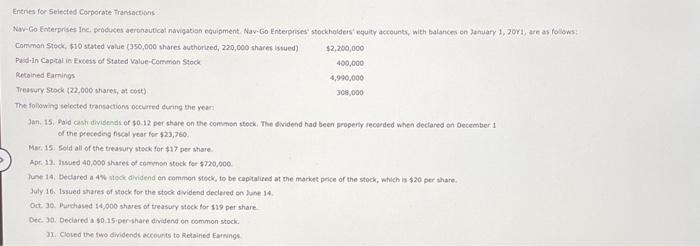

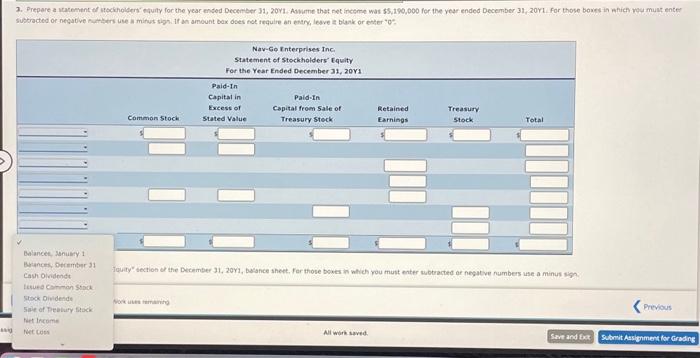

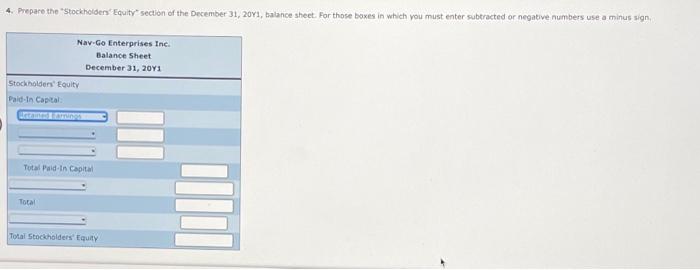

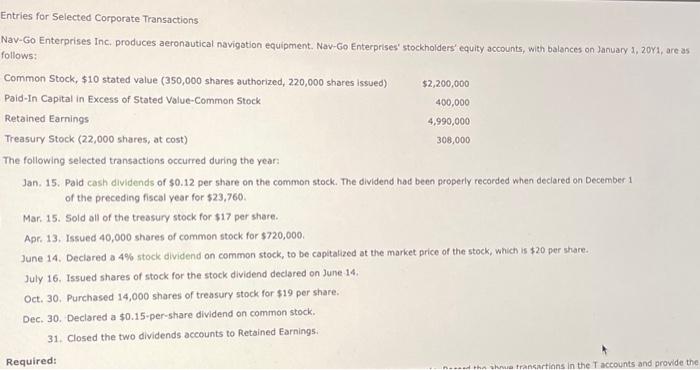

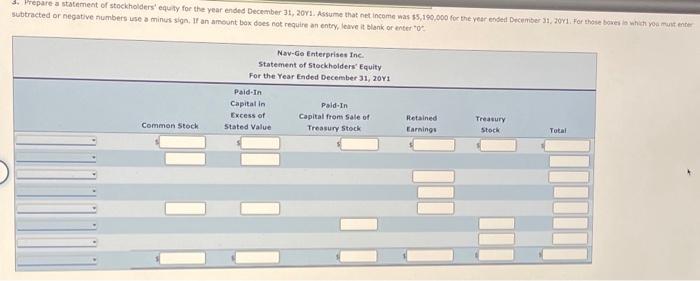

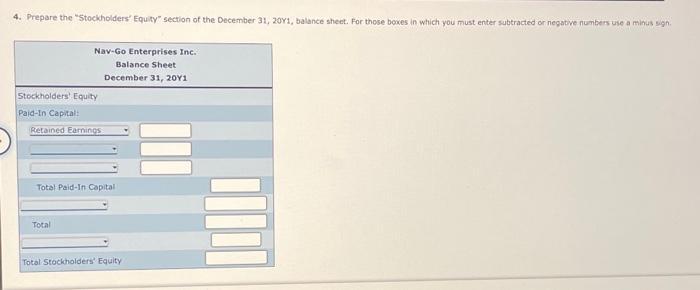

Entries foe selected Corporate Transactions: Nav-Co Eiverprises Inc, peoduces aerohautical navigation equipment. Naw-Go Enterprises' stockholders' equity accounts, with balances on Zatulary 1, 30\%I, are as folbws: Ine ronpwng setected transactions oceurted furing the year Jan. 15. Faid cask divisendt of \$0.12 per share on the commse stock. The eividend had been propenty recerded when declared on December 1 of the precedeng fiscal year for 523,760 . Mor.15: Eold all of the treawiry stack for $17 per share. Apr. 13. Insutd 40,000 shares of comenon steck fer 5720,000 Hune 14, bedared a 4\% stock dividend on common stock, to be capitaliped at the maricet price of the stock, which ia 420 per share. July 16. 1ssued shares of stock for the stook d vidend declered on fune 14. Oct 30. Purchased 14,000 shaves of treasury stoek for 119 per share Dec: 30. Declared a \$0.15.perishare dividend on common stock. 11. Cloled the two dividends eccounts to Relained Elriningt. subtracted or negabve nuthers use an minus slon. if an amount bex obes fot requlre an enang, leave a biank or ester "o". Bhances, berember 31 Cash oividendt teruea comimon strok Touty" dection of the Decimber 31, 20y1, balsnce sheet. Fer those boxes in which rou mutt enter wobracted or nesatve numbers use a minus sigh Stok Divideside 5sie of Peatury fisocik Previous fiet Incume Mececoses Al wrk saved. 4. Prepare the "Stockholden' Equity" section of the December 31,201, balance sheet. For those baxes in which you must enter subtracted or negative numbers use a minus sign. Nav-Go Enterprises inc. Balance sheet December 31, 20y1 Stockholers' Foulty Paid-in Captal Total Paid-in Copital Totai 5toceholders' Equaty Entries for Selected Corporate Transactions Nav-Go Enterprises Inc, produces aeronautical navigotion equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January L, 20r1, are as follows: The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.12 per share on the common stock. The dividend had been properly recorded when deciared on December 1 of the preceding fiscal year for $23,760 Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 40,000 shares of common stock for $720,000. June 14. Deciared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. July 16. Issued shares of stock for the stock dividend declared on June 14 . Oct. 30. Purchased 14,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.15-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earning5: stive aumbers use a minus sign, If an amount box does not requite an entry, leave it Mlanik or enter "o? 4. Prepare the "Stockholders' Equity" section of the December 31, 20Y1, balance sheet. For those boxes in which you must enter subtracted or negatve numbers use a mihus sigh