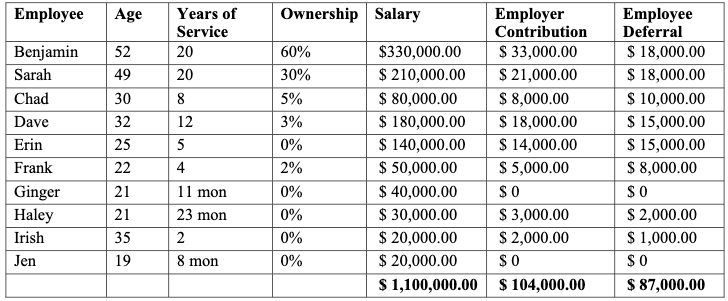

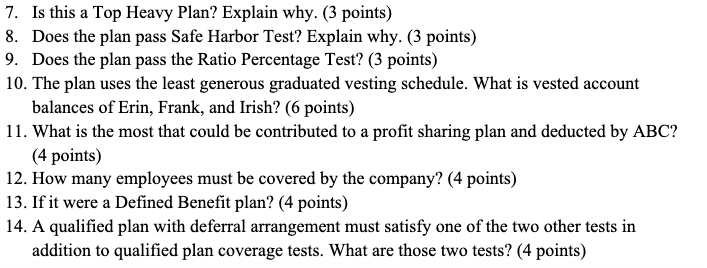

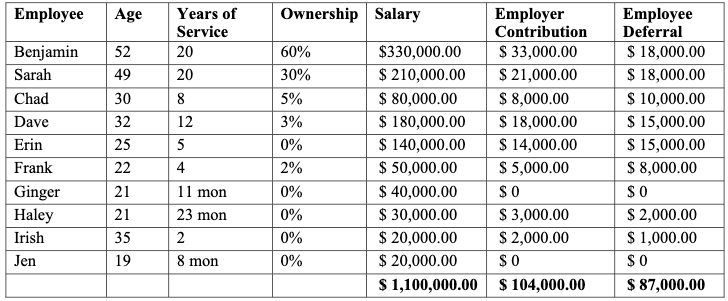

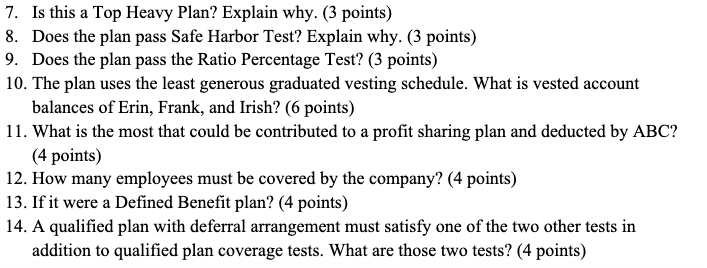

Employee Age Years of Service 20 Benjamin Sarah Chad Dave Erin Frank Ginger Haley Irish Jen 52 49 30 32 25 22 21 21 35 19 20 8 12 5 4 11 mon 23 mon 2 Ownership Salary Employer Contribution 60% $330,000.00 $ 33,000.00 30% $ 210,000.00 $ 21,000.00 5% $ 80,000.00 $ 8,000.00 3% $ 180,000.00 $ 18,000.00 0% $ 140,000.00 $ 14,000.00 $ 50,000.00 $5,000.00 0% $ 40,000.00 $0 0% $ 30,000.00 $ 3,000.00 0% $ 20,000.00 $ 2,000.00 0% $ 20,000.00 SO $ 1,100,000.00 $ 104,000.00 Employee Deferral $ 18,000.00 $ 18,000.00 $ 10,000.00 $ 15,000.00 $ 15,000.00 $ 8,000.00 SO $ 2,000.00 $ 1,000.00 $0 $ 87,000.00 2% 8 mon 7. Is this a Top Heavy Plan? Explain why. (3 points) 8. Does the plan pass Safe Harbor Test? Explain why. (3 points) 9. Does the plan pass the Ratio Percentage Test? (3 points) 10. The plan uses the least generous graduated vesting schedule. What is vested account balances of Erin, Frank, and Irish? (6 points) 11. What is the most that could be contributed to a profit sharing plan and deducted by ABC? (4 points) 12. How many employees must be covered by the company? (4 points) 13. If it were a Defined Benefit plan? (4 points) 14. A qualified plan with deferral arrangement must satisfy one of the two other tests in addition to qualified plan coverage tests. What are those two tests? (4 points) Employee Age Years of Service 20 Benjamin Sarah Chad Dave Erin Frank Ginger Haley Irish Jen 52 49 30 32 25 22 21 21 35 19 20 8 12 5 4 11 mon 23 mon 2 Ownership Salary Employer Contribution 60% $330,000.00 $ 33,000.00 30% $ 210,000.00 $ 21,000.00 5% $ 80,000.00 $ 8,000.00 3% $ 180,000.00 $ 18,000.00 0% $ 140,000.00 $ 14,000.00 $ 50,000.00 $5,000.00 0% $ 40,000.00 $0 0% $ 30,000.00 $ 3,000.00 0% $ 20,000.00 $ 2,000.00 0% $ 20,000.00 SO $ 1,100,000.00 $ 104,000.00 Employee Deferral $ 18,000.00 $ 18,000.00 $ 10,000.00 $ 15,000.00 $ 15,000.00 $ 8,000.00 SO $ 2,000.00 $ 1,000.00 $0 $ 87,000.00 2% 8 mon 7. Is this a Top Heavy Plan? Explain why. (3 points) 8. Does the plan pass Safe Harbor Test? Explain why. (3 points) 9. Does the plan pass the Ratio Percentage Test? (3 points) 10. The plan uses the least generous graduated vesting schedule. What is vested account balances of Erin, Frank, and Irish? (6 points) 11. What is the most that could be contributed to a profit sharing plan and deducted by ABC? (4 points) 12. How many employees must be covered by the company? (4 points) 13. If it were a Defined Benefit plan? (4 points) 14. A qualified plan with deferral arrangement must satisfy one of the two other tests in addition to qualified plan coverage tests. What are those two tests? (4 points)