Answered step by step

Verified Expert Solution

Question

1 Approved Answer

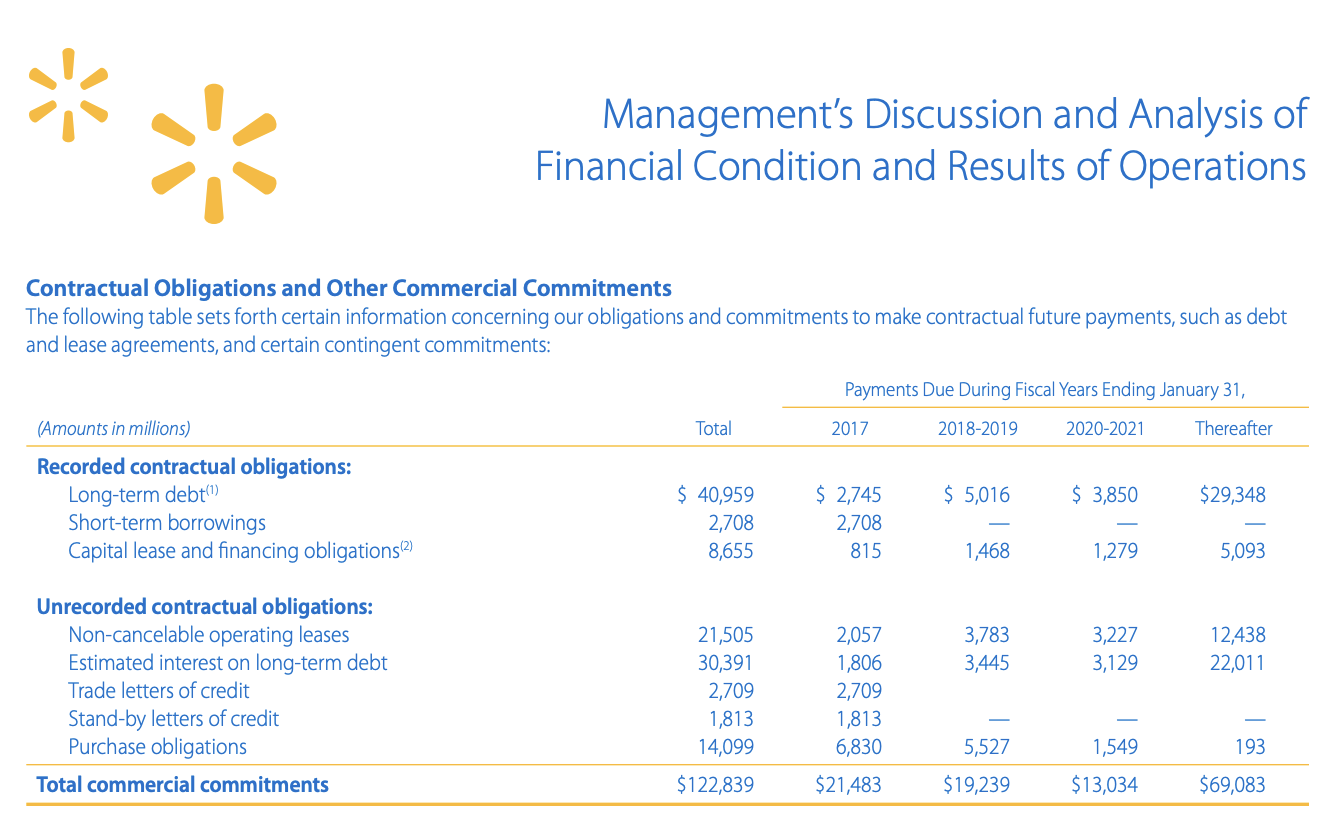

Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of

- Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year and assume 10 periods for the Thereafter period. You will need to indicate the Present value factor and the present value for each of the period(s) examined. One suggestion for the interest rate would be to divide the interest expense for the fiscal year ending January 31, 2016, by the average of the January 31, 2016, and January 31, 2015, interest-bearing debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started