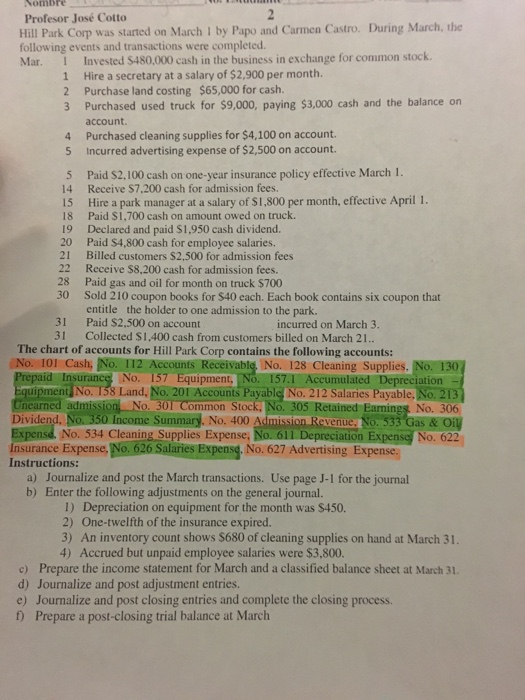

Hill Park Corp was started on March 1 by Papo and Carmen Castro. During March, the following events and transactions were completed. Mar. 1 Invested $480,000 cash in the business in exchange for common stock. 1 Hire a secretary at a salary of $2,900 per month. 2. Purchase land costing $65,000 for cash. 3. Purchased used truck for $9,000, paying $3,000 cash and the balance on account. 4. Purchased cleaning supplies for $4,100 on account. 5. incurred advertising expense of $2,500 on account. 5. Paid $2,100 cash on one-year insurance policy effective March 1. 14 Receive $7,200 cash for admission fees. 15 Hire a park manager at a salary of $1,800 per month, effective April 1. 18 Paid $ 1,700 cash on amount owed on truck. 19 Declared and paid $1,950 cash dividend. 20 Paid $4,800 cash for employee salaries. 21 Billed customers $2,500 for admission fees 22 Receive $8,200 cash for admission fees. 28 Paid gas and oil for month on truck $700 30 Sold 210 coupon books for $40 each. Each book contains six coupon that entitle the holder to one admission to the park. 31 Paid $2,500 on account incurred on March 3. 31 Collected $1,400 cash from customers billed on March 21.. The chart of accounts for Hill Park Corp contains the following accounts: No. 101 Cash. jNo. 112 Accounts Receivable. No. 12s Cleaning Supplies. No. 130 J Prepaid Insurancy No. 157 Equipment. No. 157.1 Accumulated Depreciation -I bquiprantfN'o. 158 [.and. No. 201 Accounts Payablf No. 212 Salaries Payable, No. 213 j Unearned No. ;|,I Common Stock. "No. 305 Retained Earnings. NV Dividend. No. 350 Income Summary. N,>. -IM) Admission Kcwnue. No. 533"Gas & Oil Expensi No. 534 Clcanm^Supplies Expense. No. 611 Depreciation"Expens^ No! 622 insurance Expense.]fJo. 626 Salaries Expens^. No. 627 Advertising Expense'. Instructions: No. 101 Cash, No. 112 Accounts Receivable. No. 128 Cleaning Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 157,1 Accumulated Depreciation - Equipment, No. 158 Land, No. 201 Accounts Payble, No. 212 Salaries Payable, No. 213 Gnearned admision, No. 301 Common Stock, No. 305 Retained Earnings, No. 306 Dividend, No. 350 Income Summarym No. 400 Admisission Revenue, No. 533 Gas & Oil Expense, No. 534 Cleaning Supplies Expense, No. 611 Depreciation Expense, No. 622 Insurance Expense, No. 626 Salaris Expense, No. 627 Advertising Expense. Instructions: a) Journalize and post the March transactions. Use page J-1 for the journal b) Enter the following adjustments on the general journal. 1) Depreciation on equipment for the month was $450. 2) One-twelfth of the insurance expired. 3) An inventory count shows $680 of cleaning supplies on hand at March 31. 4) Accrued but unpaid employee salaries were $3,800. c) Prepare the income statement for March and a classified balance sheet at March 31. d) Journalize and post adjustment entries. c) Journalize and post closing entries and complete the closing process. f) Prepare a post-closing trial balance at March