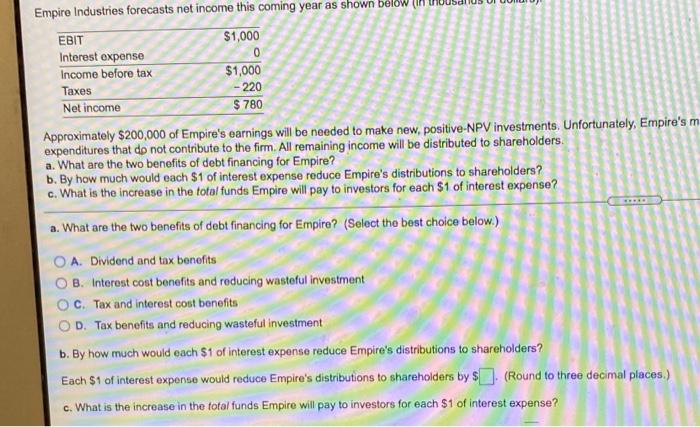

Empire Industries forecasts net income this covering year as shown below (in thousands of dollars EBIT $1.000 for export 0 frcome before tax $1.000 TANG - 220 Net Income $700 Approximately $200,000 of Empire's caminos will be needed to make new positive NPV nvestments. Unfortunately, Empire's managers are expected to waste net income on needless perka, pet projects, and other perdurera o not contribute to them. Al remaining income will be distried to shareholders What are the two brots of deling for more b. By how much would choires pense reduce Empire's darbutions to shareholders What is the increase in the forefundenpite will pay to investors for each of interes pense? . Wut we the words of frarong for the best choice below) DA Dividend onders OD Westcontents arredong wiwit De Tucand ero con benote ODY bereits and reducing went by how much would each 51 of interest expense reduce modrihs wholder Tech Storsent would reduce Empire's dictions to why Round to reduce places) What is the increase in Petaltunde me wil pay torvestonosch 31 of intereste? Empire Industries forecasts net income this coming year as shown below (Houd EBIT $1,000 Interest expense 0 Income before tax $1,000 Taxes - 220 Net income $ 780 Approximately $200,000 of Empire's earnings will be needed to make new, positive-NPV investments. Unfortunately, Empire's m expenditures that do not contribute to the firm. All remaining income will be distributed to shareholders a. What are the two benefits of debt financing for Empire? b. By how much would each $1 of interest expense reduce Empire's distributions to shareholders? c. What is the increase in the total funds Empire will pay to investors for each $1 of interest expense? a. What are the two benefits of debt financing for Empiro? (Select the best choice below.) O A. Dividend and tax benefits O B. Interest cost benefits and reducing wastoful investment OC. Tax and interest cost benefits OD. Tax benefits and reducing wasteful investment b. By how much would each $1 of interest expense reduce Empire's distributions to shareholders? Each $1 of interest expense would reduce Empire's distributions to shareholders by $. (Round to three decimal places.) c. What is the increase in the total funds Empire will pay to investors for each $1 of interest expense