Answered step by step

Verified Expert Solution

Question

1 Approved Answer

engineering economics Q7. Consider the example of Mr. Freeman winning the lottery that we covered in the beginning of Chapter 2. Recall that Mr. Freeman

engineering economics

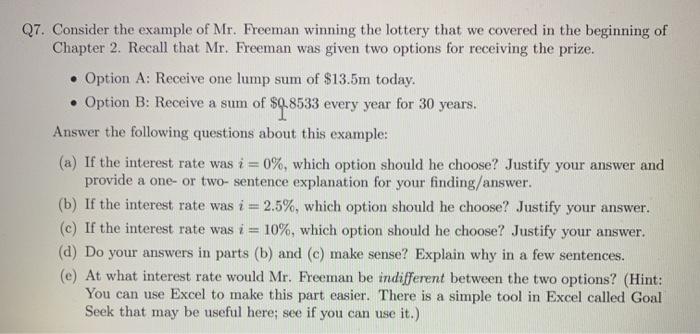

Q7. Consider the example of Mr. Freeman winning the lottery that we covered in the beginning of Chapter 2. Recall that Mr. Freeman was given two options for receiving the prize. Option A: Receive one lump sum of $13.5m today. Option B: Receive a sum of $9.8533 every year for 30 years. Answer the following questions about this example: (a) If the interest rate was i = 0%, which option should he choose? Justify your answer and provide a one- or two- sentence explanation for your finding/answer. (b) If the interest rate was i = 2.5%, which option should he choose? Justify your answer. (c) If the interest rate was i = 10%, which option should he choose? Justify your answer. (d) Do your answers in parts (b) and (c) make sense? Explain why in a few sentences. (e) At what interest rate would Mr. Freeman be indifferent between the two options? (Hint: You can use Excel to make this part easier. There is a simple tool in Excel called Goal Seek that may be useful here; see if you can use it.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started