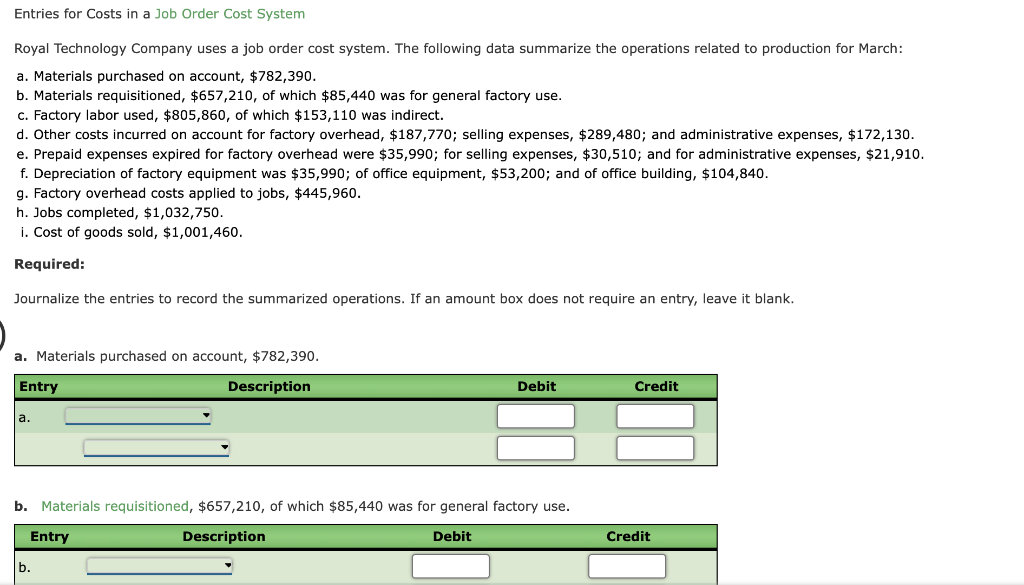

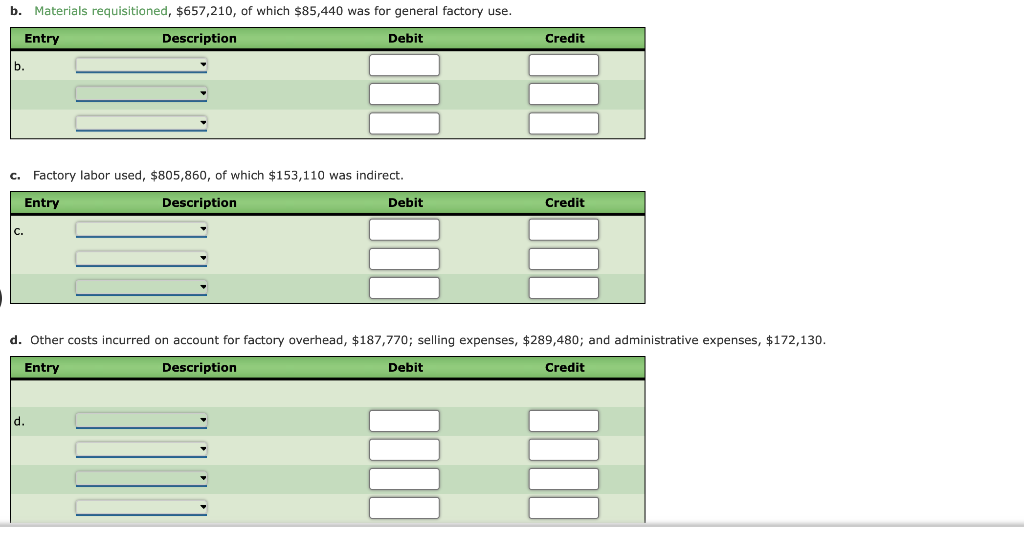

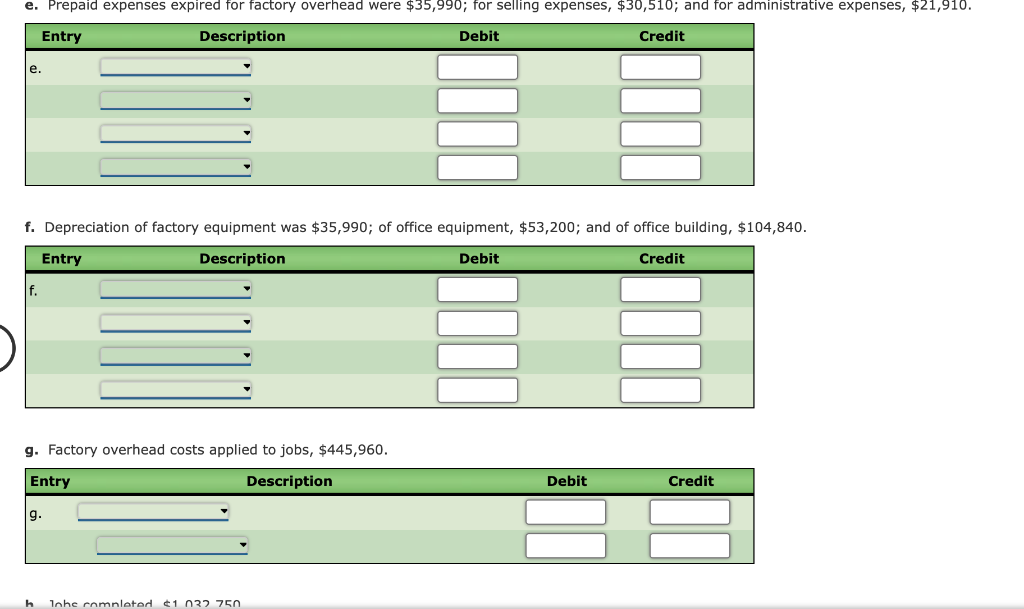

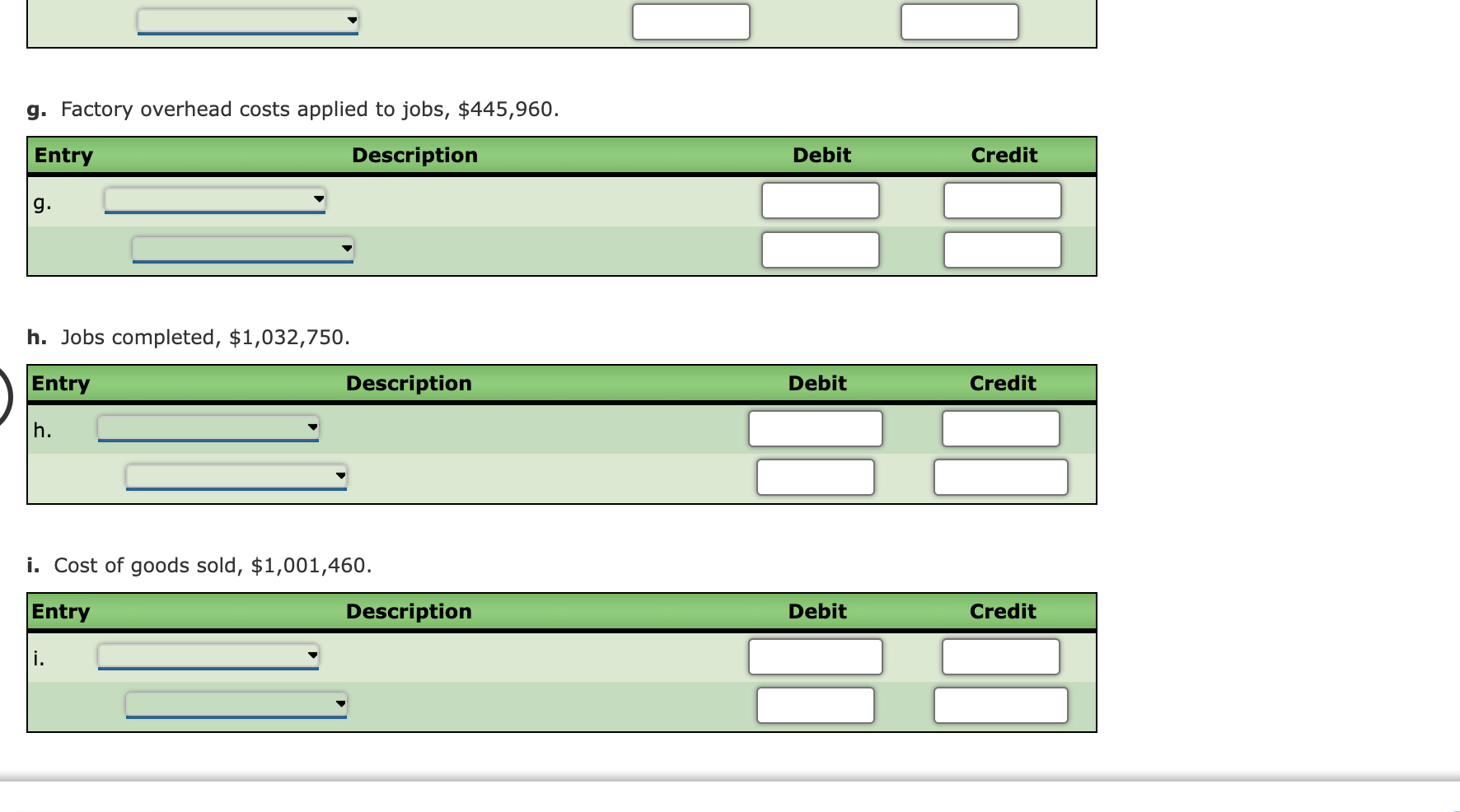

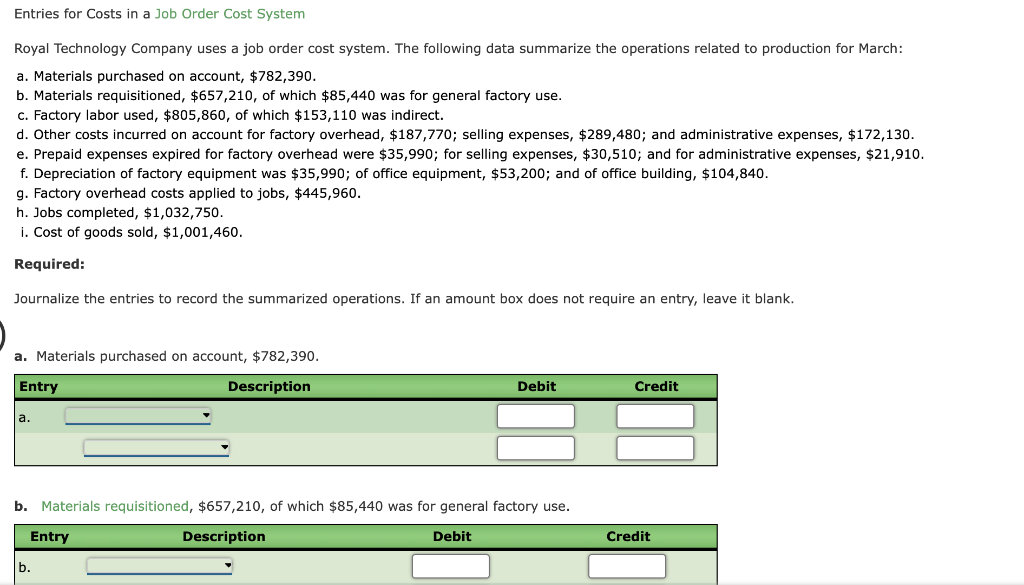

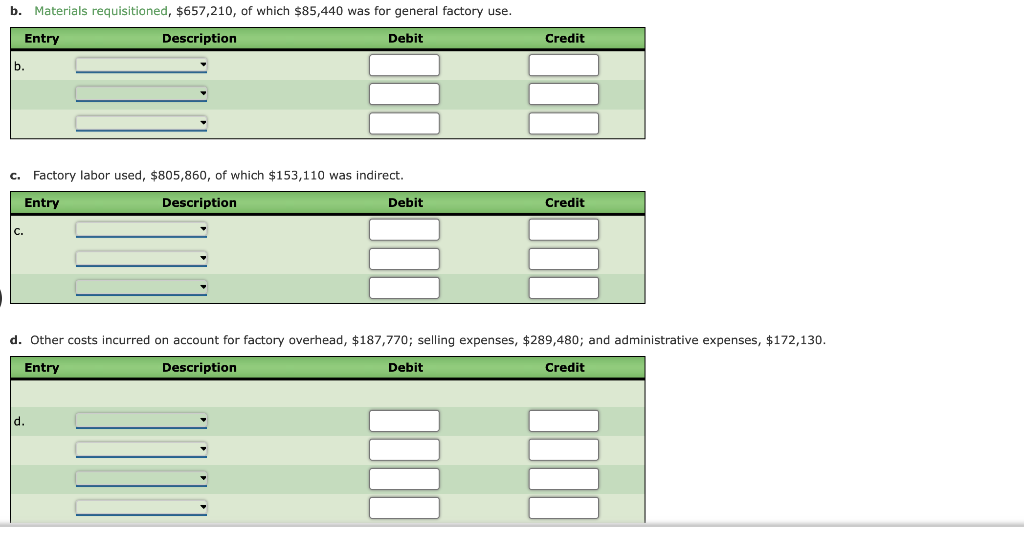

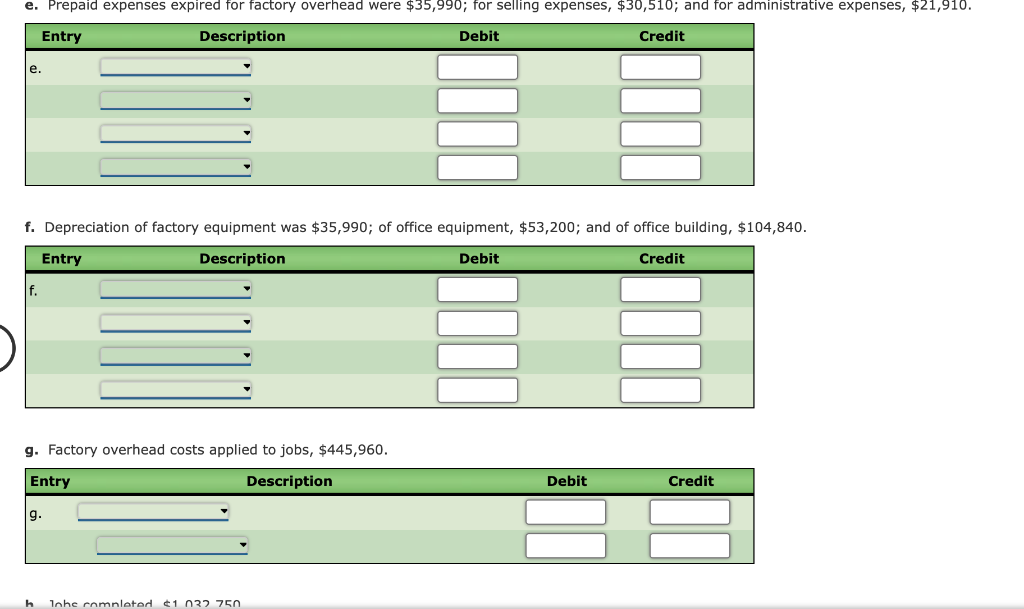

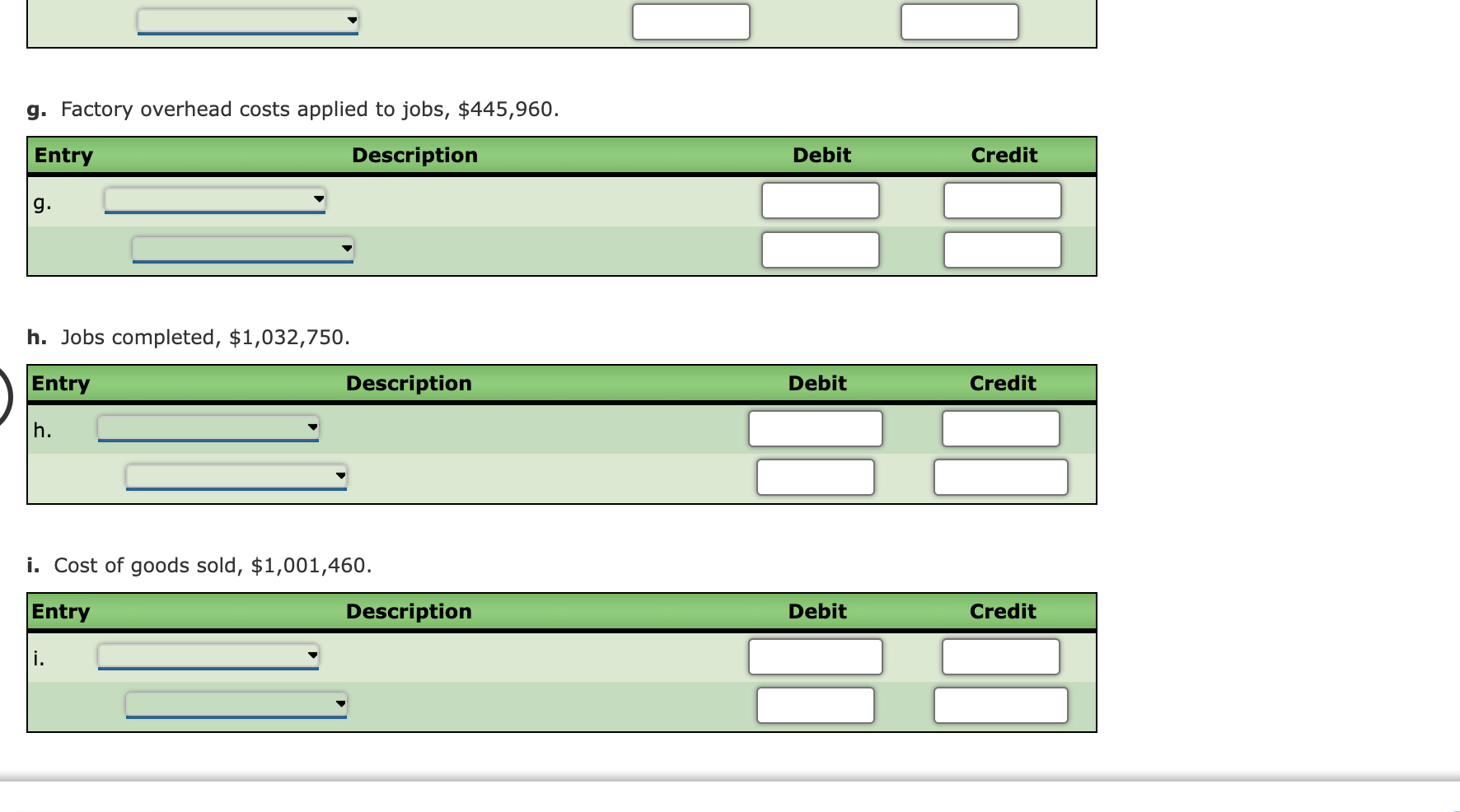

Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $782,390. b. Materials requisitioned, $657,210, of which $85,440 was for general factory use. c. Factory labor used, $805,860, of which $153,110 was indirect. d. Other costs incurred on account for factory overhead, $187,770; selling expenses, $289,480; and administrative expenses, $172,130. e. Prepaid expenses expired for factory overhead were $35,990; for selling expenses, $30,510; and for administrative expenses, $21,910. f. Depreciation of factory equipment was $35,990; of office equipment, $53,200; and of office building, $104,840. g. Factory overhead costs applied to jobs, $445,960. h. Jobs completed, $1,032,750. i. Cost of goods sold, $1,001,460. Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $782,390. Entry Description Debit Credit a. b. Materials requisitioned, $657,210, of which $85,440 was for general factory use. Entry Description Debit Credit b. b. Materials requisitioned, $657,210, of which $85,440 was for general factory use. Entry Description Debit Credit b. c. Factory labor used, $805,860, of which $153,110 was indirect. Entry Description Debit Credit . d. Other costs incurred on account for factory overhead, $187,770; selling expenses, $289,480; and administrative expenses, $172,130. Entry Description Debit Credit d. e. Prepaid expenses expired for factory overhead were $35,990; for selling expenses, $30,510; and for administrative expenses, $21,910. Entry Description Debit Credit e. f. Depreciation of factory equipment was $35,990; of office equipment, $53,200; and of office building, $104,840. Entry Description Debit Credit f. g. Factory overhead costs applied to jobs, $445,960. Entry Description Debit Credit g. lohe comnleted 1 022 750 g. Factory overhead costs applied to jobs, $445,960. Entry Description Debit Credit g. h. Jobs completed, $1,032,750. Entry Description Debit Credit h. i. Cost of goods sold, $1,001,460. Entry Description Debit Credit