Question

Enter the new line of business (Numbers in '000 except unit price, and you may keep numbers/answers in '000.) The Toy World is a leading

"Enter the new line of business"

(Numbers in '000 except unit price, and you may keep numbers/answers in '000.)

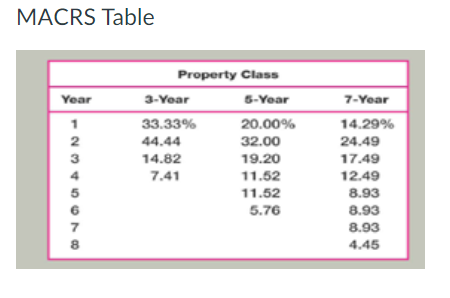

The "Toy World" is a leading producer of toys. The firm is considering a new line of product - the "Inside Out" toy set. The firm plans on a3-year production. The firm will pay $70 to conduct the market analysis and determine the extent of customer demand for the new toy line. The new toy line will be produced in a building owned by the firm and located near Los Angeles. The building is currently leased out to another firm for $50 per year. The firm will buy new equipment to produce the new toy. The purchase price of the new equipment is $900, the shipping cost is $20, and the modification cost is $80. The new equipment follows a 5-year MACRS schedule.The estimated salvage value of this equipment is $250 at the end of project. The firm is expected to sell 350 units of new toy each year. The unit price is expected to be $12. There will be two types of non-depreciation operating costs:the total variable costs are expected to be 70% of sales and the fixed costs are expected to be $500 each year.

The working capital is expected toincrease by $600immediately at year 0, with the beginning working capital being zero. For year 1 and year 2, working capital will be equal to 10% ofnext year'ssales revenue.At the end of the project, all working capital will be liquidated.

The company adopts the "subjective approach" to estimate the project WACC. The firm WACC is 6% and the "subjective" factor to adjust for the risk level of project is 2%. This new project is classified as "high risk" project. The corporate tax rate is 21%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started