Answered step by step

Verified Expert Solution

Question

1 Approved Answer

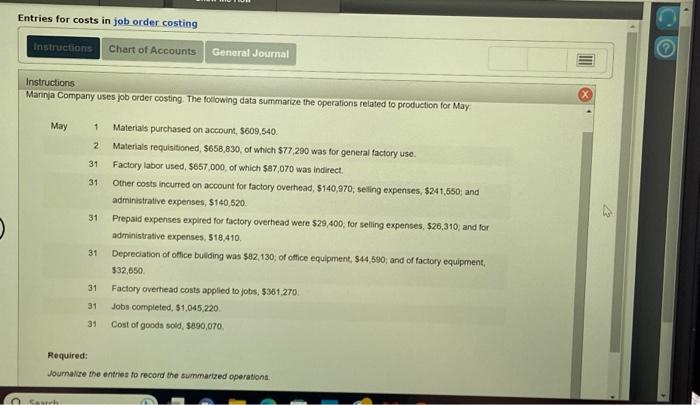

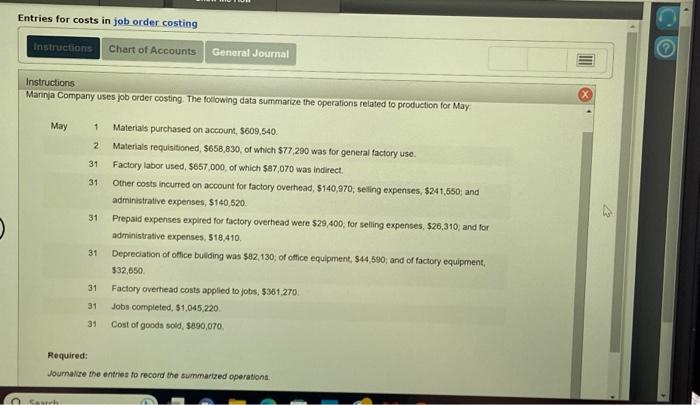

Entries for costs in job order costing May 1 Materials purchased on account, 5609,540. 2 Materials requisitioned, $658,830, of which $77,290 was for general factory

Entries for costs in job order costing

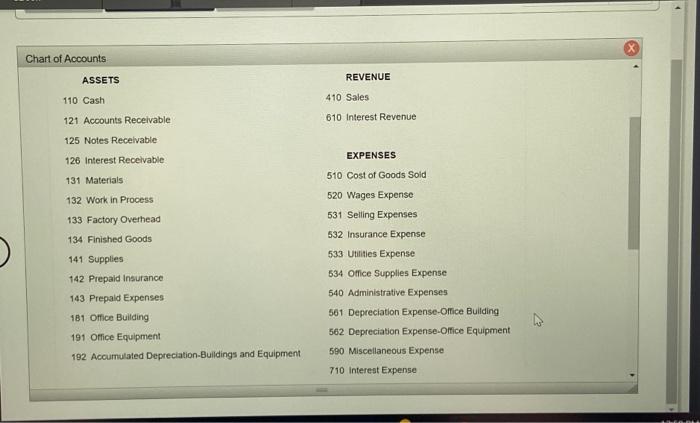

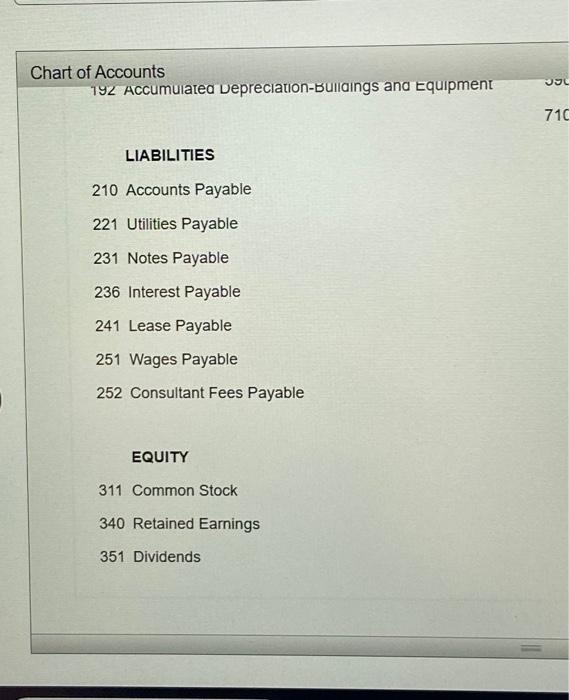

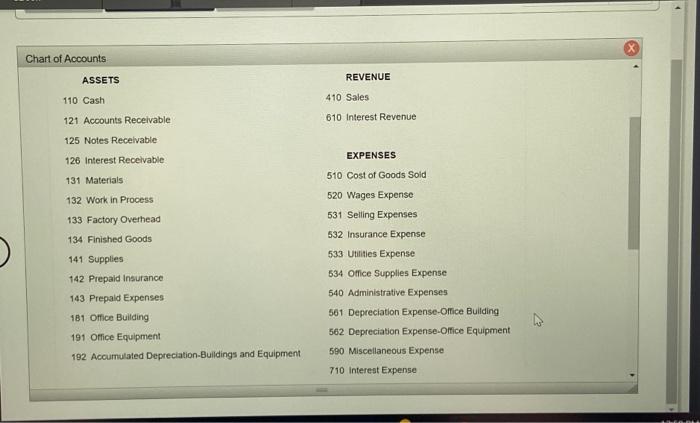

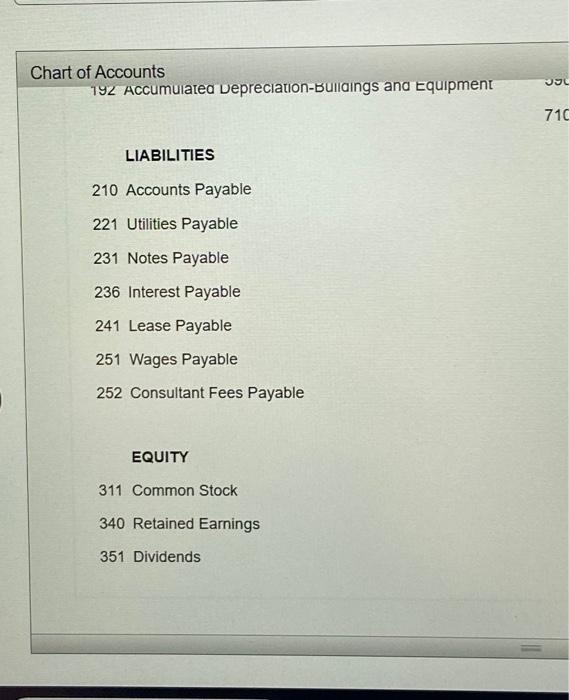

May 1 Materials purchased on account, 5609,540. 2 Materials requisitioned, $658,830, of which $77,290 was for general factory use. 31 Factory labor used, $657,000, of which $87,070 was indirect. 31 Other costs incurred on account for tactory overhead, $140,970; seiling expenses, $241,550; and administrative expenses, $140,520. 31 Prepaid expenses expired for tactory overhead were $29,400; for selling expenses, $26,310; and for administrative expenses, $18,410. 31 Depreciation of office bulding was $82,130; of office equipment, $44,500; and of factory equipment, $32,650. 31 Factory overhead costs applied to jobs, $361,270. 31 Jobs completed, $1,045,220. 31 Cost of goods sold, $890,070. Required: Joumakre the entries to record the summarized operationt. Chart of Accounts ASSETS 110 Cash 121 Accounts Receivable 125 Notes Recelvable 126 Interest Recelvable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance 143 Prepaid Expenses 181 Office Building 191 Office Equipment 192 Accumulated Depreciation-Buildings and Equipment REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Goods Sold 520 Wages Expense 531 Selling Expenses 532 Insurance Expense 533 Utilities Expense 534 Office Supplies Expense 540 Administrative Expenses 561 Depreciation Expense-OFice Building 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 interest Expense LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends Journalize the entries to record the summarized operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started