Answered step by step

Verified Expert Solution

Question

1 Approved Answer

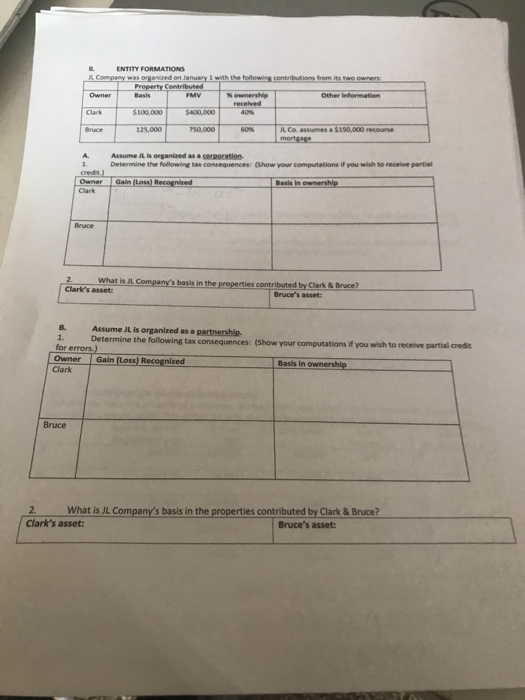

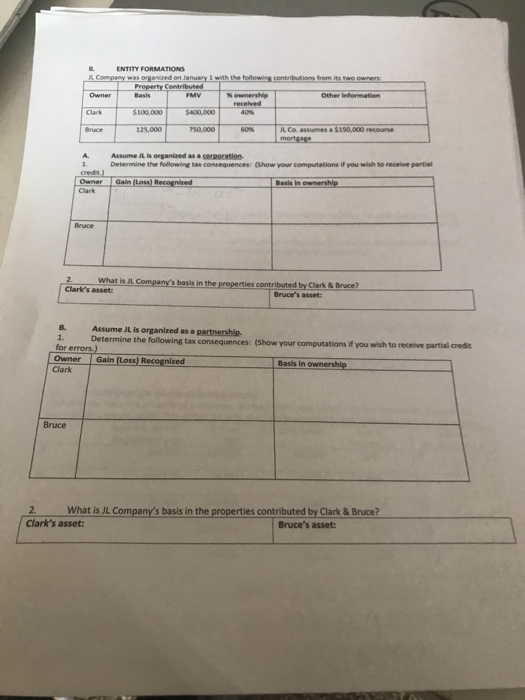

ENTITY FORMATIONS Company was organized on January 1 with the following contributions from its two owners Property Contributed Other information $100,000 $400,000 il ceases $150.000

ENTITY FORMATIONS Company was organized on January 1 with the following contributions from its two owners Property Contributed Other information $100,000 $400,000 il ceases $150.000 recen Assume ili organized as a corporation Determine the following tax consequences (Show your computations if you wish to receive parti credit.) Owner Clark Gain (Loss) Recognized Basis in ownership 2. What is il Company's basis in the properties contributed by Clark & Bruce? Clark's asset Bruce's asset: Assume I is organized as a partnership Determine the following tax consequences: Show your computations if you wish to receive partial credit for errors.) Owner Gain (Loss) Recognized Basis in ownership Clark 2. What is JL Company's basis in the properties contributed by Clark & Bruce? Clark's asset: Bruce's asset

ENTITY FORMATIONS Company was organized on January 1 with the following contributions from its two owners Property Contributed Other information $100,000 $400,000 il ceases $150.000 recen Assume ili organized as a corporation Determine the following tax consequences (Show your computations if you wish to receive parti credit.) Owner Clark Gain (Loss) Recognized Basis in ownership 2. What is il Company's basis in the properties contributed by Clark & Bruce? Clark's asset Bruce's asset: Assume I is organized as a partnership Determine the following tax consequences: Show your computations if you wish to receive partial credit for errors.) Owner Gain (Loss) Recognized Basis in ownership Clark 2. What is JL Company's basis in the properties contributed by Clark & Bruce? Clark's asset: Bruce's asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started