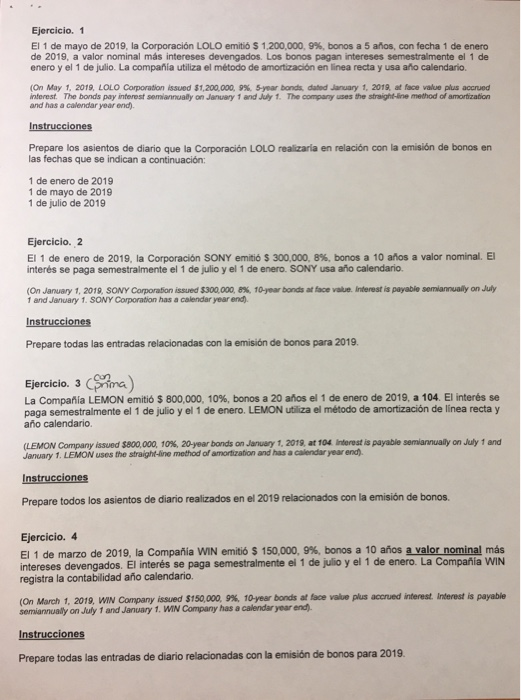

Ejercicio. 1 El 1 de mayo de 2019, la Corporacin LOLO emiti $ 1,200,0009%, bonos a 5 aos, con fecha 1 de enero de 2019, a valor nominal ms intereses devengados. Los bonos pagan intereses semestralmente el 1 de enero y el 1 de julio. La compaa utiliza el mtodo de amortizacin en linea recta y usa ao calendario. (On May 1, 2019, LOLO Corporadon issued $1,200,000, 9%, Syear bonds, dated January 1, 2019, at face value plus accrued interest. The bonds pay interest semiannually on January 1 and July 1. The company uses the straight-line method of amortization and has a calendar year end). Instrucciones Prepare los asientos de diario que la Corporacin LOLO realizara en relacin con la emisin de bonos en las fechas que se indican a continuacin: 1 de enero de 2019 1 de mayo de 2019 1 de julio de 2019 Ejercicio. 2 El 1 de enero de 2019, la Corporacin SONY emiti $ 300,000, 8%, bonos a 10 aos a valor nominal. E inters se paga semestralmente el 1 de julio y el 1 de enero. SONY usa ao calendario. (On January 1, 2019. SONY Corporation issued $300,000, 8%, 10-year bonds atbce vaue. Idemat is payable semanualy on July 1 and January 1. SONY Corporation has a calendar year end Prepare todas las entradas relacionadas con la emisin de bonos para 2019. Ejercicio. 3 na) La Compaa LEMON emiti $ 800,000, 10%, bonos a 20 aos el 1 de enero de 2019, a 104. El inters se paga semestralmente el 1 de julio y el 1 de enero LEMON utiliza el mtodo de amortizacin de linea recta y ao calendario. ual n July 1 and o 10% 20-year bords on January 1, 2019 at 104 interest is payable semia o LEMON Company issueds January 1. LEMON uses the straight-line method of amortization and has a calendar year end). Instrucciones Prepare todos los asientos de diario realizados en el 2019 relacionados con la emisin de bonos. Ejercicio. 4 El 1 de marzo de 2019, la Compaa WIN emiti $ 150,000, 9%, bonos a 10 aos avalornominal ms intereses devengados. El inters se paga semestralmente el 1 de julio y el 1 de enero. La Compania WIN registra la contabilidad ao calendario. (On March 1, 2019 WIN Co p any issued $150,000 5% 10year bords att e vale plus accrued interest interest is payable semiannually on July 1 and January 1. WIN Company has a calendar year end). Prepare todas las entradas de diario relacionadas con la emisin de bonos para 2019. Ejercicio. 1 El 1 de mayo de 2019, la Corporacin LOLO emiti $ 1,200,0009%, bonos a 5 aos, con fecha 1 de enero de 2019, a valor nominal ms intereses devengados. Los bonos pagan intereses semestralmente el 1 de enero y el 1 de julio. La compaa utiliza el mtodo de amortizacin en linea recta y usa ao calendario. (On May 1, 2019, LOLO Corporadon issued $1,200,000, 9%, Syear bonds, dated January 1, 2019, at face value plus accrued interest. The bonds pay interest semiannually on January 1 and July 1. The company uses the straight-line method of amortization and has a calendar year end). Instrucciones Prepare los asientos de diario que la Corporacin LOLO realizara en relacin con la emisin de bonos en las fechas que se indican a continuacin: 1 de enero de 2019 1 de mayo de 2019 1 de julio de 2019 Ejercicio. 2 El 1 de enero de 2019, la Corporacin SONY emiti $ 300,000, 8%, bonos a 10 aos a valor nominal. E inters se paga semestralmente el 1 de julio y el 1 de enero. SONY usa ao calendario. (On January 1, 2019. SONY Corporation issued $300,000, 8%, 10-year bonds atbce vaue. Idemat is payable semanualy on July 1 and January 1. SONY Corporation has a calendar year end Prepare todas las entradas relacionadas con la emisin de bonos para 2019. Ejercicio. 3 na) La Compaa LEMON emiti $ 800,000, 10%, bonos a 20 aos el 1 de enero de 2019, a 104. El inters se paga semestralmente el 1 de julio y el 1 de enero LEMON utiliza el mtodo de amortizacin de linea recta y ao calendario. ual n July 1 and o 10% 20-year bords on January 1, 2019 at 104 interest is payable semia o LEMON Company issueds January 1. LEMON uses the straight-line method of amortization and has a calendar year end). Instrucciones Prepare todos los asientos de diario realizados en el 2019 relacionados con la emisin de bonos. Ejercicio. 4 El 1 de marzo de 2019, la Compaa WIN emiti $ 150,000, 9%, bonos a 10 aos avalornominal ms intereses devengados. El inters se paga semestralmente el 1 de julio y el 1 de enero. La Compania WIN registra la contabilidad ao calendario. (On March 1, 2019 WIN Co p any issued $150,000 5% 10year bords att e vale plus accrued interest interest is payable semiannually on July 1 and January 1. WIN Company has a calendar year end). Prepare todas las entradas de diario relacionadas con la emisin de bonos para 2019