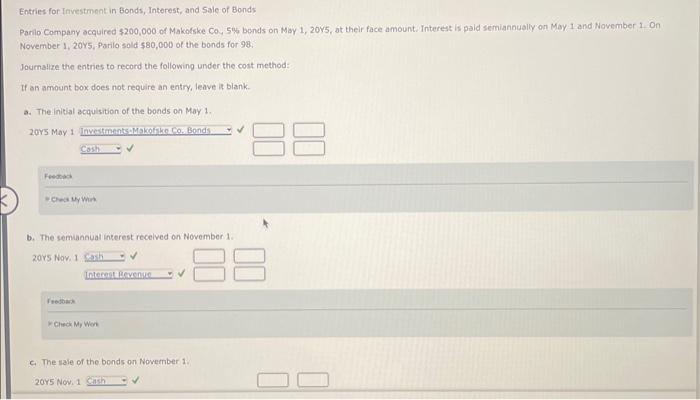

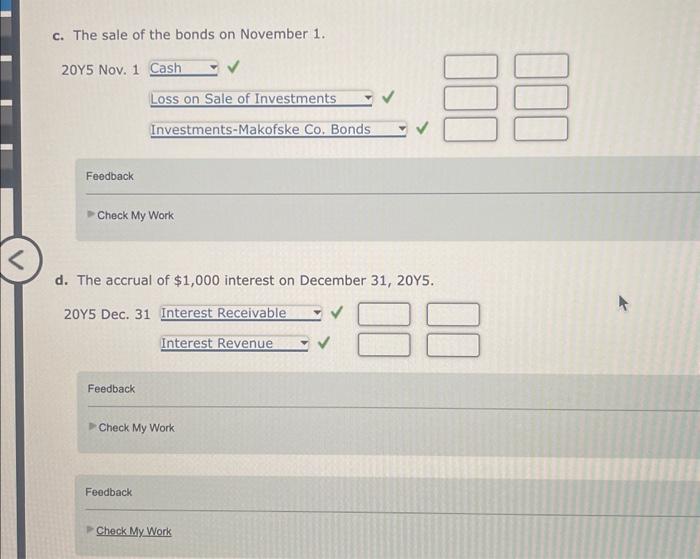

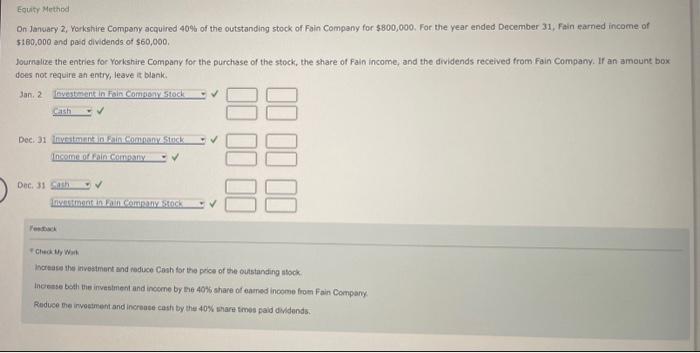

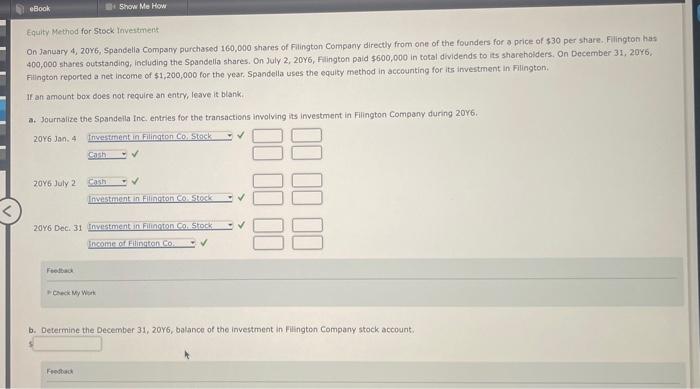

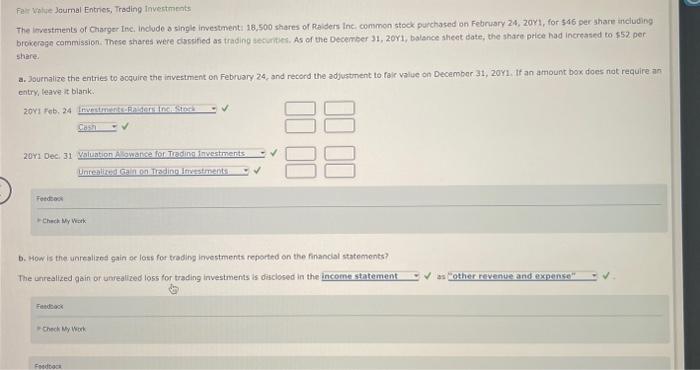

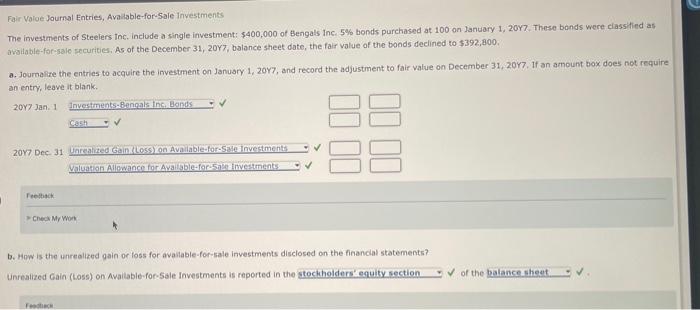

Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $200,000 of Makotske Co, 5% bonds on May 1,20 , at their face amount Interest is paid semiannually on May 1 and November 1 . On November 1, 20Y5, Parilo sold $80,000 of the bonds for 98 . Joumalze the entries to record the following under the cost method: If an ambunt box does not require an entry, leave is blank. a. The initial acaulsition of the boeds on Mav 1 . 20 b. The semiannuat interest recelved on November 1 . 20S Nav, 1 rredoarin rcheck Mr, Won c. The saie of the bonds on November 1 . Check My Work d. The accrual of $1,000 interest on December 31, 20 Y5. 20Y Feedback Check My Work Dn Janvary 2, Yerkshire Company acquired 40% of the outstanding stock of Fain Company for $800,000. For the year ended December 31 , Fain eamed income of $180,000 and paid dividends of $60,000. Journalize the entries for Yorkshire Company for the purchase of the stock, the share of fain income, and the dridends received from Fain Company. If an amount box does not require an entry, leave is blank. festicet " cleody wah increase the investment and reduce Cash lor the price of the outstanding atock. Incerse both bie investinent and income by 2040% share of eamed income froen Fain Company. Redice the invoetment and increace cash by the 40% thare times paid deldends. Equity Mathod for Stock Inyestmenk On January 4, 20Y6, Spandelia Compsry purchased 160,000 shares of Filington company directly from one of the founders for a price of $30 per share. Filington has 400,000 shares outstanding, including the Spandelia shares. On July 2, 20Y6, Filington paid $600,000 in total dividends to its sharehalders, On December 31,2046 , Filington reported a net income of $1,200,000 for the yesr, Spandella uses the equity method in accounting for its investment in Filington. If an amount box does not require an entry, leave it blank. a. Journilize the Spandeila inc. entries for the transactions involving its investment in Filington Company during 20Y6. Feetsact Poteckly wert b. Determine the December 31,206, balance of the investment in Filington Company stock account. Fey Wolye Joumal Entries, Trading invectments The investments of Crarger Inc. include a single imvestmenti 18,500 shares of Reisers Inc common stock purchased on February 24 , 201, for 506 per share including broverege commission. These shares were caspified as thading securtits. As of the December 31, 20r1, balance sheet date, the share price had increased to 552 . per. share a. 30umalize the entries to acquire the irivestment on February 24 , and record the adjustment to faie value on Decembor 31 , 20l. If an amount box, does not require an entry, leave it blank: 2011 2011.1 Fetcesent - Chech Mr Watk b. How is the wntralizes gain oe loss for trading investments reported on the finandal statements? The unrealized gain of unrealized loss for trading investments is disclosed in the: Fatuback t- Theck My Wowk. Fair Voloe Journal Entries, Ava iable-for-Sale Investments The investments of Steelers Inc, include a single investment: $400,000 of Bengals inc. 5% bonds purchased at 100 on January 1,20%7. These bends were ciassitied as avollable-for-sale securities, As of the Desember 31, 20Y7, balance sheet date, the fair value of the bands declined to $392,800. a. Journalize the entries to acquire the investment on January 1, 20y7, and record the adjustment to fair value on December 31 , 20y7. If an amount box does not require an entrv. leave it blank. 201 201 feethack. Checa Mr wort: b. How is the unrealized gain or foss for avallable-for-sale investments disclosed on the financial statements? Unrealized Gain (Loss) on Avallable-for-5ale Investments is reported in the s. of the