Answered step by step

Verified Expert Solution

Question

1 Approved Answer

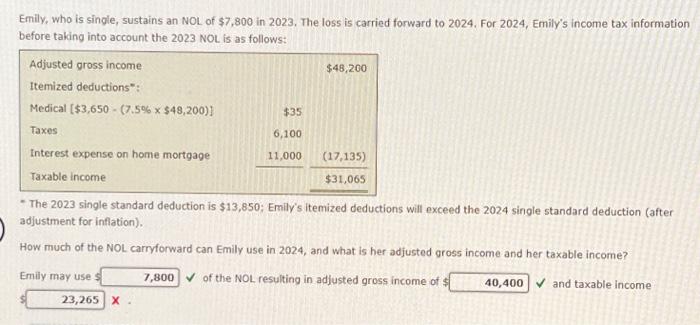

Emily, who is single, sustains an NOL of $7,800 in 2023. The loss is carried forward to 2024. For 2024, Emily's income tax information before

Emily, who is single, sustains an NOL of $7,800 in 2023. The loss is carried forward to 2024. For 2024, Emily's income tax information before taking into account the 2023 NOL is as follows: Adjusted gross income Itemized deductions*: Medical [$3,650 - (7.5% x $48,200)] Taxes Interest expense on home mortgage Taxable income $35 6,100 11,000 Emily may use $ 23,265 X $48,200 (17,135) $31,065 The 2023 single standard deduction is $13,850; Emily's itemized deductions will exceed the 2024 single standard deduction (after adjustment for inflation). How much of the NOL carryforward can Emily use in 2024, and what is her adjusted gross income and her taxable income? 7,800 of the NOL resulting in adjusted gross income of $ 40,400 and taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started