Answered step by step

Verified Expert Solution

Question

1 Approved Answer

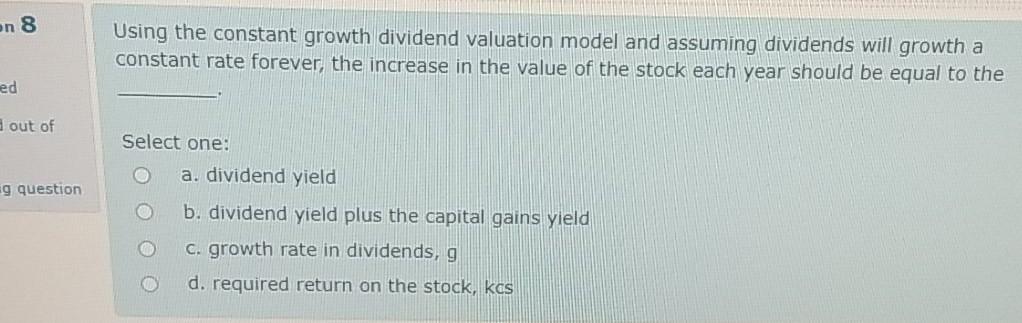

en 8 Using the constant growth dividend valuation model and assuming dividends will growth a constant rate forever, the increase in the value of the

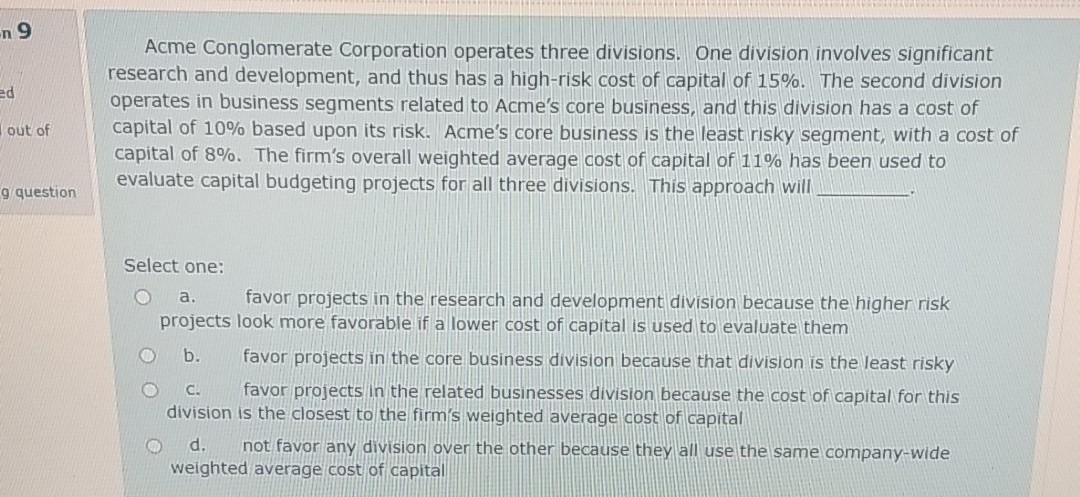

en 8 Using the constant growth dividend valuation model and assuming dividends will growth a constant rate forever, the increase in the value of the stock each year should be equal to the ed out of Select one: a. dividend yield ag question b. dividend yield plus the capital gains yield c. growth rate in dividends, g d. required return on the stock kos -n 9 ed Acme Conglomerate Corporation operates three divisions. One division involves significant research and development, and thus has a high-risk cost of capital of 15%. The second division operates in business segments related to Acme's core business, and this division has a cost of capital of 10% based upon its risk. Acme's core business is the least risky segment, with a cost of capital of 8%. The firm's overall weighted average cost of capital of 11% has been used to evaluate capital budgeting projects for all three divisions. This approach will out of g question , Select one: favor projects in the research and development division because the higher risk projects look more favorable if a lower cost of capital is used to evaluate them O b. favor projects in the core business division because that division is the least risky favor projects in the related businesses division because the cost of capital for this division is the closest to the firm's weighted average cost of capital not favor any division over the other because they all use the same company-wide weighted average cost of capital d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started