Question

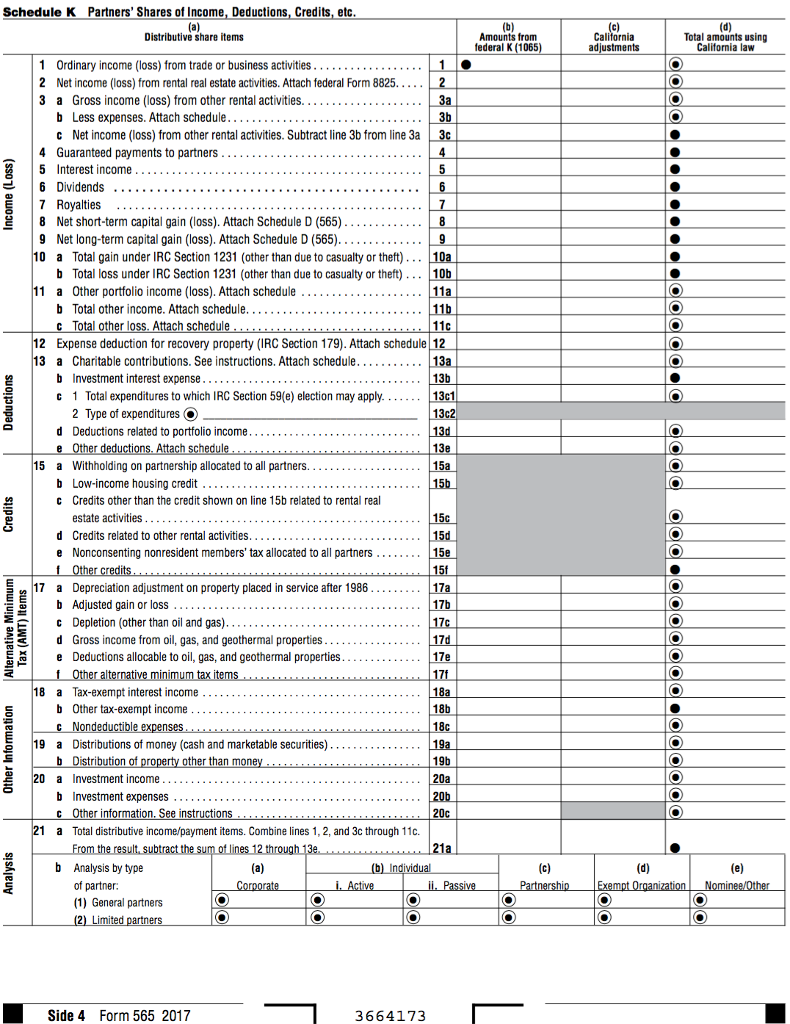

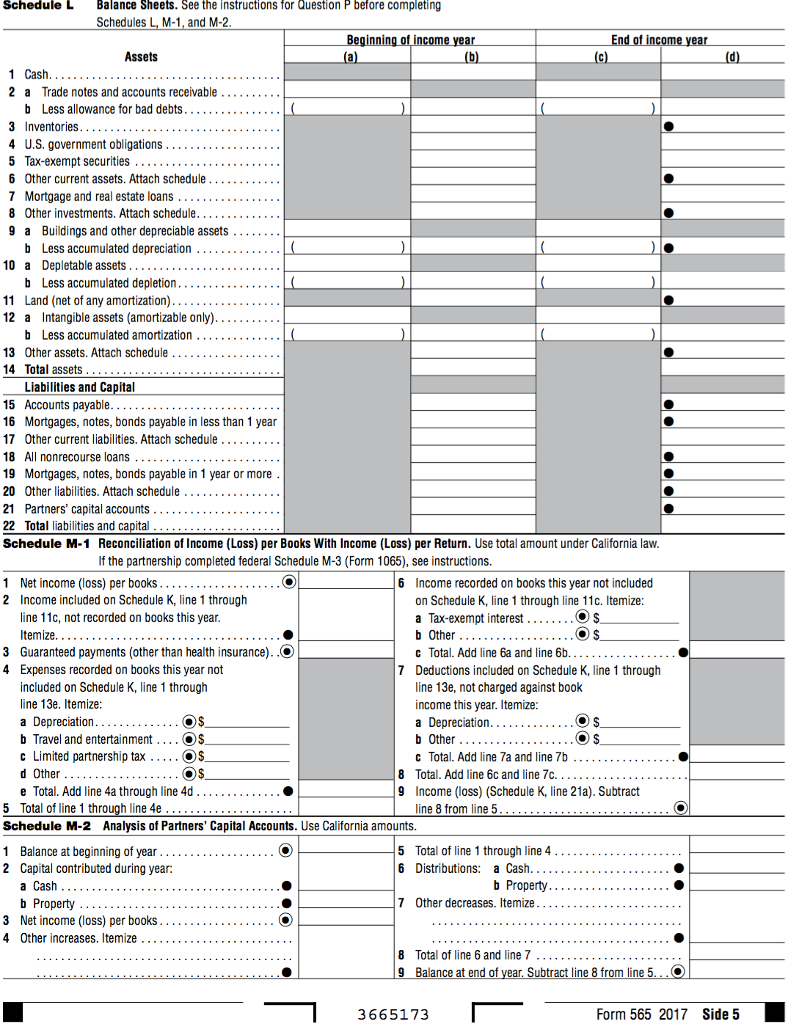

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a consulting service.

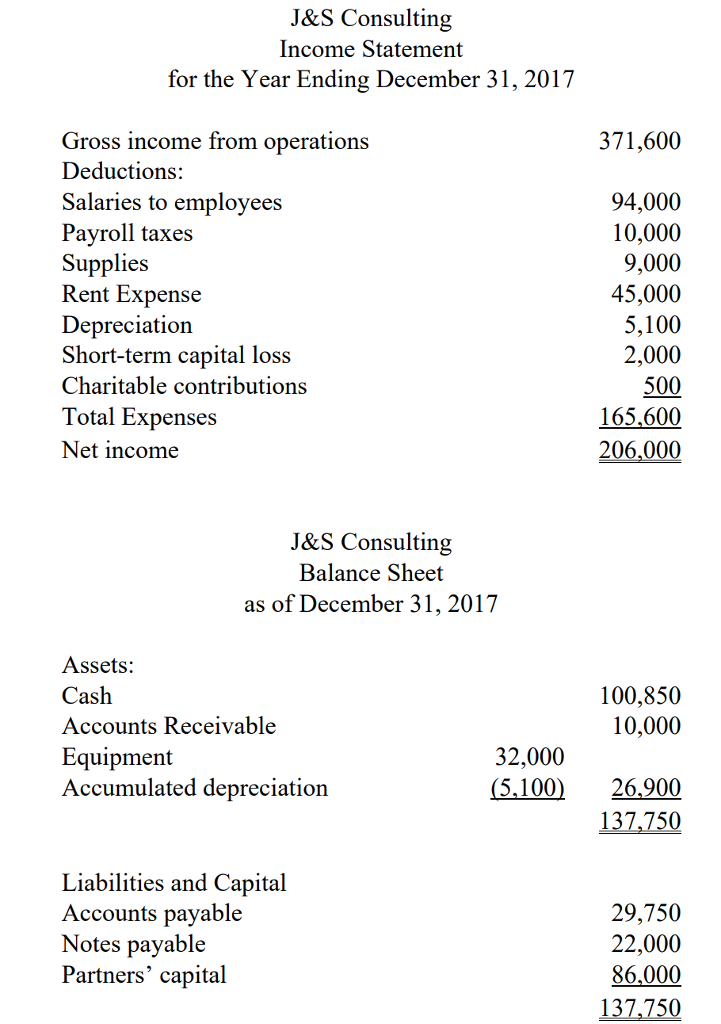

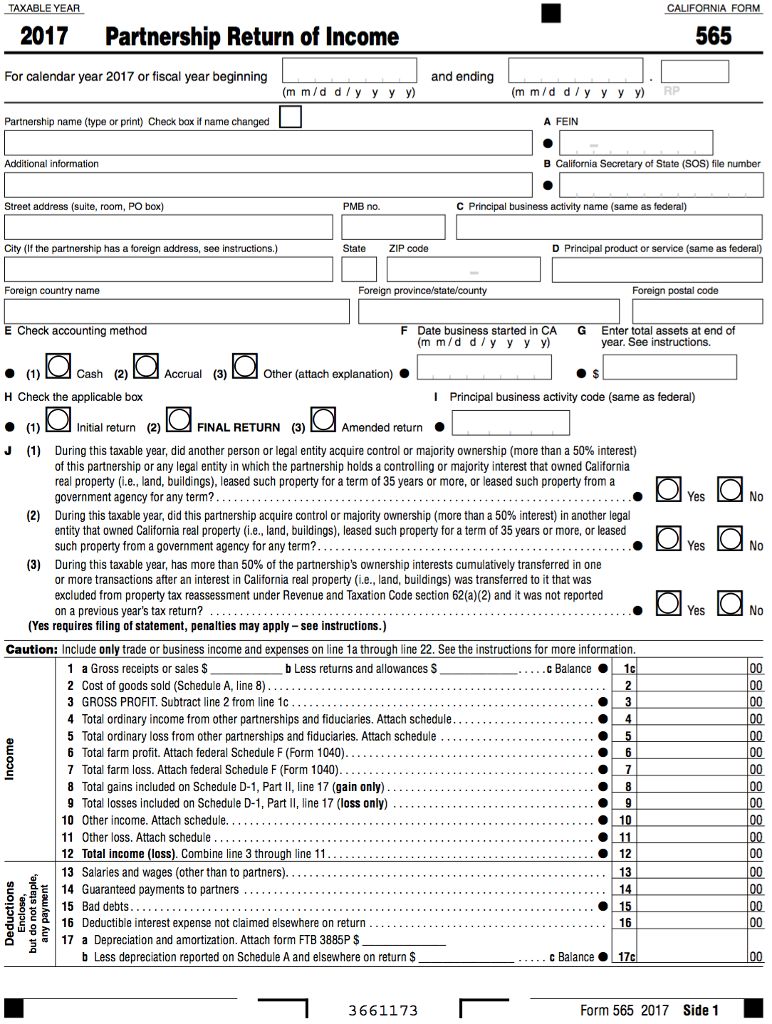

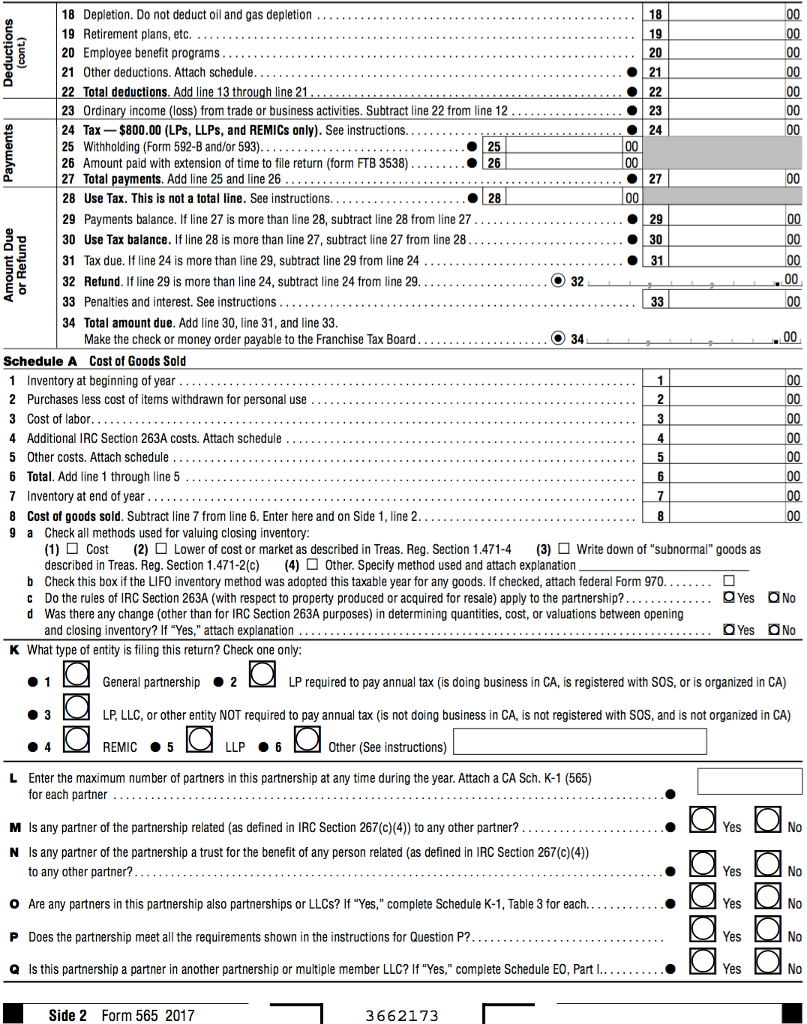

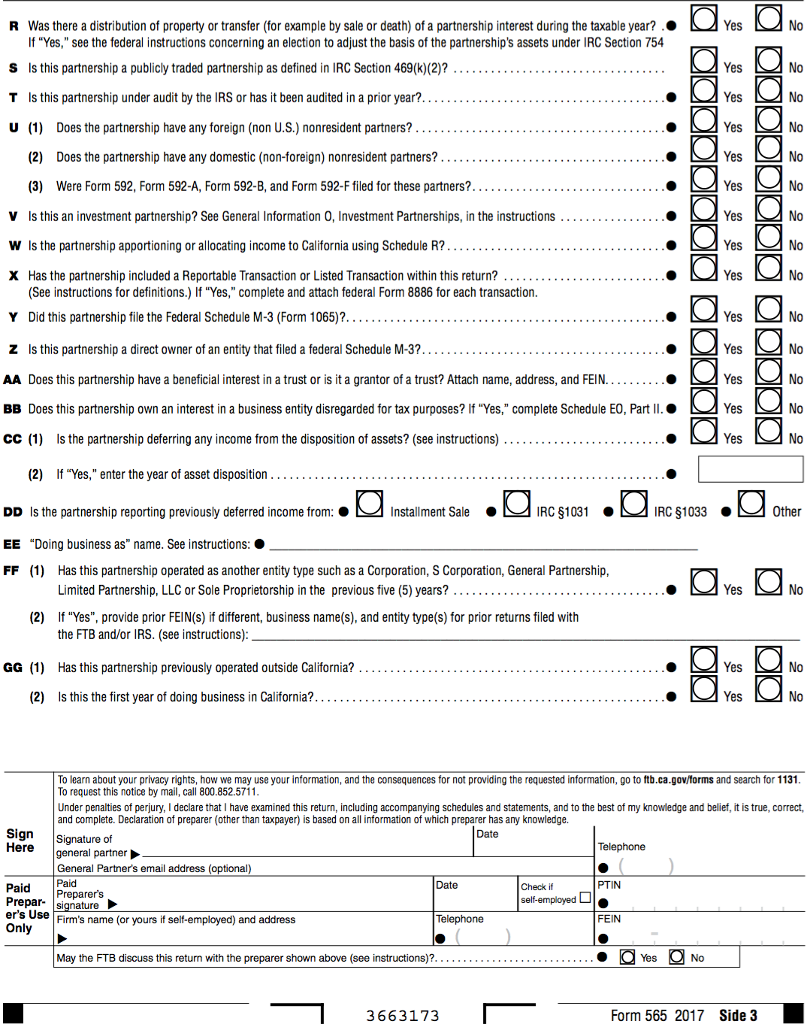

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a consulting service. The partnerships first year of operation is 2016. Emily and James divide income and expenses equally. The partnership name is J&S Consulting, it is located at 1023 Broadway, Los Angeles, CA 90026, and its Federal ID number is 95-6767676. The 2017 financial statements for the partnership are presented below.

Each partner contributed $20,000 to start the partnership. Each partner also withdrew $86,000 during the year. Emily lives at 456 E. 70th Street, Los Angeles, CA 90020, and James lives at 436 E. Highland Avenue, Los Angeles, CA 90022.

I need help filling out the California Form 565 return please!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started