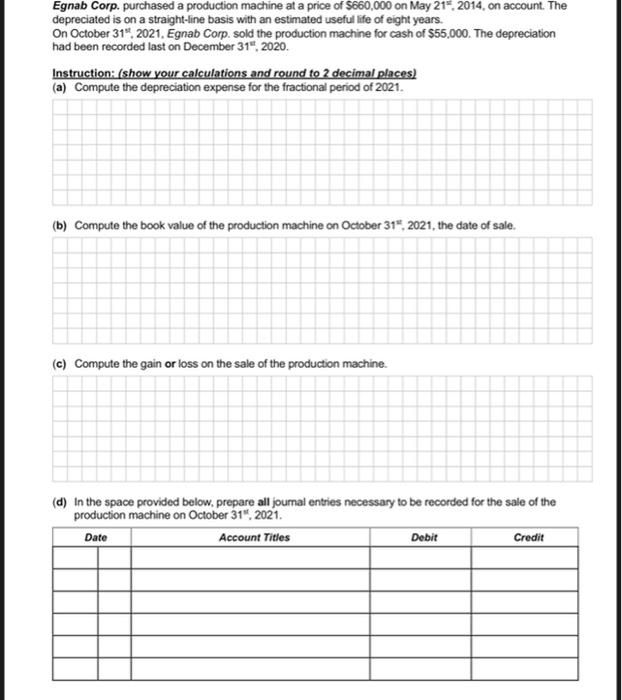

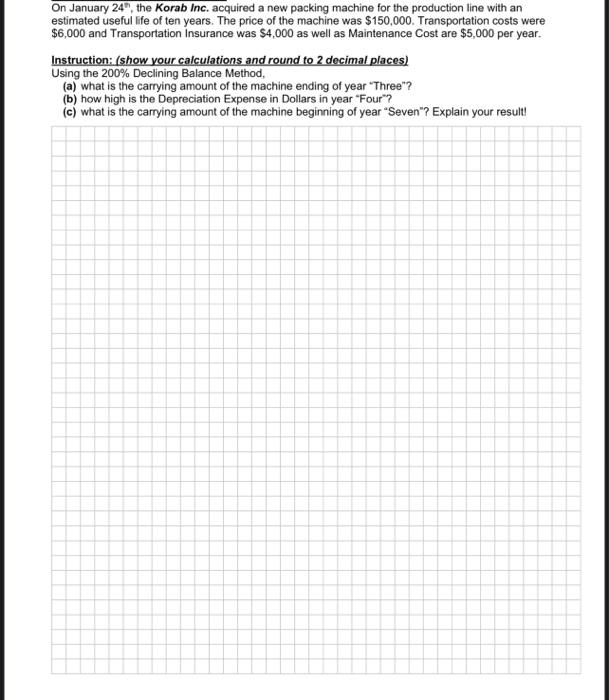

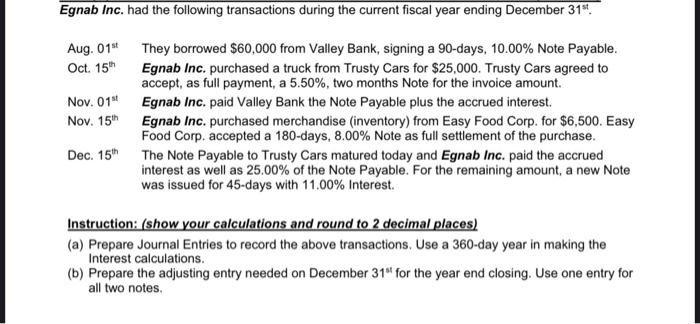

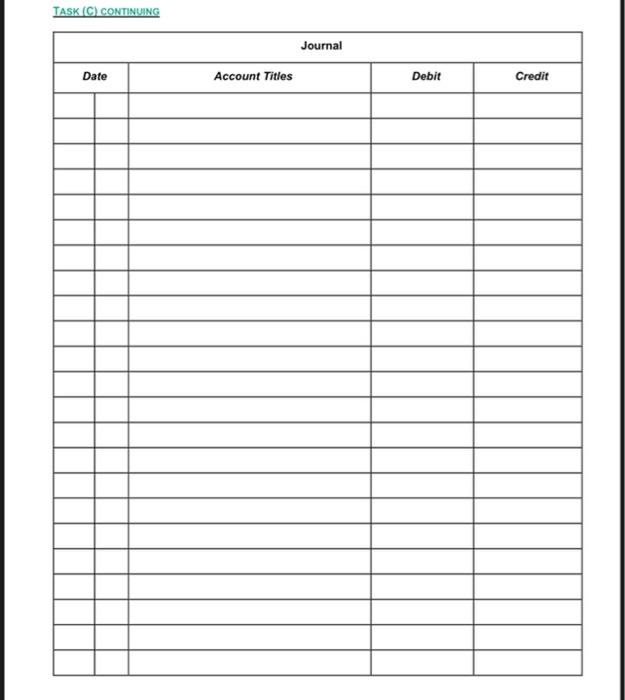

Egnab Corp. purchased a production machine at a price of S660,000 on May 21, 2014, on account. The depreciated is on a straight-line basis with an estimated useful life of eight years. On October 31, 2021. Egnab Corp. sold the production machine for cash of $55,000. The depreciation had been recorded last on December 31" 2020. Instruction: (show your calculations and round to 2 decimal places) (a) Compute the depreciation expense for the fractional period of 2021. (b) Compute the book value of the production machine on October 31", 2021, the date of sale. (c) Compute the gain or loss on the sale of the production machine. (d) In the space provided below, prepare all oumal entries necessary to be recorded for the sale of the production machine on October 31", 2021. Account Titles Debit Credit Date On January 24, the Korab Inc. acquired a new packing machine for the production line with an estimated useful life of ten years. The price of the machine was $150,000. Transportation costs were $6,000 and Transportation Insurance was $4,000 as well as Maintenance Cost are $5,000 per year. Instruction: (show your calculations and round to 2 decimal places) Using the 200% Declining Balance Method, (a) what is the carrying amount of the machine ending of year "Three"? (b) how high is the Depreciation Expense in Dollars in year "Four? (c) what is the carrying amount of the machine beginning of year "Seven"? Explain your result! Egnab Inc. had the following transactions during the current fiscal year ending December 31". Aug. 01 They borrowed $60,000 from Valley Bank, signing a 90-days, 10.00% Note Payable. Oct. 15 Egnab Inc. purchased a truck from Trusty Cars for $25,000. Trusty Cars agreed to accept, as full payment, a 5.50%, two months Note for the invoice amount Nov. 01 Egnab Inc. paid Valley Bank the Note Payable plus the accrued interest Nov. 15 Egnab Inc. purchased merchandise (inventory) from Easy Food Corp. for $6,500. Easy Food Corp. accepted a 180-days, 8.00% Note as full settlement of the purchase. Dec. 15 The Note Payable to Trusty Cars matured today and Egnab Inc. paid the accrued interest as well as 25.00% of the Note Payable. For the remaining amount, a new Note was issued for 45-days with 11.00% Interest. Instruction: (show your calculations and round to 2 decimal places) (a) Prepare Journal Entries to record the above transactions. Use a 360-day year in making the Interest calculations. (b) Prepare the adjusting entry needed on December 31" for the year end closing. Use one entry for all two notes TASK(C) CONTINUING Journal Date Account Titles Debit Credit Describe intangible Assets and name three examples