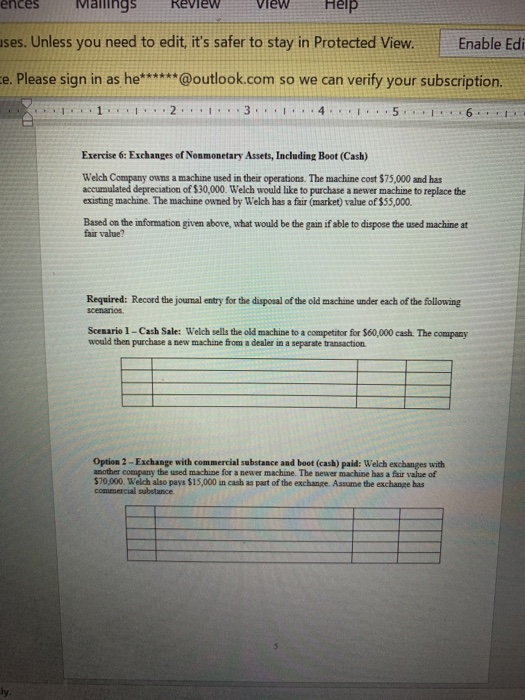

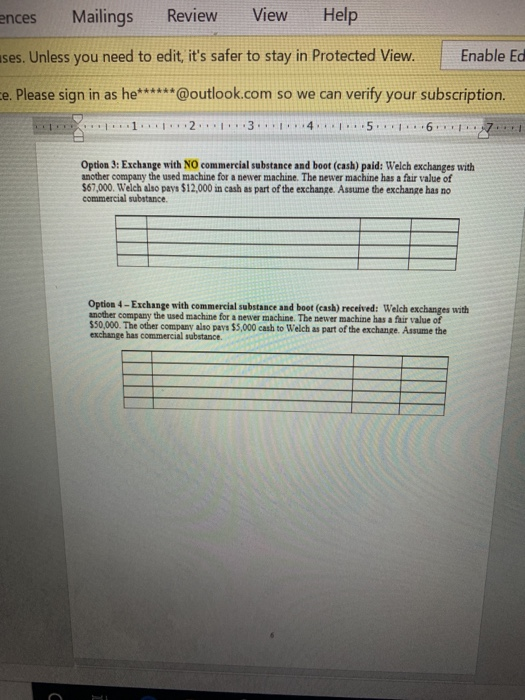

ences Ivanings Review View H elp ses. Unless you need to edit it's safer to stay in Protected View Enable Edi e. Please sign in as he****** @outlook.com so we can verify your subscription. 1 ..2.. .3 ..4. ..5.. ..6... Exercise 6: Exchanges of Nonmonetary Assets, Including Boot (Cash) Welch Company owns a machine wed in their operations. The machine cost $75,000 and has accumulated depreciation of $30,000. Welch would like to purchase a newer machine to replace the existing machine. The machine owned by Welch has a fair (market) value of $55,000. Based on the information given above, what would be the gain if able to dispose the used machine at fair value? Required: Record the journal entry for the disposal of the old machine under each of the following scenos Scenario 1 - Cash Sale: Welch sell the old machine to a competitor for $60,000 cash. The company would then purchase a new machine from a dealer in a separate transaction Option 2 - Exchange with commercial substance and boot (cash) paid: Welch exchanges with another company the used machine for a newer machine. The newer machine has a fair value of $70,000. Welch also pays $15,000 in cash a part of the exchange Assume the exchange commercial substance. ences Mailings Review View Help ses. Unless you need to edit, it's safer to stay in Protected View Enable Ea e. Please sign in as he******@outlook.com so we can verify your subscription ... 2 . ..3... ..4 . 5 .6. 7 Option 3: Exchange with NO Commercial substance and boot (cash) paid: Welch exchanges with another company the used machine for a newer machine. The newer machine has a fair value of $67,000. Welch also pays $12,000 in cash as part of the exchange. Assume the exchange has no commercial substance Option 4 - Exchange with commercial substance and boot (cash) received: Welch exchanges with another company the used machine for a newer machine. The newer machine has a fair value of 550,000. The other company alto pays 55,000 cash to Welch as part of the exchange. Assume the exchange has commercial substance