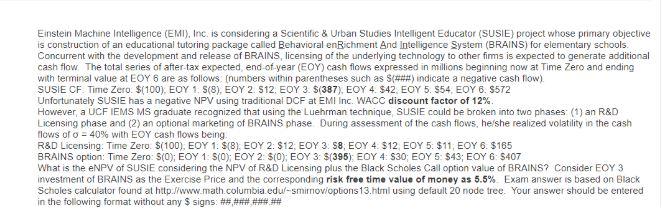

Einstein Machine Inteligence (EMI), Inc. is considering a Scientific& Urban Studies Intelligent Educator (SUSIE) project whose primary objective is construction of an educational tutoring package called Behavioral enBichment And Inteligence System (BRAINS) for elementary schools Concurrent with the development and release of BRAINS, licensing of the underlying technology to other firms is expected to generate additional cash flow The total series of after-tax expected, end-of year (EOY) cash flows expressed in millions beginning now at Time Zero and ending with terminal value at EOY 6 are as follows (numbers within parentheses such as S(###"ndicate a negative cash now) SUSIE CF. Time Zero. $(100), EOY 1. S(8), EOY 2 S12, EOY 3. S(387), EOY 4. $42, EOY 5. S54, EOY 6. S572 Unfortunately SUSIE has a negative NPV using traditional DCF at EMI Inc. WACC discount factor of 12% However, a UCF IEMS MS graduate recagnized that using the Luehrman technique, SUSIE could be broken into two phases: (1) an R&D Licensing phase and (2) an optional marketing of BRAINS phase During assessment of the cash flows, heshe realized volatility in the cash flows oro-40% with EOY cash nows being R&D Licensing: Time Zero $(100), EOY 1 $(8), EOY 2: $12, EOY 3. S8, EOY 4. $12, EOY 5: $11, EOY 6. $165 BRAINS option: Time Zero: S(0) EOY 1: S(0) EOY 2: $(0), EOY 3: $(395 EOY 4: S30; EOY 5: $43; EOY 6: $407 What is the eNPV of SUSIE considering the NPV of R&D Licensing plus the Black Scholes Call option value of BRAINS? Consider EOY 3 investment of BRAINS as the Exercise Price and the corresponding risk free time value of money as 5.5% Exam answer based on Black Scholes calculator found at http J/www.math.columbia edul-smirnovioptions 13.html using default 20 node tree. Your answer should be entered in the following format without any $ signs. ##### ##### 9 3 5 Einstein Machine Inteligence (EMI), Inc. is considering a Scientific& Urban Studies Intelligent Educator (SUSIE) project whose primary objective is construction of an educational tutoring package called Behavioral enBichment And Inteligence System (BRAINS) for elementary schools Concurrent with the development and release of BRAINS, licensing of the underlying technology to other firms is expected to generate additional cash flow The total series of after-tax expected, end-of year (EOY) cash flows expressed in millions beginning now at Time Zero and ending with terminal value at EOY 6 are as follows (numbers within parentheses such as S(###"ndicate a negative cash now) SUSIE CF. Time Zero. $(100), EOY 1. S(8), EOY 2 S12, EOY 3. S(387), EOY 4. $42, EOY 5. S54, EOY 6. S572 Unfortunately SUSIE has a negative NPV using traditional DCF at EMI Inc. WACC discount factor of 12% However, a UCF IEMS MS graduate recagnized that using the Luehrman technique, SUSIE could be broken into two phases: (1) an R&D Licensing phase and (2) an optional marketing of BRAINS phase During assessment of the cash flows, heshe realized volatility in the cash flows oro-40% with EOY cash nows being R&D Licensing: Time Zero $(100), EOY 1 $(8), EOY 2: $12, EOY 3. S8, EOY 4. $12, EOY 5: $11, EOY 6. $165 BRAINS option: Time Zero: S(0) EOY 1: S(0) EOY 2: $(0), EOY 3: $(395 EOY 4: S30; EOY 5: $43; EOY 6: $407 What is the eNPV of SUSIE considering the NPV of R&D Licensing plus the Black Scholes Call option value of BRAINS? Consider EOY 3 investment of BRAINS as the Exercise Price and the corresponding risk free time value of money as 5.5% Exam answer based on Black Scholes calculator found at http J/www.math.columbia edul-smirnovioptions 13.html using default 20 node tree. Your answer should be entered in the following format without any $ signs. ##### ##### 9 3 5