Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Enter the appropriate word(s) to complete the statement. (10 points). 46. Apportionment is a means by which a corporation's the states in which it

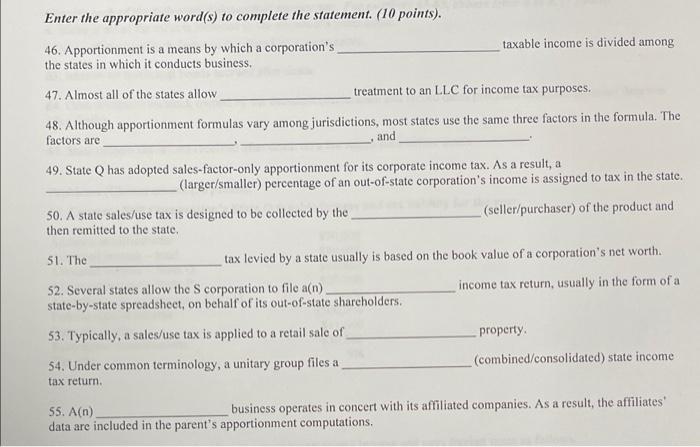

Enter the appropriate word(s) to complete the statement. (10 points). 46. Apportionment is a means by which a corporation's the states in which it conducts business. 47. Almost all of the states allow treatment to an LLC for income tax purposes. 48. Although apportionment formulas vary among jurisdictions, most states use the same three factors in the formula. The factors are and 49. State Q has adopted sales-factor-only apportionment for its corporate income tax. As a result, a (larger/smaller) percentage of an out-of-state corporation's income is assigned to tax in the state. _(seller/purchaser) of the product and 50. A state sales/use tax is designed to be collected by the then remitted to the state. taxable income is divided among 51. The 52. Several states allow the S corporation to file a(n). state-by-state spreadsheet, on behalf of its out-of-state shareholders. 53. Typically, a sales/use tax is applied to a retail sale of 54. Under common terminology, a unitary group files a tax return. tax levied by a state usually is based on the book value of a corporation's net worth. income tax return, usually in the form of a 55. A(n). data are included in the parent's apportionment computations. property. (combined/consolidated) state income business operates in concert with its affiliated companies. As a result, the affiliates'

Step by Step Solution

There are 3 Steps involved in it

Step: 1

46 Solution business Explanation Corporation computes the net income for the company ie determines a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started