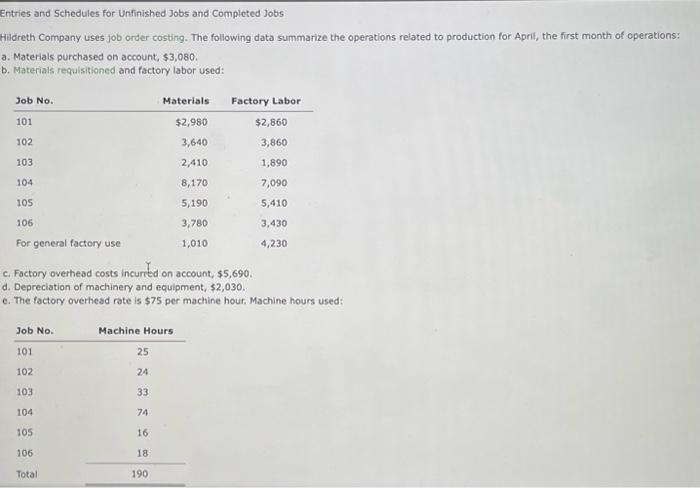

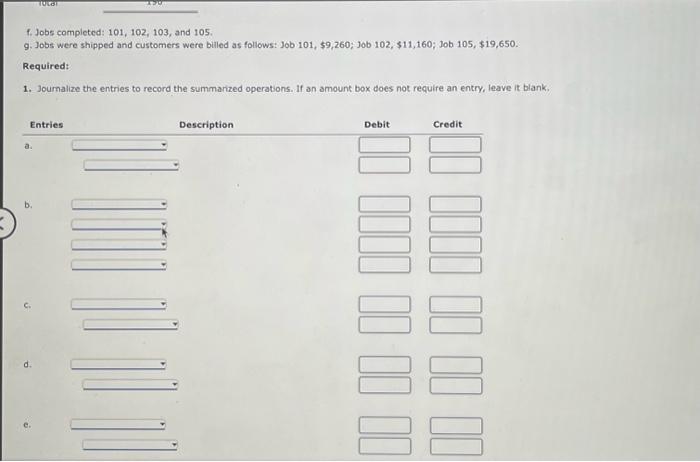

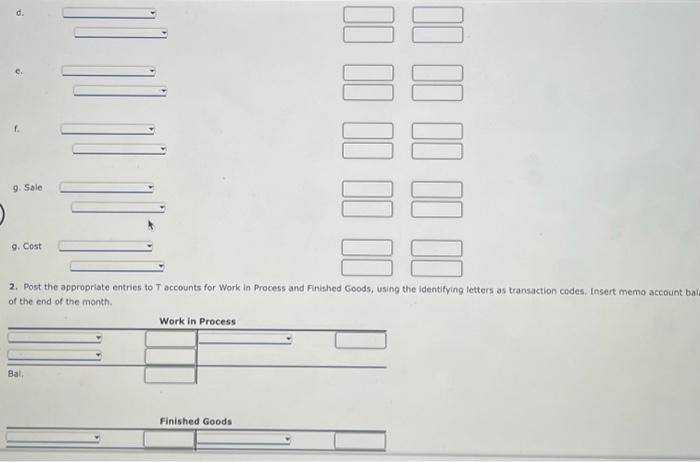

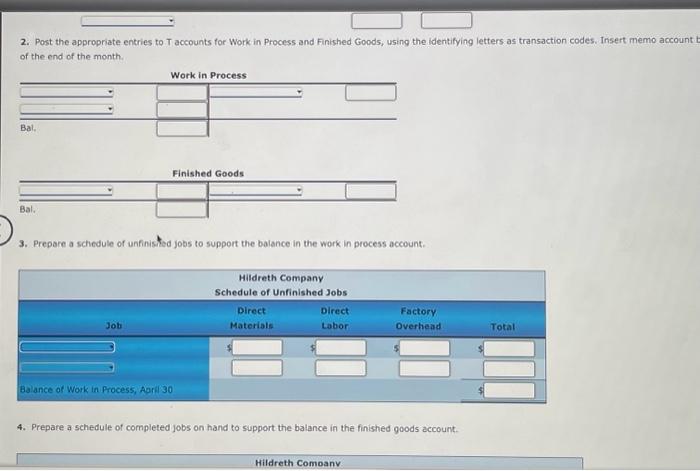

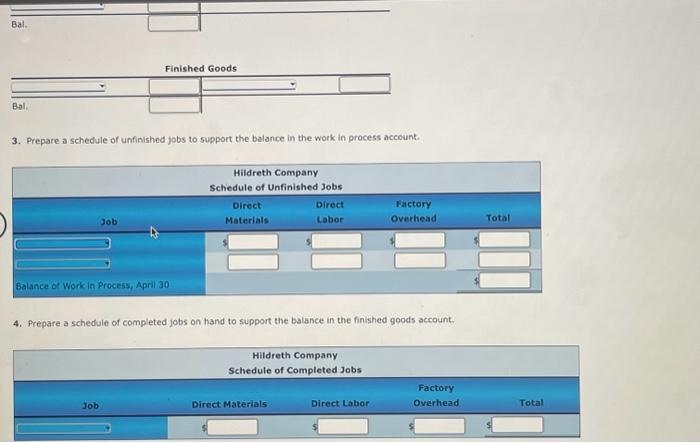

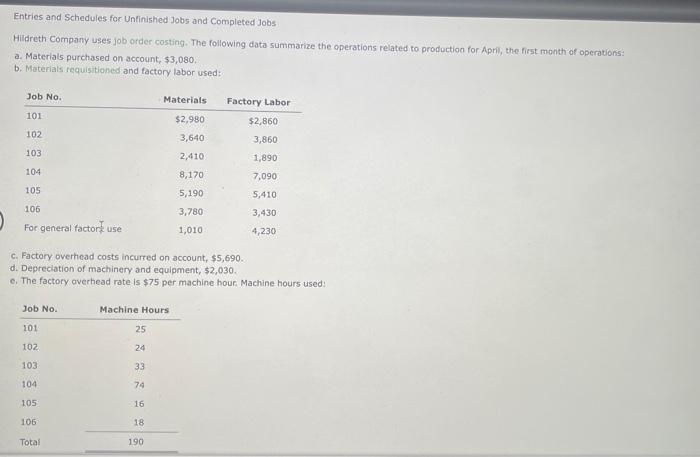

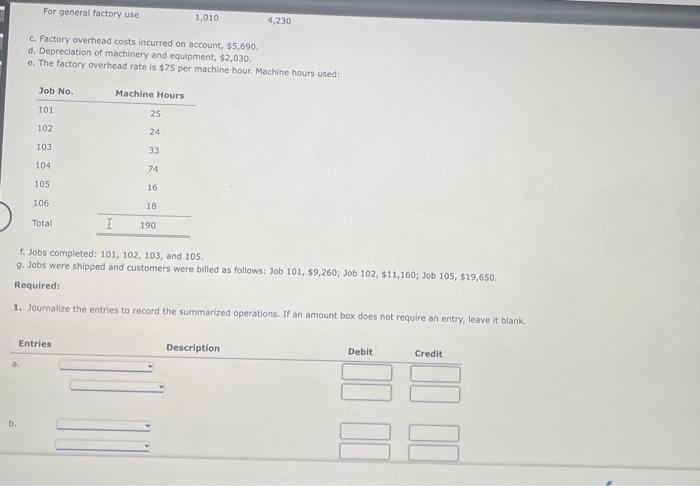

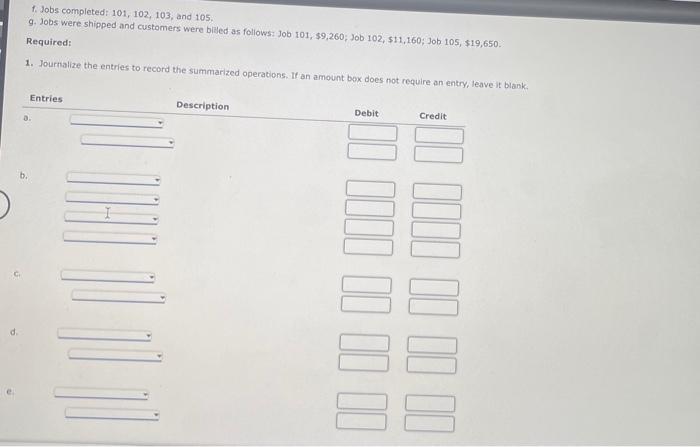

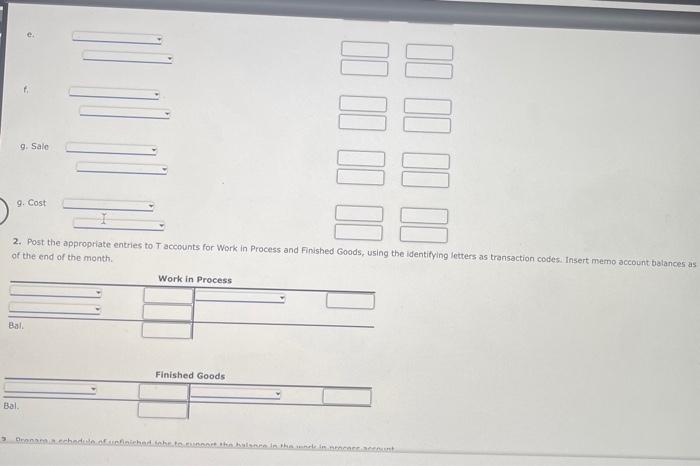

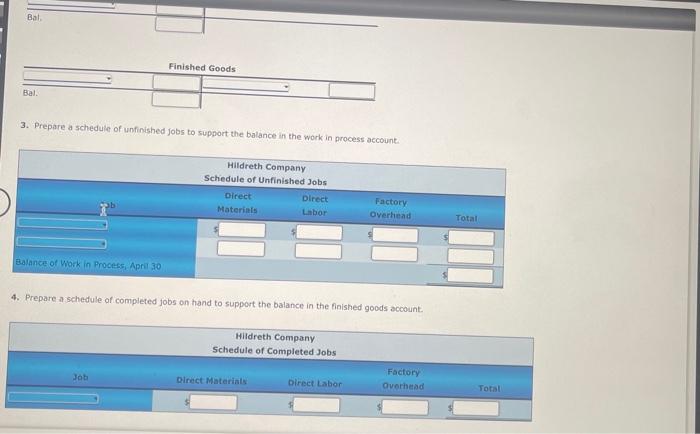

Entries and Schedules for Unfinished Jobs and Completed Jobs Hidreth Company uses job order costing. The following data summarize the operations related to production for April, the first month of operations: a. Materials purchased on account, $3,080. b. Materials requisitioned and factory labor used: c. Factory overhesd costs incurted on account, $5,690. d. Depreciation of machinery and equipment, $2,030. e. The factory overhead rate is $75 per machine hour. Machine hours used: 1. Jobs completed: 101,102,103, and 105 . 9. Jobs were shipped and customers were billed as follows: Job 101, $9,260; Job 102, $11,160; Job. 105, $19,650. Required: 1. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes, Insert memo account ba of the end of the month. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the ldentifying letters as transaction codes. Insert memo account of the end of the month. 3. Prepare a schedule of unfinisked jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. Entries and Schedules for Unfinished Jobs and Completed Jobs Hildreth Company uses job order costing. The following data summarize the operations related to prodoction for April, the fiest month of operationis: a. Materlals purchased on account, $3,080 b. Materials requisitioned and factory labor used: C. Factory overhead costs incurred on account, $5,690. d. Depreciation of machinery and equipment, 52,030 . e. The factory averhead rate is $75 per machine hour. Machine hours used: c. Factory overhead costs incurred on account, $5,690 d. Depreciation of machinery and equipment, $2,030. e. The factory overhead rate is $75 per machine hour. Machine hours used: f. Jobs completed: 101,102,103, and 105 . 9. Jobs were shipped and customers were billed as follows: Job 101, $9,260; Job 102, $11,160;J0b105,$19,650. Requiredi 1. Joumalize the entries to record the summarized operations. If an amount box doves not require an entry, leave it blank 1. Jobs completed: 101,102,103, and 105 . 9. Jobs were shipped and customers were bised as follows: Job 101, $9,260; Job 102, $11,160; Job 105,$19,650. Required: 1. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. of the end of the month. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the inished goods account