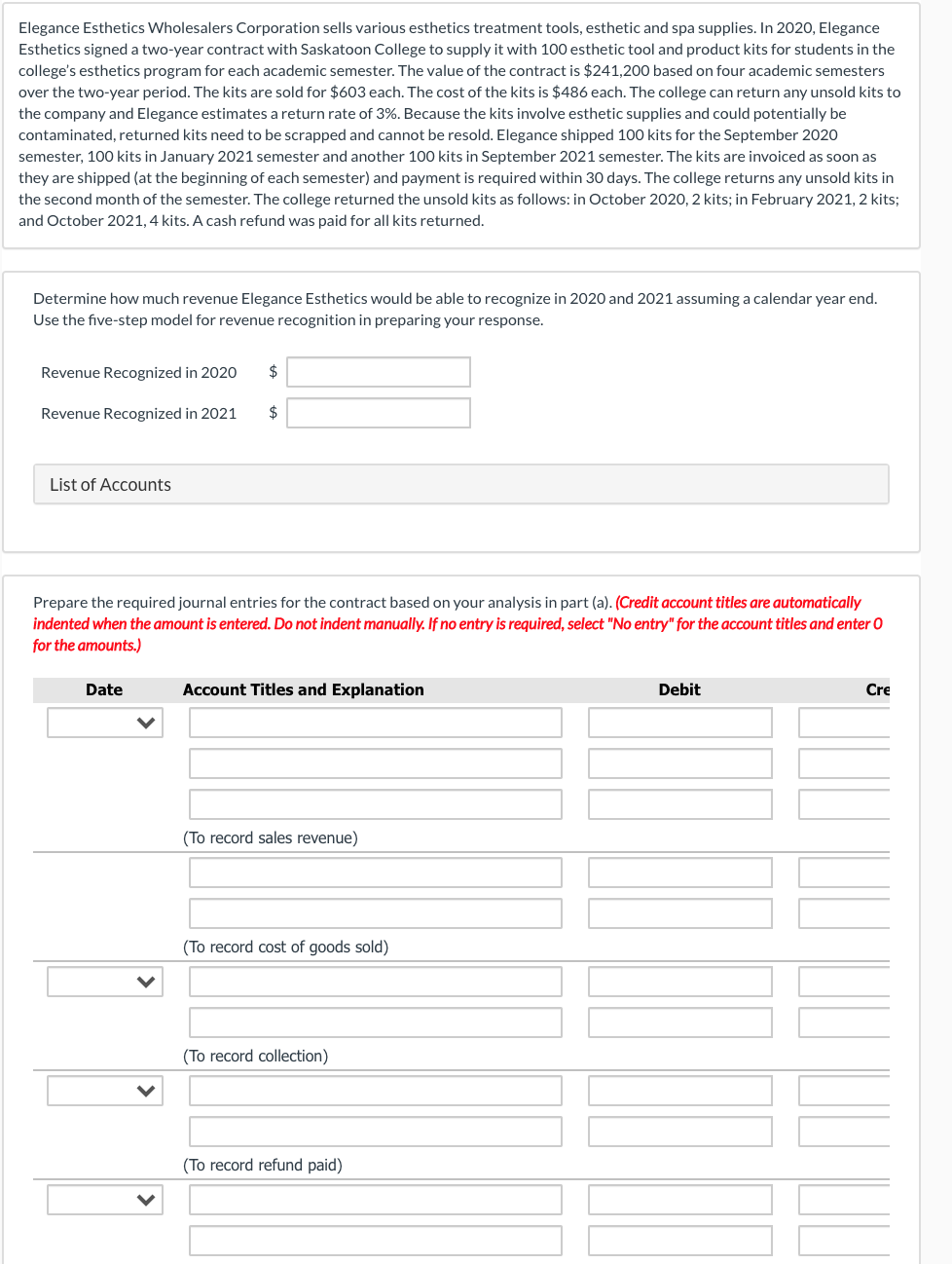

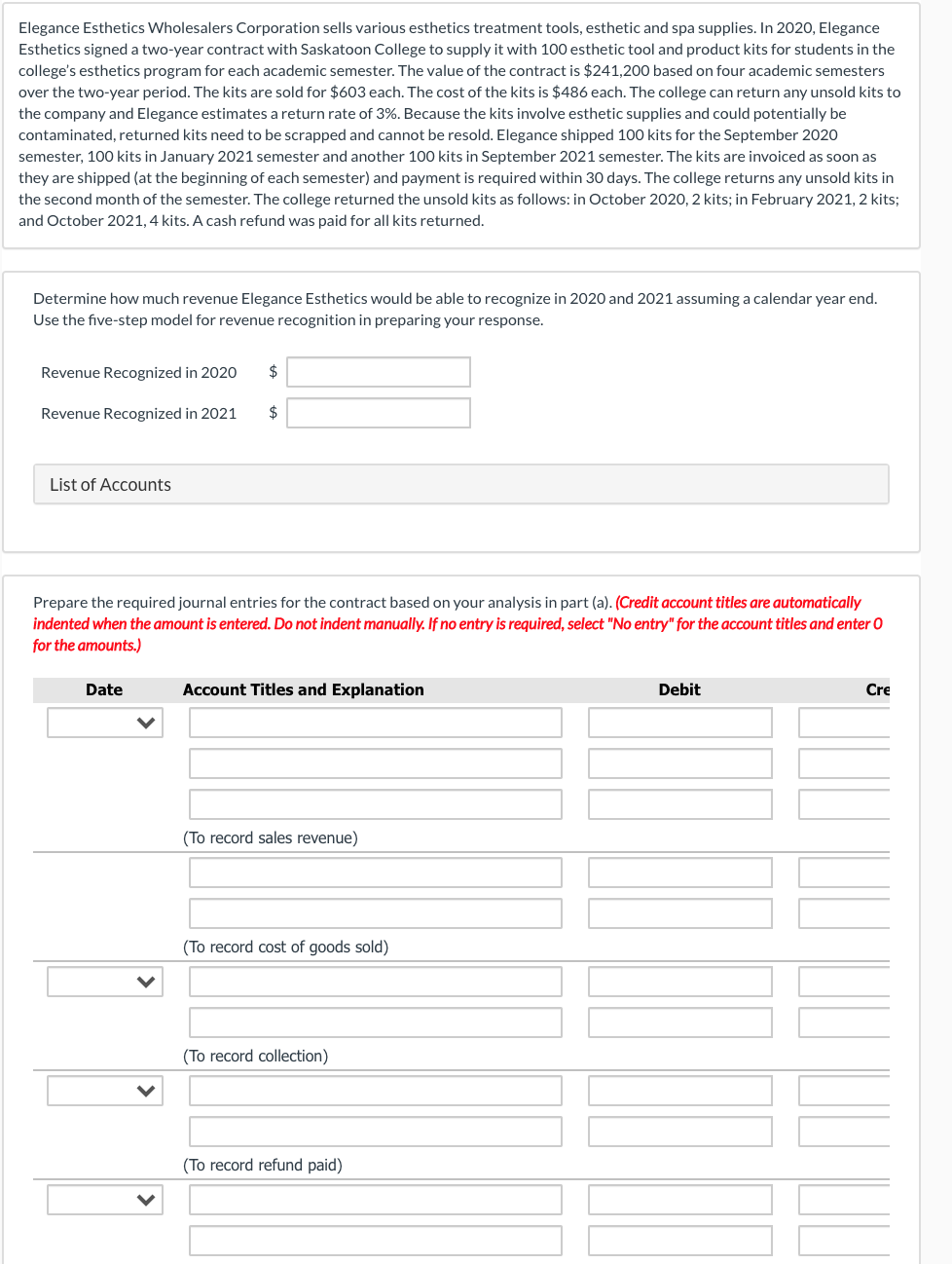

Elegance Esthetics Wholesalers Corporation sells various esthetics treatment tools, esthetic and spa supplies. In 2020, Elegance Esthetics signed a two-year contract with Saskatoon College to supply it with 100 esthetic tool and product kits for students in the college's esthetics program for each academic semester. The value of the contract is $241,200 based on four academic semesters over the two-year period. The kits are sold for $603 each. The cost of the kits is $486 each. The college can return any unsold kits to the company and Elegance estimates a return rate of 3%. Because the kits involve esthetic supplies and could potentially be contaminated, returned kits need to be scrapped and cannot be resold. Elegance shipped 100 kits for the September 2020 semester, 100 kits in January 2021 semester and another 100 kits in September 2021 semester. The kits are invoiced as soon as they are shipped at the beginning of each semester) and payment is required within 30 days. The college returns any unsold kits in the second month of the semester. The college returned the unsold kits as follows: in October 2020,2 kits; in February 2021, 2 kits; and October 2021,4 kits. A cash refund was paid for all kits returned. Determine how much revenue Elegance Esthetics would be able to recognize in 2020 and 2021 assuming a calendar year end. Use the five-step model for revenue recognition in preparing your response. Revenue Recognized in 2020 $ Revenue Recognized in 2021 $ List of Accounts Prepare the required journal entries for the contract based on your analysis in part (a). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Cre (To record sales revenue) (To record cost of goods sold) (To record collection) (To record refund paid) Elegance Esthetics Wholesalers Corporation sells various esthetics treatment tools, esthetic and spa supplies. In 2020, Elegance Esthetics signed a two-year contract with Saskatoon College to supply it with 100 esthetic tool and product kits for students in the college's esthetics program for each academic semester. The value of the contract is $241,200 based on four academic semesters over the two-year period. The kits are sold for $603 each. The cost of the kits is $486 each. The college can return any unsold kits to the company and Elegance estimates a return rate of 3%. Because the kits involve esthetic supplies and could potentially be contaminated, returned kits need to be scrapped and cannot be resold. Elegance shipped 100 kits for the September 2020 semester, 100 kits in January 2021 semester and another 100 kits in September 2021 semester. The kits are invoiced as soon as they are shipped at the beginning of each semester) and payment is required within 30 days. The college returns any unsold kits in the second month of the semester. The college returned the unsold kits as follows: in October 2020,2 kits; in February 2021, 2 kits; and October 2021,4 kits. A cash refund was paid for all kits returned. Determine how much revenue Elegance Esthetics would be able to recognize in 2020 and 2021 assuming a calendar year end. Use the five-step model for revenue recognition in preparing your response. Revenue Recognized in 2020 $ Revenue Recognized in 2021 $ List of Accounts Prepare the required journal entries for the contract based on your analysis in part (a). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Cre (To record sales revenue) (To record cost of goods sold) (To record collection) (To record refund paid)