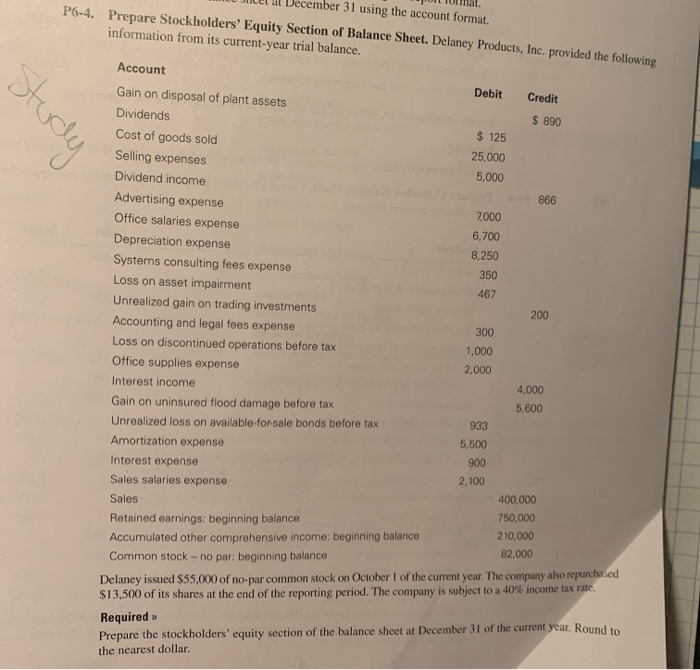

ember 31 using the account format. Prepare Stockholders' Equity Section of Balance Sheet. Delaney Products, Inc. provided the following P6-4. information from its current-year trial balance. Account Debit Credit Gain on disposal of plant assets $ 890 Dividends $ 125 Cost of goods sold 25,000 Selling expenses 5,000 Dividend income 866 Advertising expense 7,000 Office salaries expense 6,700 Depreciation expense 8,250 Systems consulting fees expense 350 Loss on asset impairment 467 Unrealized gain on trading investments 200 Accounting and legal fees expense 300 Loss on discontinued operations before tax 1,000 2,000 Office supplies expense 4,000 Interest income 5,600 Gain on uninsured flood damage before tax 933 Unrealized loss on available-for-sale bonds before tax 5,500 Amortization expense 900 Interest expense 2,100 Sales salaries expense 400,000 Sales 750,000 Retained earnings: beginning balance 210,000 Accumulated other comprehensive income: beginning balance 82,000 Delaney issued $55,000 of no-par common stock on October I of the current year. The company also repurchased $13,500 of its shares at the end of the reporting period. The company is subject to a 40% income tax rate. Common stock - no par: beginning balance Required Prepare the stockholders' equity section of the balance sheet at December 31 of the current year. Round to the nearest dollar. ember 31 using the account format. Prepare Stockholders' Equity Section of Balance Sheet. Delaney Products, Inc. provided the following P6-4. information from its current-year trial balance. Account Debit Credit Gain on disposal of plant assets $ 890 Dividends $ 125 Cost of goods sold 25,000 Selling expenses 5,000 Dividend income 866 Advertising expense 7,000 Office salaries expense 6,700 Depreciation expense 8,250 Systems consulting fees expense 350 Loss on asset impairment 467 Unrealized gain on trading investments 200 Accounting and legal fees expense 300 Loss on discontinued operations before tax 1,000 2,000 Office supplies expense 4,000 Interest income 5,600 Gain on uninsured flood damage before tax 933 Unrealized loss on available-for-sale bonds before tax 5,500 Amortization expense 900 Interest expense 2,100 Sales salaries expense 400,000 Sales 750,000 Retained earnings: beginning balance 210,000 Accumulated other comprehensive income: beginning balance 82,000 Delaney issued $55,000 of no-par common stock on October I of the current year. The company also repurchased $13,500 of its shares at the end of the reporting period. The company is subject to a 40% income tax rate. Common stock - no par: beginning balance Required Prepare the stockholders' equity section of the balance sheet at December 31 of the current year. Round to the nearest dollar