Answered step by step

Verified Expert Solution

Question

1 Approved Answer

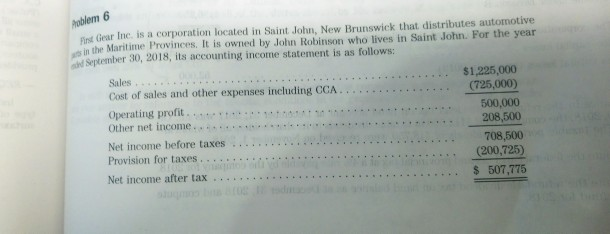

em Finst Gear Ine. is a corporation located in Saint John, New Brunswick that distributes automotive in the Maritime Provinces. It is owned by John

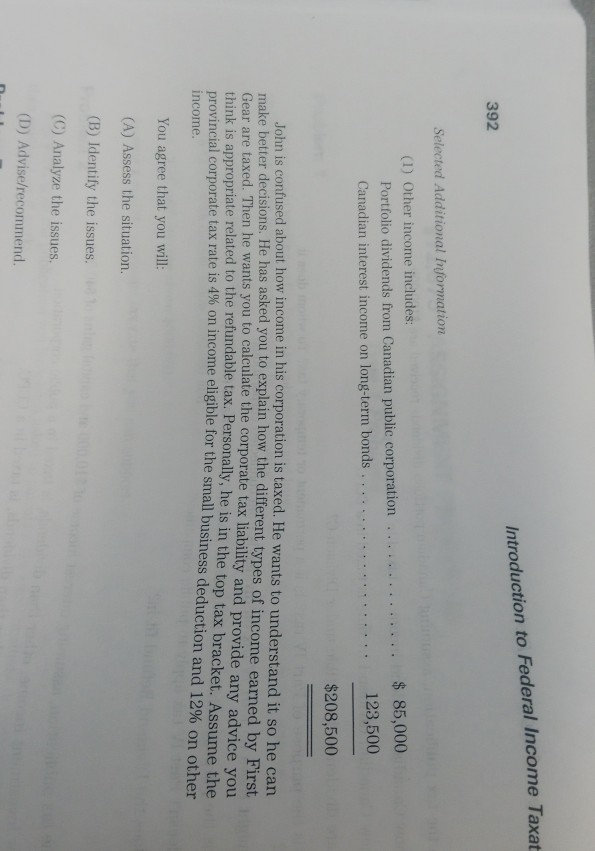

em Finst Gear Ine. is a corporation located in Saint John, New Brunswick that distributes automotive in the Maritime Provinces. It is owned by John Robinson who lives in Saint John. For the year l September 30, 2018, its accounting income statement is as follows: $1,225,000 Sales Cost of sales and other expenses including CCA Operating profit Other net income.. Net income before taxes . . Provision for taxes. (725,000) 500,000 208,500 708,500 (200,725) 507,775 Net income after tax Introduction to Federal Income Taxat 392 Selected Additional Information (1) Other income includes: Portfolio dividends from Canadian public corporation..... Canadian interest income on long-term bonds... 85,000 123,500 $208,500 John is confused about how income in his corporation is taxed. He wants to understand it so he can He has asked you to explain how the different types of income earned by First ants you to calculate the corporate tax liability and provide any advice you ropriate related to the refundable tax. Personally, he is in the top tax bracket. Assume the % on income eligible for the small business deduction and 12% on other make better decisions. ear are taxed. Then he w provincial corporate tax rate is 4 You agree that you will: (A) Assess the situation. (B) Identify the issues. (C) Analyze the issues. (D) Advise/recommend em Finst Gear Ine. is a corporation located in Saint John, New Brunswick that distributes automotive in the Maritime Provinces. It is owned by John Robinson who lives in Saint John. For the year l September 30, 2018, its accounting income statement is as follows: $1,225,000 Sales Cost of sales and other expenses including CCA Operating profit Other net income.. Net income before taxes . . Provision for taxes. (725,000) 500,000 208,500 708,500 (200,725) 507,775 Net income after tax Introduction to Federal Income Taxat 392 Selected Additional Information (1) Other income includes: Portfolio dividends from Canadian public corporation..... Canadian interest income on long-term bonds... 85,000 123,500 $208,500 John is confused about how income in his corporation is taxed. He wants to understand it so he can He has asked you to explain how the different types of income earned by First ants you to calculate the corporate tax liability and provide any advice you ropriate related to the refundable tax. Personally, he is in the top tax bracket. Assume the % on income eligible for the small business deduction and 12% on other make better decisions. ear are taxed. Then he w provincial corporate tax rate is 4 You agree that you will: (A) Assess the situation. (B) Identify the issues. (C) Analyze the issues. (D) Advise/recommend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started