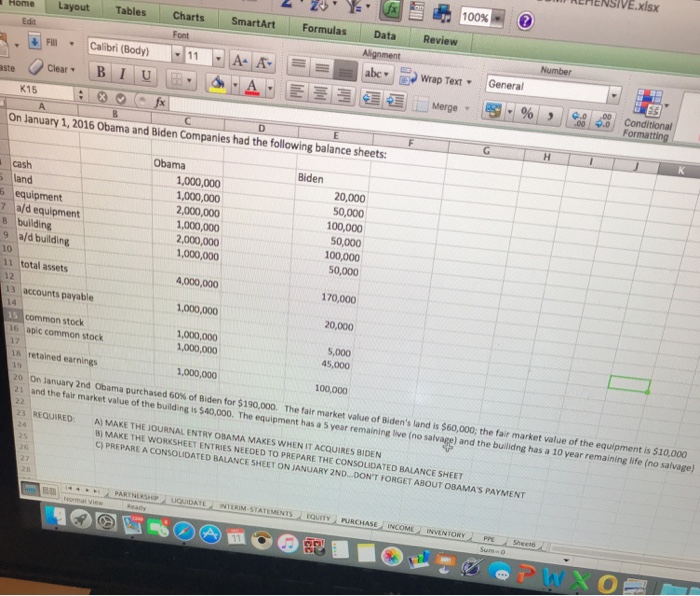

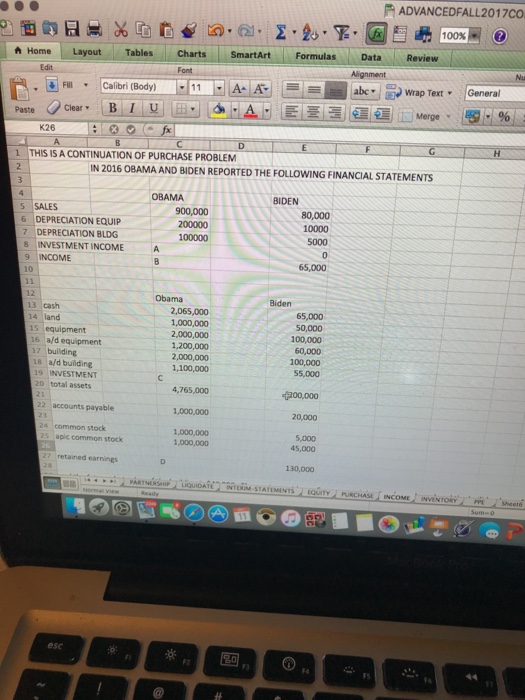

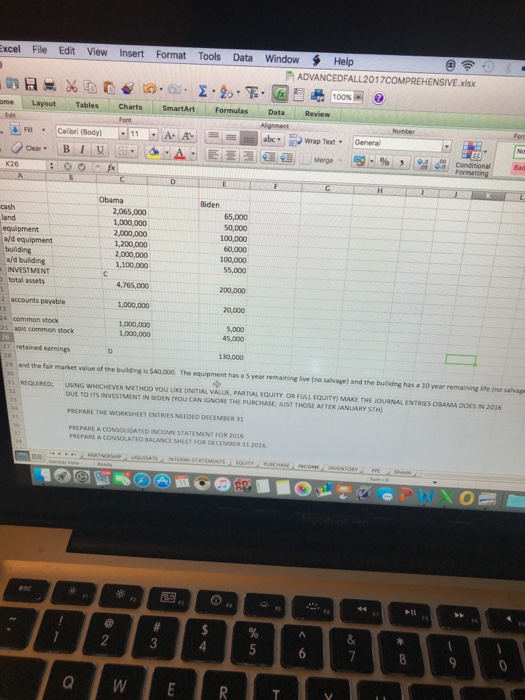

EHENSIVE.xisx 100% Home Layout Tables Charts SmartArt Formulas Data Review %Conditional Formatting- K15 On January 1, 2016 Obama and Biden Companies had the following balance sheets: Obama Biden cash land 1,000,000 1,000,000 2,000,000 1,000,000 2,000,000 1,000,000 0,000 0,000 100,000 0,000 6 equipment 7 a/d equipment B building 9 a/d building 10 100,000 50,000 11 total assets 4,000,000 170,000 12 accounts payable 1,000,000 20,000 common stock 16 apic common stock 1,000,000 1,000,000 1,000,000 5,000 45,000 retained earnings 100,000 On January 2nd Obama purchased 60% of Biden for $190,000. The fair market value of Biden's land is S60 000, the fair market value of the equipment is $10,000 lvagel and the builiding has a 10 year remaining life (no salvage) fair market value of the building is $40,000. The equipment has a 5 year remaining live (no sa 23REQUIRED: A) MAKE THE JOURNAL ENTRY OBAMA MAKES WHEN IT B) MAKE THE WORKSHEET ENT RIES NEEDED TO PREPARE THE CONSOLIDATED BALANCE SHEET C) PREPARE A CONSOLIDATED BALANCE SHEET ON JANUARY 2ND. .DONT ORGET ABOUT OBAMA'S PAYMENT STATEMENTS KQUTY PURCHASE INCOME INVENTORY PPE Shee6 Sum 0 EHENSIVE.xisx 100% Home Layout Tables Charts SmartArt Formulas Data Review %Conditional Formatting- K15 On January 1, 2016 Obama and Biden Companies had the following balance sheets: Obama Biden cash land 1,000,000 1,000,000 2,000,000 1,000,000 2,000,000 1,000,000 0,000 0,000 100,000 0,000 6 equipment 7 a/d equipment B building 9 a/d building 10 100,000 50,000 11 total assets 4,000,000 170,000 12 accounts payable 1,000,000 20,000 common stock 16 apic common stock 1,000,000 1,000,000 1,000,000 5,000 45,000 retained earnings 100,000 On January 2nd Obama purchased 60% of Biden for $190,000. The fair market value of Biden's land is S60 000, the fair market value of the equipment is $10,000 lvagel and the builiding has a 10 year remaining life (no salvage) fair market value of the building is $40,000. The equipment has a 5 year remaining live (no sa 23REQUIRED: A) MAKE THE JOURNAL ENTRY OBAMA MAKES WHEN IT B) MAKE THE WORKSHEET ENT RIES NEEDED TO PREPARE THE CONSOLIDATED BALANCE SHEET C) PREPARE A CONSOLIDATED BALANCE SHEET ON JANUARY 2ND. .DONT ORGET ABOUT OBAMA'S PAYMENT STATEMENTS KQUTY PURCHASE INCOME INVENTORY PPE Shee6 Sum 0