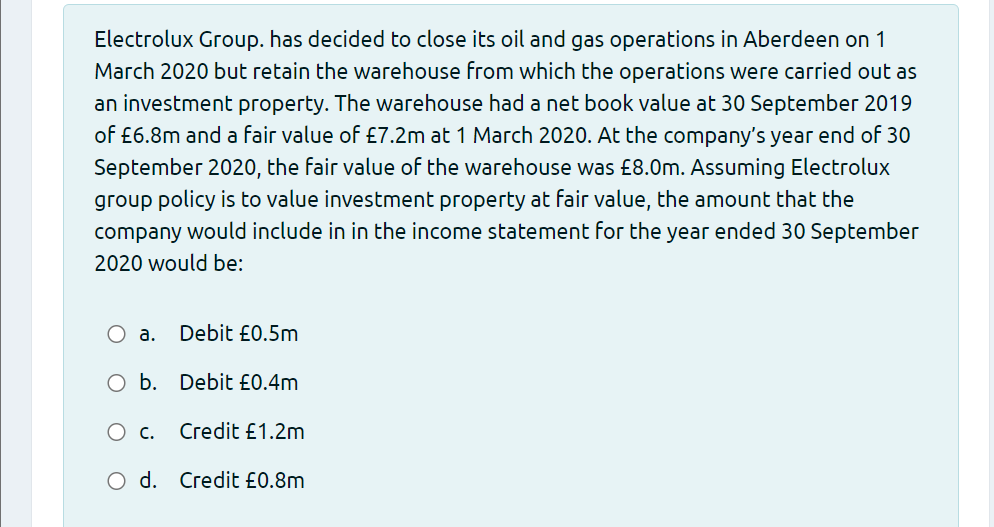

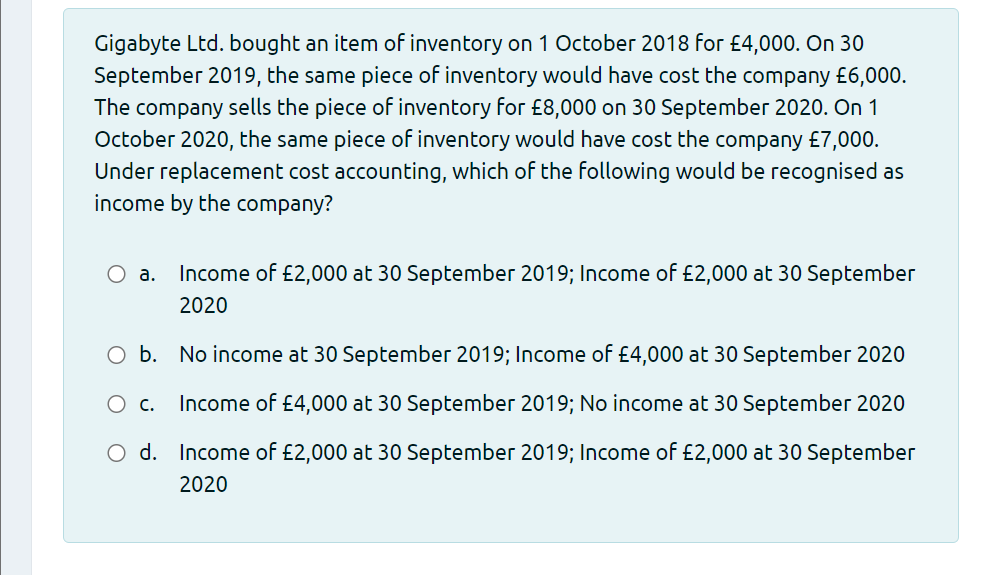

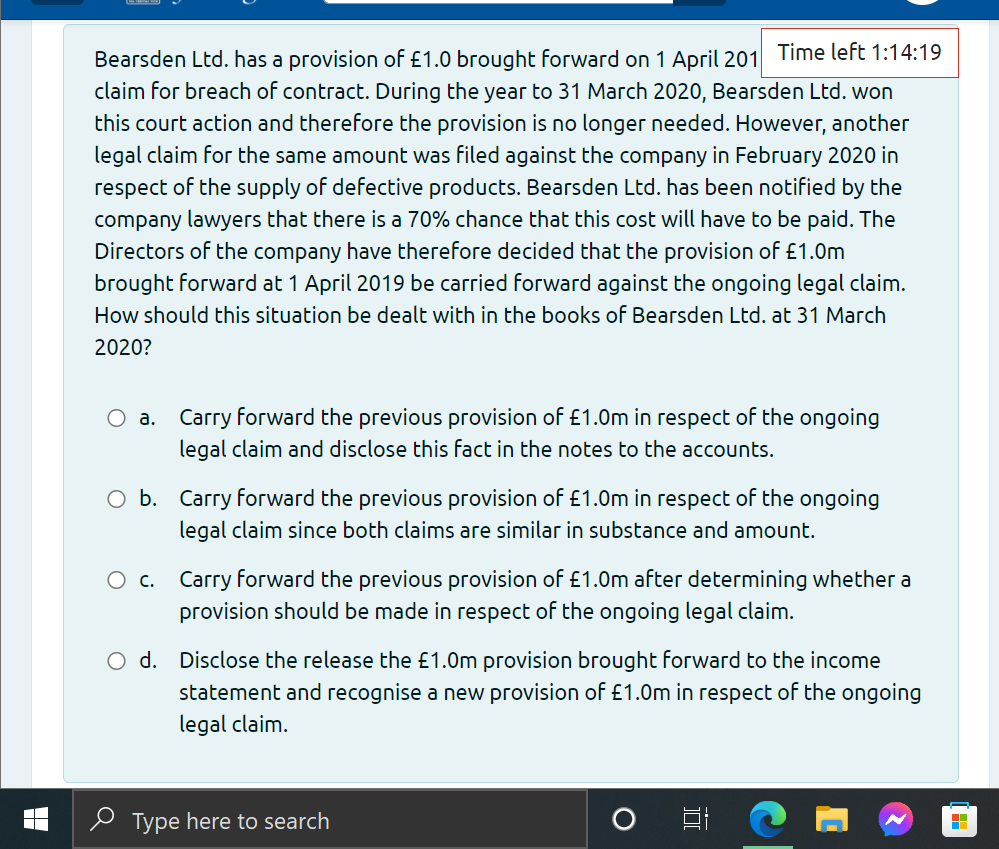

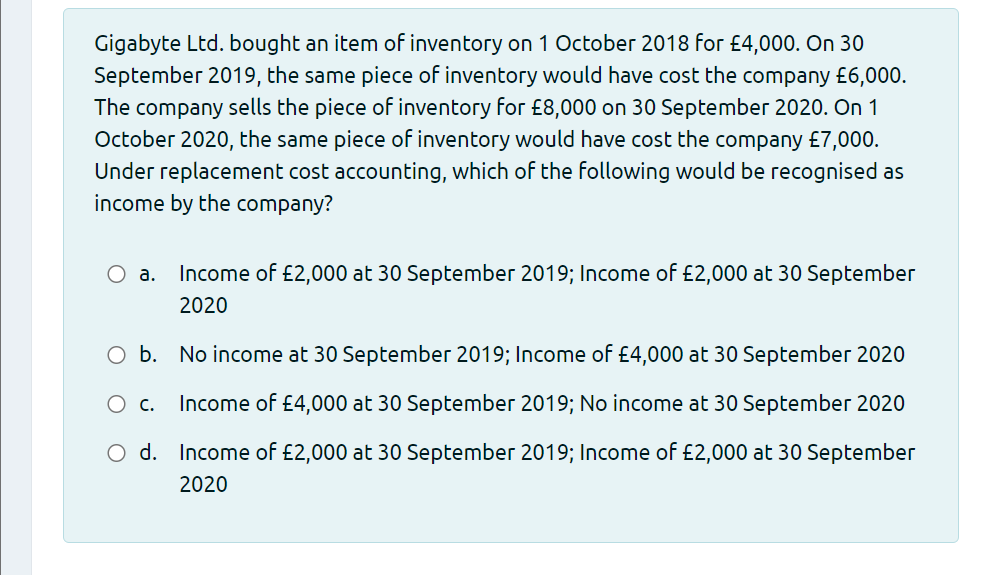

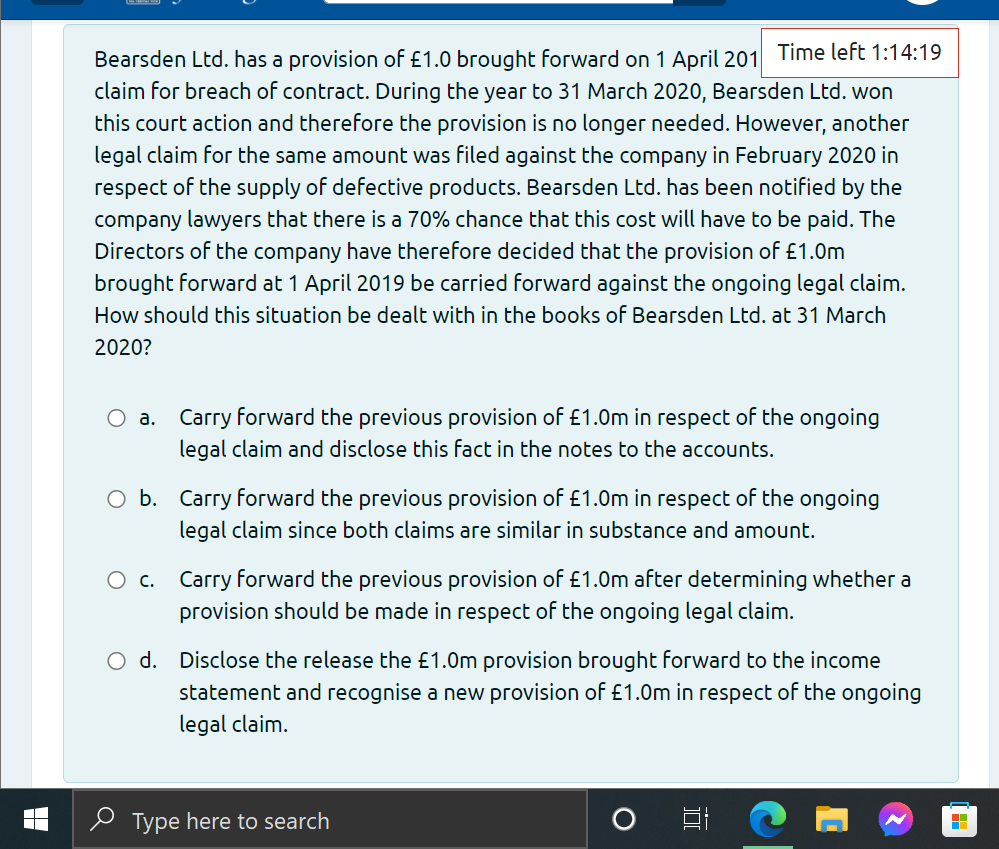

Electrolux Group. has decided to close its oil and gas operations in Aberdeen on 1 March 2020 but retain the warehouse from which the operations were carried out as an investment property. The warehouse had a net book value at 30 September 2019 of 6.8m and a fair value of 7.2m at 1 March 2020. At the company's year end of 30 September 2020, the fair value of the warehouse was 8.0m. Assuming Electrolux group policy is to value investment property at fair value, the amount that the company would include in in the income statement for the year ended 30 September 2020 would be: O a. Debit 0.5m O b. Debit 0.4m O c. Credit 1.2m O d. Credit 0.8m Gigabyte Ltd. bought an item of inventory on 1 October 2018 for 4,000. On 30 September 2019, the same piece of inventory would have cost the company 6,000. The company sells the piece of inventory for 8,000 on 30 September 2020. On 1 October 2020, the same piece of inventory would have cost the company 7,000. Under replacement cost accounting, which of the following would be recognised as income by the company? O a. Income of 2,000 at 30 September 2019; Income of 2,000 at 30 September 2020 O b. No income at 30 September 2019; Income of 4,000 at 30 September 2020 O c. Income of 4,000 at 30 September 2019; No income at 30 September 2020 O d. Income of 2,000 at 30 September 2019; Income of 2,000 at 30 September 2020 Bearsden Ltd. has a provision of 1.0 brought forward on 1 April 201 Time left 1:14:19 claim for breach of contract. During the year to 31 March 2020, Bearsden Ltd. won this court action and therefore the provision is no longer needed. However, another legal claim for the same amount was filed against the company in February 2020 in respect of the supply of defective products. Bearsden Ltd. has been notified by the company lawyers that there is a 70% chance that this cost will have to be paid. The Directors of the company have therefore decided that the provision of 1.Om brought forward at 1 April 2019 be carried forward against the ongoing legal claim. How should this situation be dealt with in the books of Bearsden Ltd. at 31 March 2020? O a. Carry forward the previous provision of 1.Om in respect of the ongoing legal claim and disclose this fact in the notes to the accounts. O b. Carry forward the previous provision of 1.0m in respect of the ongoing legal claim since both claims are similar in substance and amount. O C. Carry forward the previous provision of 1.0m after determining whether a provision should be made in respect of the ongoing legal claim. O d. Disclose the release the 1.0m provision brought forward to the income statement and recognise a new provision of 1.0m in respect of the ongoing legal claim. Type here to search