 68 E $58.900 42 59 F $238 000 39 70 $30 400 16 71 3374000 72 1 72 H41400 32 73 J 58 74 K 292000 17 75 7700 37 Total 90 76 Total 77 709 Total 78 79 Annual Grand Total (maximum loan amt) Premium Calculating monthly Interest 80 decimal format 81 interest at max. loan: 82 Note: Enter as whole percentage One Month's interest 1.96 od 84 RE ing sating balance require rate of interest on this loan? 19. Zerox Copying Company plans to borrow $172,000. New Jersey National Bank 17. Your company plans to borrow $13 million for 12 months, and your banker gives you a stated rate of 24 percent interest. You would like to know the effective rate of interest for the following types of loans. (Each of the following parts stands alone.) (LOS a. Simple 24 percent interest with a 10 percent compensating balance. b. Discounted interest. c. An installment loan (12 payments). d. Discounted interest with a 5 percent compensating balance. 18. If you borrow $5,300 at $400 interest for one year, what is your effective interest Em rate for the following payment plans? dil a. Annual payment. b. Semiannual payments. c. Quarterly payments. d. Monthly payments. Advanced Problems will lend the money at one-half percentage point over the prime rate at the time 21 percent. The principal in this case will he finds that the firm can effectively use in the 28. The treasurer for Pittsburgh Iron Works wishes to use financial futures to hedge her interest rate exposure. She will sell five Treasury futures contracts al $138,000 per contract. It is July and the contracts must be closed out in December of this year. Long-term interest rates are currently 13.3 percent. If they increase to 14.5 percent, assume the value of the contracts will go down Chapter 8 Sources of Short-Term Financing 27. Charmin Paper Company sells to the 12 accounts listed next. Account A B D E F G H Receivable Balance Outstanding $ 60,800 168,000 78,300 24,300 58,900 238,000 30,400 374,000 41,400 96,500 292,000 67,700 Average Age of the Account over the Last Year 22 43 19 55 42 39 16 72 32 58 17 37 1 J L Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 15.5 percent, and Capital charges 4.5 percent over prime to Charmin as its annual loan rate. a. Determine the maximum loan for which Charmin Paper Company could qualify b. Determine how much one month's interest expense would be on the loan balance determined in part a. ( by 5 percent, Alinifi Effective rate b 39 39 Part 3 Refer to Problem 8-18 (page 139 Create - 251) Effect on Interest Rates with Different Payment Plans 41 Effective Rate of interest with Different Payment Plans 42 Payment Enter percentages as whole numbers plus Use formula 8-6 on 43 Plan up to 2 decimals places where necessary page 123, for b.c,&d a Annual payment 45 46 2. Semi-annual pay 48 1 49 X 50 c uarterly payments 51 52 53 d Monthly payments 54 Note: Remember to move the decimal point two places to the right to convert your calculation in column "J" to a percentage (whole number plus 2 decimal places, if fraction) 88 X 3 Age 58 Part 4 Refer to Problem 8-27 (page 141- Primis - 253) Accounts Receivable Financing 60 Charmin Paper Company 61 Accounts eceivable Enter appropriate individual balances in appropriate columns 62 ReceivabAverage 30 days 40 days 45 days Percent Net 63 Account Balance or less or less or less Pledged Pledged A 560.100 22 65 B $160.000 43 66 $78,300 19 67 D $24300 55 68 E $58.900 42 59 F $238 000 39 70 $30 400 16 71 3374000 72 1 72 H41400 32 73 J 58 74 K 292000 17 75 7700 37 Total 90 76 Total 77 709 Total 78 79 Annual Grand Total (maximum loan amt) Premium Calculating monthly Interest 80 decimal format 81 interest at max. loan: 82 Note: Enter as whole percentage One Month's interest 1.96 od 84 RE ing sating balance require rate of interest on this loan? 19. Zerox Copying Company plans to borrow $172,000. New Jersey National Bank 17. Your company plans to borrow $13 million for 12 months, and your banker gives you a stated rate of 24 percent interest. You would like to know the effective rate of interest for the following types of loans. (Each of the following parts stands alone.) (LOS a. Simple 24 percent interest with a 10 percent compensating balance. b. Discounted interest. c. An installment loan (12 payments). d. Discounted interest with a 5 percent compensating balance. 18. If you borrow $5,300 at $400 interest for one year, what is your effective interest Em rate for the following payment plans? dil a. Annual payment. b. Semiannual payments. c. Quarterly payments. d. Monthly payments. Advanced Problems will lend the money at one-half percentage point over the prime rate at the time 21 percent. The principal in this case will he finds that the firm can effectively use in the 28. The treasurer for Pittsburgh Iron Works wishes to use financial futures to hedge her interest rate exposure. She will sell five Treasury futures contracts al $138,000 per contract. It is July and the contracts must be closed out in December of this year. Long-term interest rates are currently 13.3 percent. If they increase to 14.5 percent, assume the value of the contracts will go down Chapter 8 Sources of Short-Term Financing 27. Charmin Paper Company sells to the 12 accounts listed next. Account A B D E F G H Receivable Balance Outstanding $ 60,800 168,000 78,300 24,300 58,900 238,000 30,400 374,000 41,400 96,500 292,000 67,700 Average Age of the Account over the Last Year 22 43 19 55 42 39 16 72 32 58 17 37 1 J L Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 15.5 percent, and Capital charges 4.5 percent over prime to Charmin as its annual loan rate. a. Determine the maximum loan for which Charmin Paper Company could qualify b. Determine how much one month's interest expense would be on the loan balance determined in part a. ( by 5 percent, Alinifi