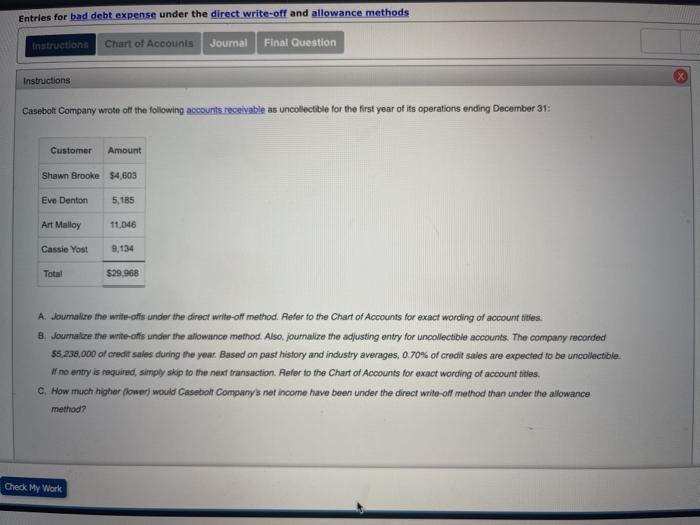

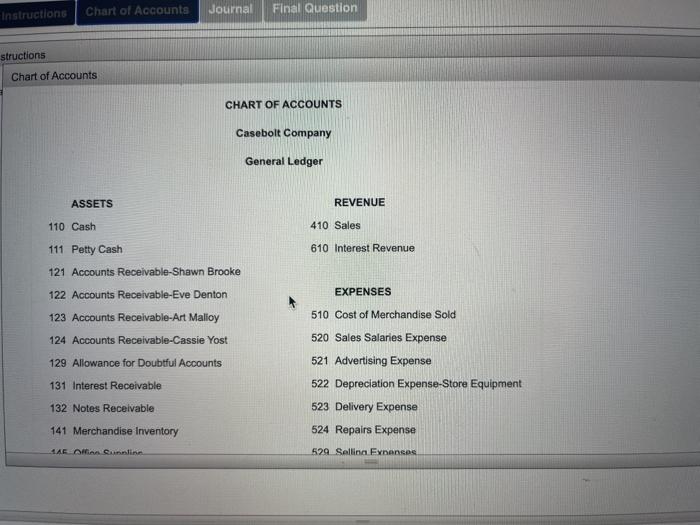

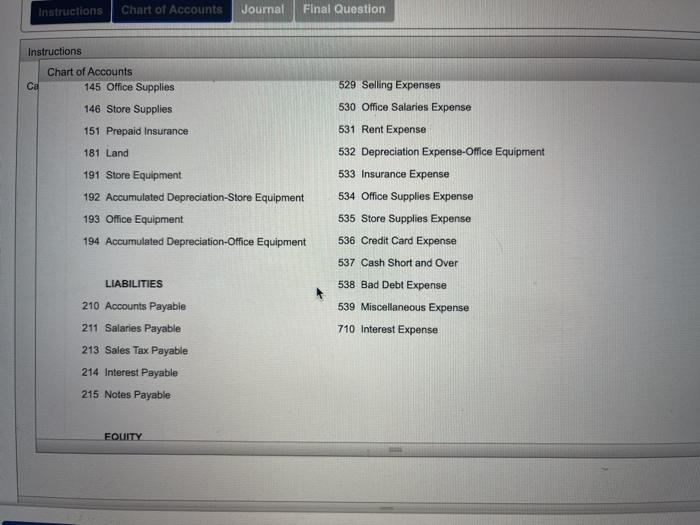

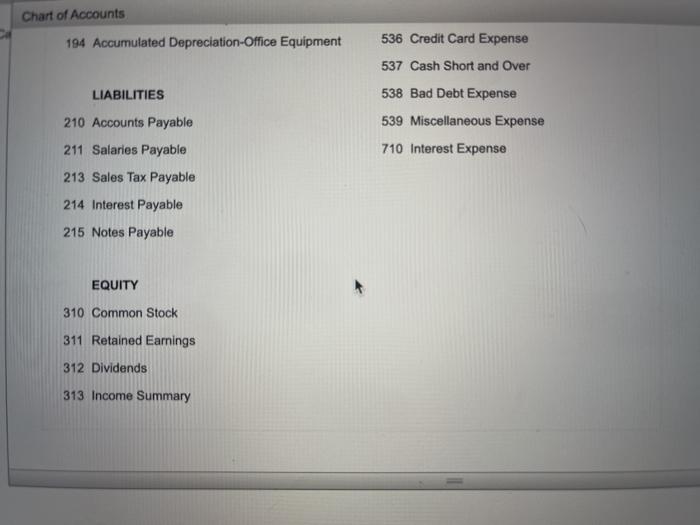

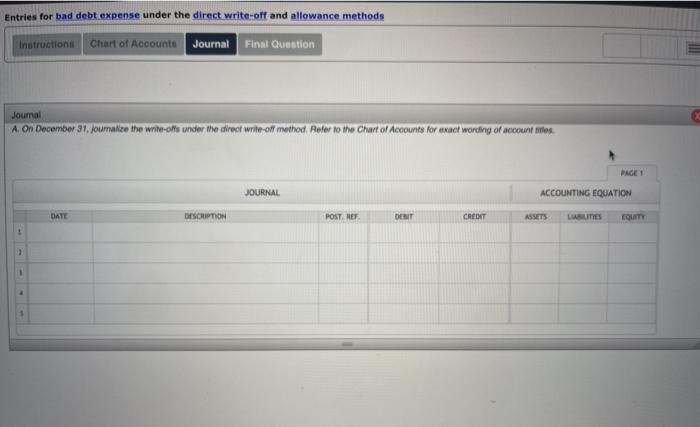

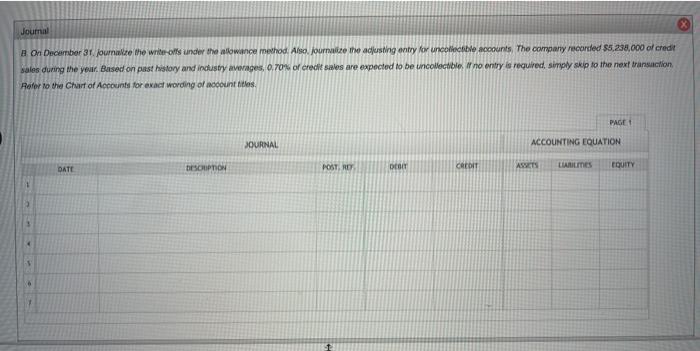

Entries for bad debt expense under the direct write-off and allowance methods Instructions Chart of Accounts Journal Final Question Instructions Casebolt Company wrote of the following accounts receivable as uncollectible for the first year of its operations ending December 31: Customer Amount Shawn Brooke $4,603 Eve Denton 5,185 Art Malloy 11,046 Cassie Yost 9,134 Total $29.968 A. Journalze the write-offs under the direct write-off method. Refer to the Chart of Accounts for exact wording of account titles B. Journakze the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded $5.238,000 of credit sales during the year. Based on past history and industry averages, 0.70% of credit sales are expected to be uncollectible. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. C. How much higher flower) would Casebolt Company's net income have been under the direct write-off method than under the allowance method? Check My Work Journal Chart of Accounts Instructions Final Question structions Chart of Accounts CHART OF ACCOUNTS Casebolt Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 610 Interest Revenue 111 Petty Cash 121 Accounts Receivable-Shawn Brooke 122 Accounts Receivable-Eve Denton EXPENSES 510 Cost of Merchandise Sold 123 Accounts Receivable-Art Malioy 124 Accounts Receivable-Cassie Yost 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 524 Repairs Expense 14 Cunninn 529 Selling Expenses Instructions Chart of Accounts Journal Final Question Instructions Chart of Accounts 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 529 Selling Expenses 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 533 Insurance Expense 534 Office Supplies Expense 535 Store Supplies Expense 536 Credit Card Expense 191 Store Equipment 192 Accumulated Depreciation Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY Chart of Accounts 194 Accumulated Depreciation Office Equipment 536 Credit Card Expense 537 Cash Short and Over LIABILITIES 538 Bad Debt Expense 210 Accounts Payable 539 Miscellaneous Expense 710 Interest Expense 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary Entries for bad debt expense under the direct write-off and allowance methods Chart of Accounts Journal Final Question Instructions Journal A. on December 31. journalize the write-offs under the direct write-ort method. Polor to the Chart of Accounts for exact wording of account ortos PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DENT CRENT ASSETS LUUTIES 2 Journal On December 3r journalize the write-offs under the allowance method Abio journalize the adjusting entry ko un collectible accounts. The company recorded $5.238,000 of credit sales during the year. Based on past history and industry averages, 0.70% of credit sales are expected to be unicollectible, no entry is required, simply skip to the next transaction Refer to the Churf of Accounts for exact wording of account titles PAGE JOURNAL ACCOUNTING EQUATION DATE DESCUPTION POSTRO DEO CREDIT AWETS LANILES EQUITY Instructions Chart of Accounts Journal Final Question Journal Final Question C. How much higher owwe would Caseball Company's net income have been under the direct write-off method than under the allowance method? by $