Answered step by step

Verified Expert Solution

Question

1 Approved Answer

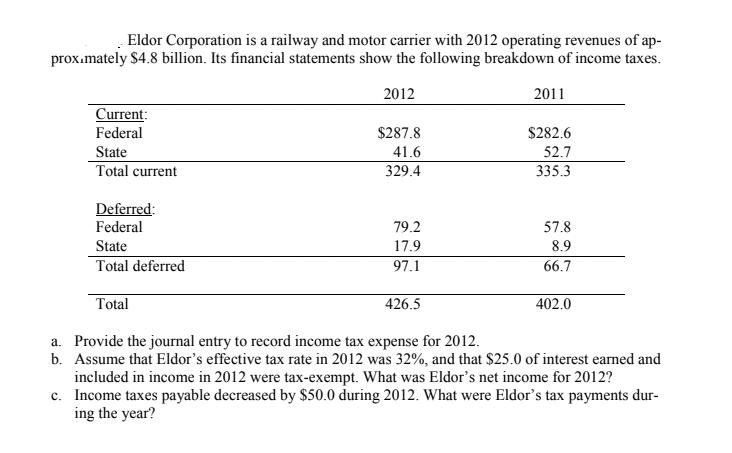

Eldor Corporation is a railway and motor carrier with 2012 operating revenues of ap- proximately $4.8 billion. Its financial statements show the following breakdown

Eldor Corporation is a railway and motor carrier with 2012 operating revenues of ap- proximately $4.8 billion. Its financial statements show the following breakdown of income taxes. Current: Federal State Total current Deferred: Federal State Total deferred Total 2012 $287.8 41.6 329.4 79.2 17.9 97.1 426.5 2011 $282.6 52.7 335.3 57.8 8.9 66.7 402.0 a. Provide the journal entry to record income tax expense for 2012. b. Assume that Eldor's effective tax rate in 2012 was 32%, and that $25.0 of interest earned and included in income in 2012 were tax-exempt. What was Eldor's net income for 2012? c. Income taxes payable decreased by $50.0 during 2012. What were Eldor's tax payments dur- ing the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To record income tax expense for 2012 the journal entry would be as follows Income Tax Expense 426...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started