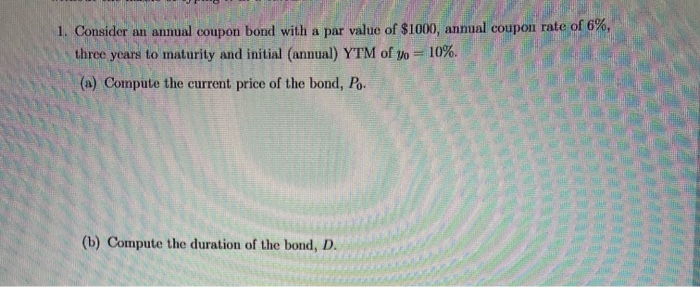

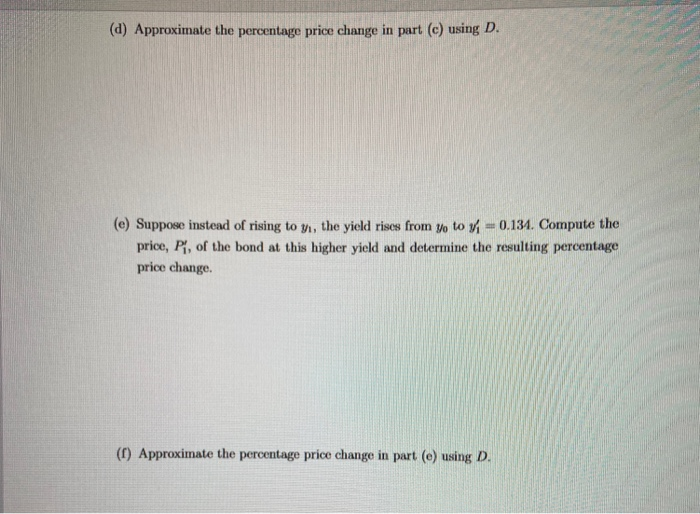

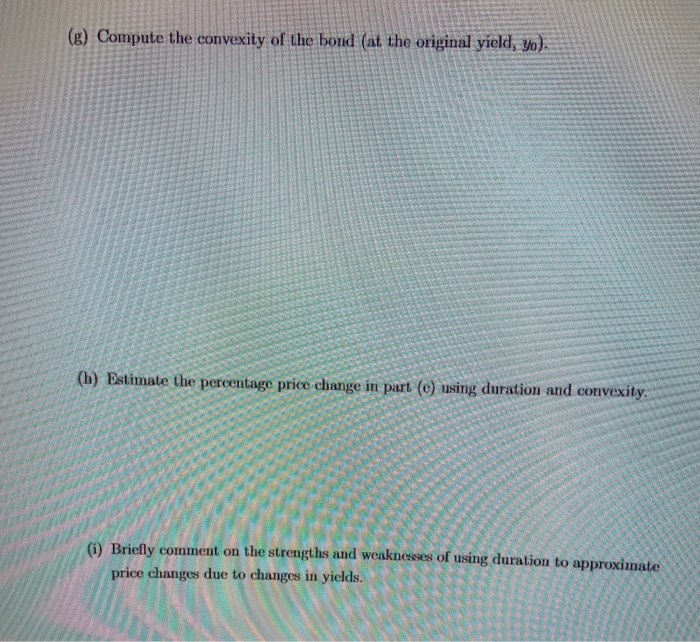

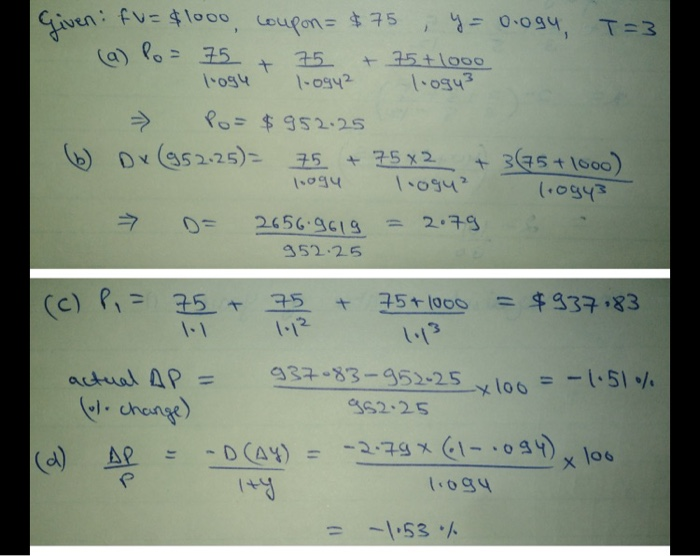

. . . 1. Consider an annual coupon bond with a par value of $1000, annual coupon rate of 6%, three years to maturity and initial (annual) YTM of yo = 10%. (a) Compute the current price of the bond, Po. EEEEE (1) Compute the duration of the bond, D. (a) Approximate the percentage price change in part (e) using D. (e) Suppose instead of rising to y, the yield rises from yo to -0.134. Compute the price, Pr, of the bond at this higher yield and determine the resulting percentage price change. (1) Approximate the percentage price change in part (e) using D. (g) Compute the convexity of the bond (at the original yield, yo). (h) Estimate the percentage price change in part (e) using duration and convexity. (0) Briefly comment on the strengths and weaknesses of using duration to approximate price changes due to changes in yields. Given fu= $1000 coupon = $75, y = 0.ogy, T=3 (a) Po= 75 + 75 - 75 + 1000 loogle loogy? l-ogy3 Po= $952.25 (6 x (952.25)= 75 + 75x2 + 3(75 +1000) logy 1.ogu logy D= 2656.9619 26569619 = 2.79 = 2.79 952.25 (c) P = 75 + 75 + 75+1000 = $937.83 actual AP = 937083-952-25 x 100 = -1.51% (ol. change) 952-25 (M) AP = -0(04) = -2.79* 61-.094), los logy x loo = -1.53 . . . 1. Consider an annual coupon bond with a par value of $1000, annual coupon rate of 6%, three years to maturity and initial (annual) YTM of yo = 10%. (a) Compute the current price of the bond, Po. EEEEE (1) Compute the duration of the bond, D. (a) Approximate the percentage price change in part (e) using D. (e) Suppose instead of rising to y, the yield rises from yo to -0.134. Compute the price, Pr, of the bond at this higher yield and determine the resulting percentage price change. (1) Approximate the percentage price change in part (e) using D. (g) Compute the convexity of the bond (at the original yield, yo). (h) Estimate the percentage price change in part (e) using duration and convexity. (0) Briefly comment on the strengths and weaknesses of using duration to approximate price changes due to changes in yields. Given fu= $1000 coupon = $75, y = 0.ogy, T=3 (a) Po= 75 + 75 - 75 + 1000 loogle loogy? l-ogy3 Po= $952.25 (6 x (952.25)= 75 + 75x2 + 3(75 +1000) logy 1.ogu logy D= 2656.9619 26569619 = 2.79 = 2.79 952.25 (c) P = 75 + 75 + 75+1000 = $937.83 actual AP = 937083-952-25 x 100 = -1.51% (ol. change) 952-25 (M) AP = -0(04) = -2.79* 61-.094), los logy x loo = -1.53