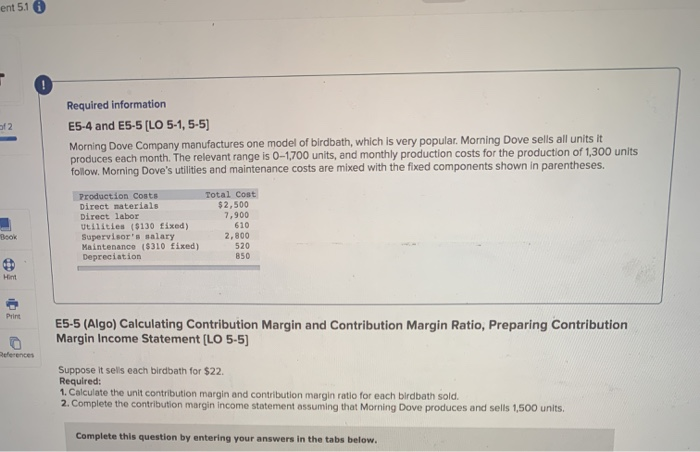

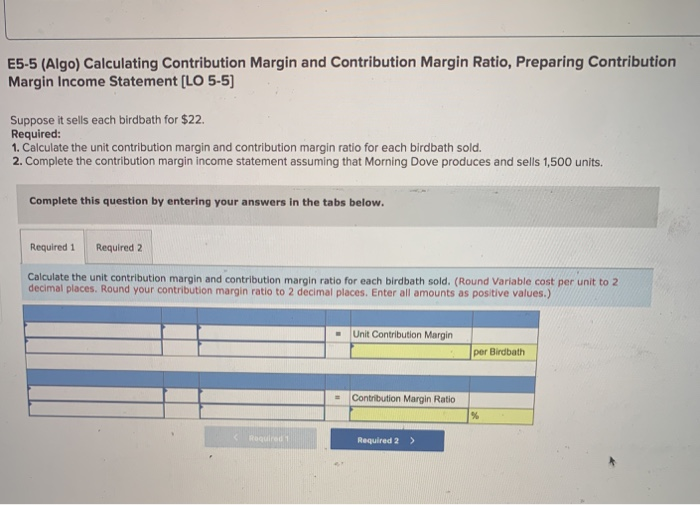

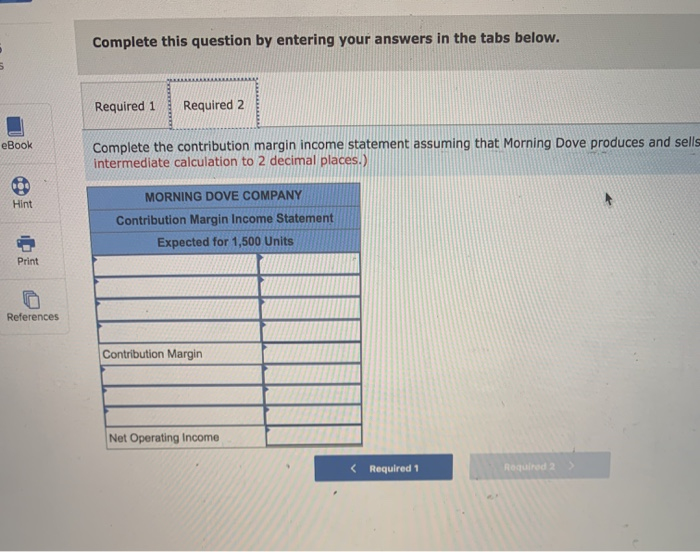

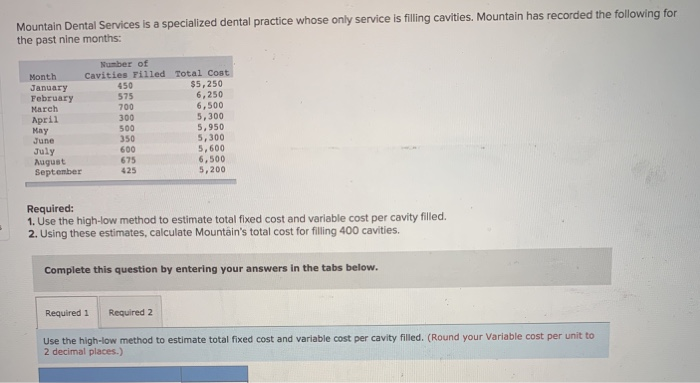

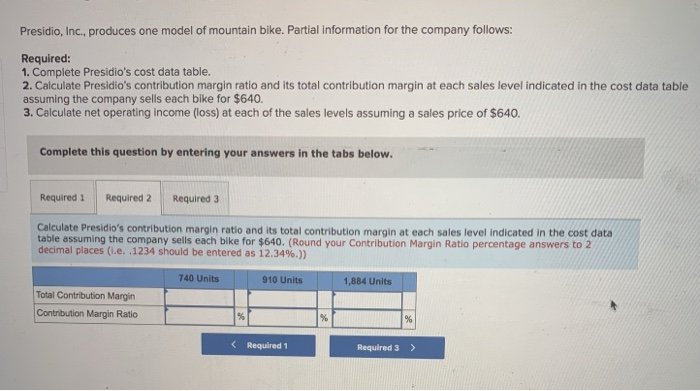

ent 5.10 Required information E5-4 and E5-5 [LO 5-1, 5-5) Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,700 units, and monthly production costs for the production of 1,300 units follow, Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($130 fixed) Supervisor's salary Maintenance ($310 fixed) Depreciation Total Cost $2,500 7.900 610 2,800 520 850 E5-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio, Preparing Contribution Margin Income Statement (LO 5-5) References Suppose it sells each birdbath for $22. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units. Complete this question by entering your answers in the tabs below. E5-5 (Algo) Calculating Contribution Margin and Contribution Margin Ratio, Preparing Contribution Margin Income Statement [LO 5-5) Suppose it sells each birdbath for $22. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. (Round Variable cost per unit to 2 decimal places. Round your contribution margin ratio to 2 decimal places. Enter all amounts as positive values.) - Unit Contribution Margin per Birdbath - Contribution Margin Ratio Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 eBook Complete the contribution margin income statement assuming that Morning Dove produces and sells intermediate calculation to 2 decimal places.) Hint MORNING DOVE COMPANY Contribution Margin Income Statement Expected for 1,500 Units Print References Contribution Margin I Net Operating Income Required 1 Required 2 . Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months: Number of Month Cavities Filled Total Cost January 450 $5,250 February 575 6,250 March 700 6,500 Apr 11 300 5,300 May 500 5,950 June 350 5,300 July 5.600 August 675 6,500 September 425 5.200 500 Required: 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. 2. Using these estimates, calculate Mountain's total cost for filling 400 cavities. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the high-low method to estimate total fixed cost and variable cost per cavity filled. (Round your Variable cost per unit to 2 decimal places.) Presidio, Inc., produces one model of mountain bike. Partial Information for the company follows: Required: 1. Complete Presidio's cost data table. 2. Calculate Presidio's contribution margin ratio and its total contribution margin at each sales level indicated in the cost data table assuming the company sells each bike for $640. 3. Calculate net operating income (loss) at each of the sales levels assuming a sales price of $640. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate Presidio's contribution margin ratio and its total contribution margin at each sales level indicated in the cost data table assuming the company sells each bike for $640. (Round your Contribution Margin Ratio percentage answers to 2 decimal places (.e. .1234 should be entered as 12.34%.)) 740 Units 910 Units 1,884 Units Total Contribution Margin Contribution Margin Ratio %