Answered step by step

Verified Expert Solution

Question

1 Approved Answer

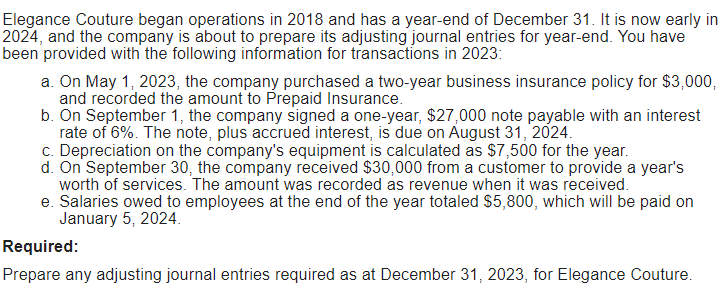

Elegance Couture began operations in 2018 and has a year-end of December 31. It is now early in 2024, and the company is about

Elegance Couture began operations in 2018 and has a year-end of December 31. It is now early in 2024, and the company is about to prepare its adjusting journal entries for year-end. You have been provided with the following information for transactions in 2023: a. On May 1, 2023, the company purchased a two-year business insurance policy for $3,000, and recorded the amount to Prepaid Insurance. b. On September 1, the company signed a one-year, $27,000 note payable with an interest rate of 6%. The note, plus accrued interest, is due on August 31, 2024. c. Depreciation on the company's equipment is calculated as $7,500 for the year. d. On September 30, the company received $30,000 from a customer to provide a year's worth of services. The amount was recorded as revenue when it was received. e. Salaries owed to employees at the end of the year totaled $5,800, which will be paid on January 5, 2024. Required: Prepare any adjusting journal entries required as at December 31, 2023, for Elegance Couture.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the adjusting journal entries required as of December 31 2023 for Elegance Couture we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started