Question

Elon Motors produces electric automobiles. In recent years, they have been making all components of the cars, excluding the batteries for each vehicle. The company's

Elon Motors produces electric automobiles. In recent years, they have been making all components of the cars, excluding the batteries for each vehicle. The company's leadership team has been considering the ways to reduce the cost of producing its cars. They have considered various options and believe that they could reduce the cost of each car if they produce the car batteries instead of purchasing them from their current vendor, Avari Battery Company.

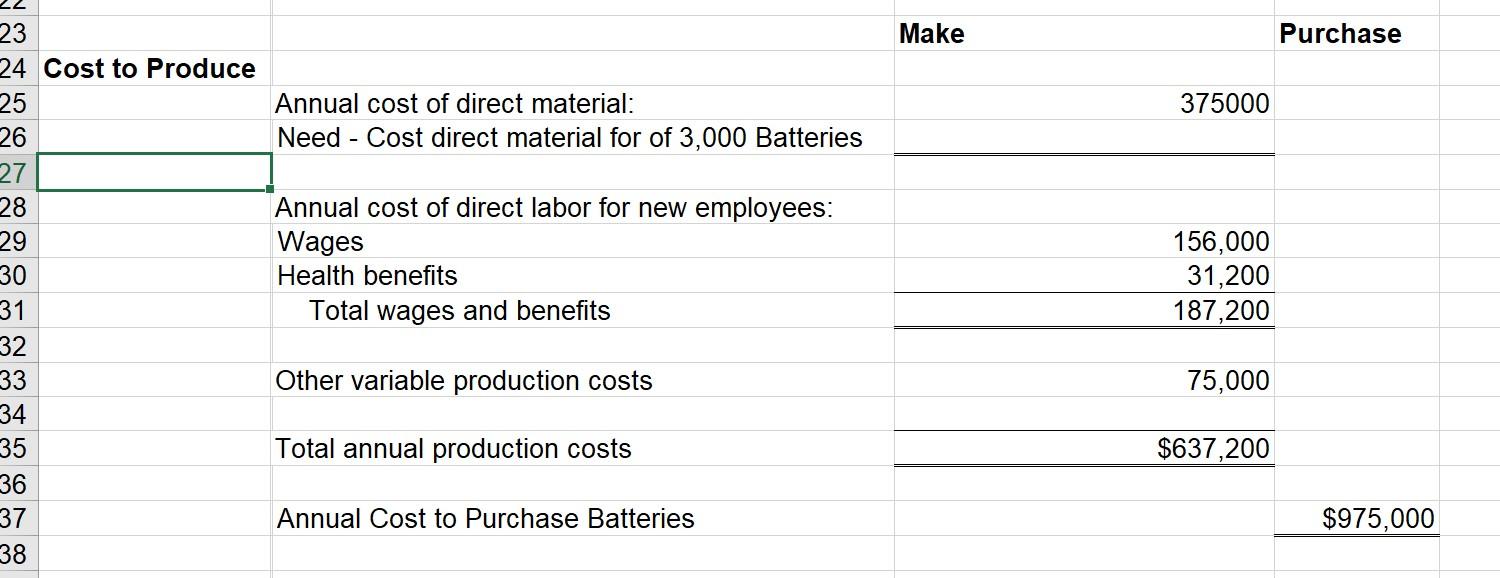

Currently, the cost of each battery is $325 per unit. The company feels that they could greatly reduce the cost if the production team makes each battery. However, to produce these batteries, the company will need to purchase specialized equipment that costs $1,570,000. However, this equipment will have a useful life of 12 years and is expected to have a salvage value of $70,000 at the end of that time.

Currently, the company purchases 3,000 batteries per year, and the company expects that the production will remain the same for the coming 12-year period. To make the batteries, the company expects that they will need to purchase direct materials at a cost of $125 per battery produced. In addition, the company will need to employ three production workers to make the batteries. The workers likely work 2,080 hours per year and make $25 per hour. In addition, health benefits will amount to 20% of the workers' annual wages. In addition, variable manufacturing overhead costs are estimated to be $25 per unit.

Because there is currently unused space in the factory, no additional fixed costs would be incurred if this proposal is accepted. The company's cost of capital (hurdle rate) has been determined to be 10% for all new projects, and the current tax rate of 30% is anticipated to remain unchanged. The pricing for the company's products as well as number of units sold will not be affected by this decision. The straight-line depreciation method would be used if the new equipment is purchased.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started