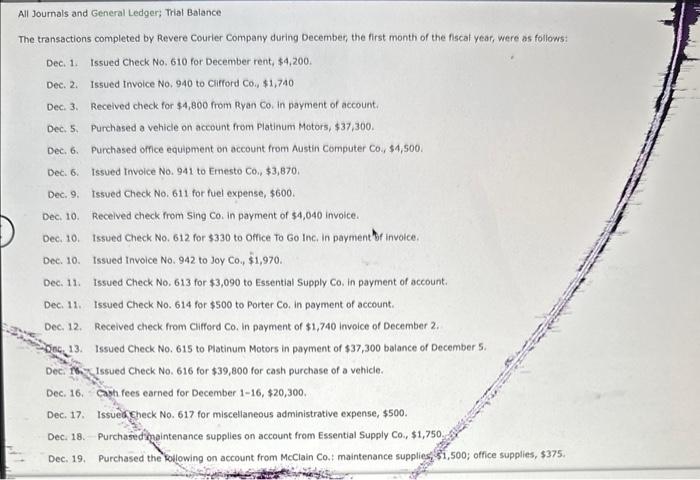

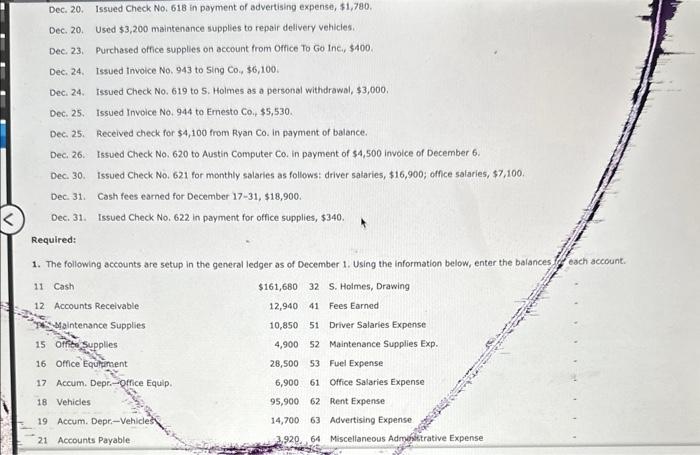

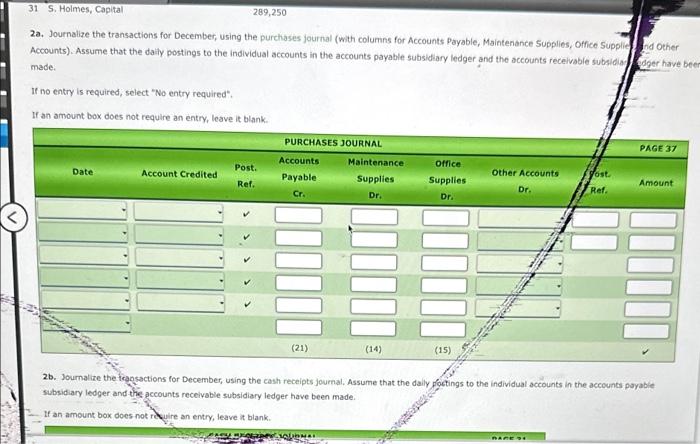

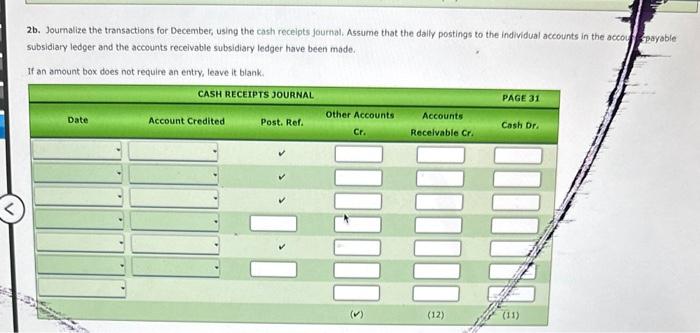

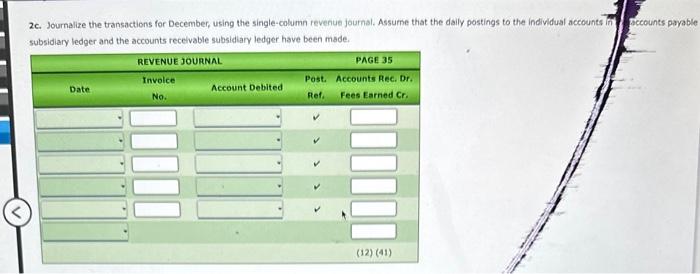

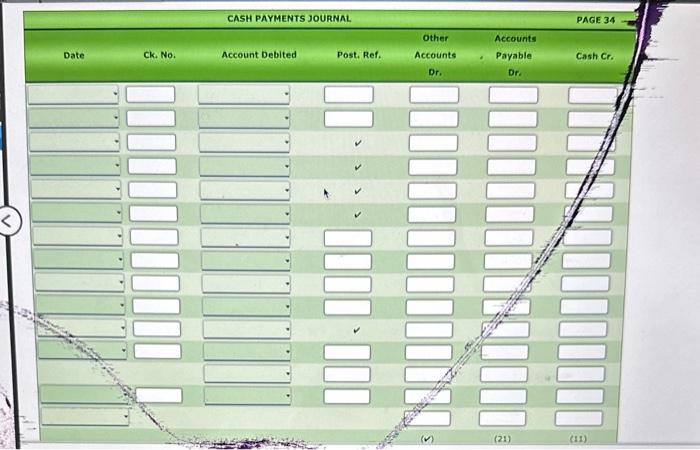

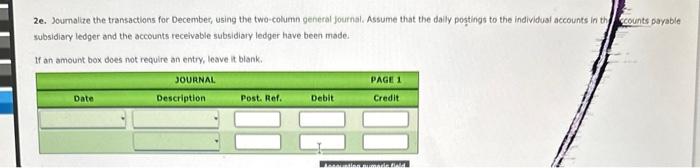

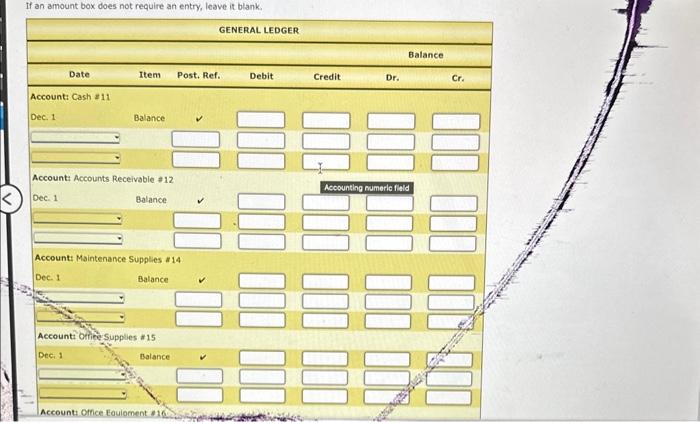

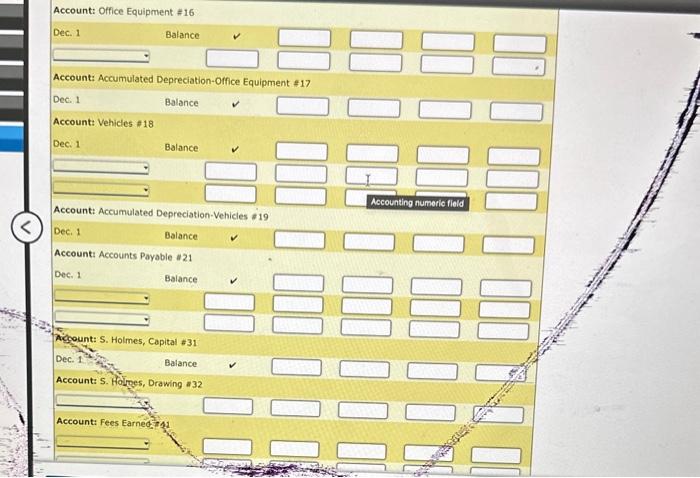

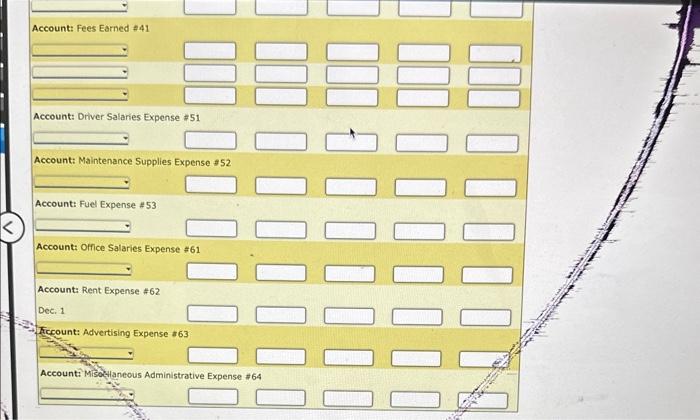

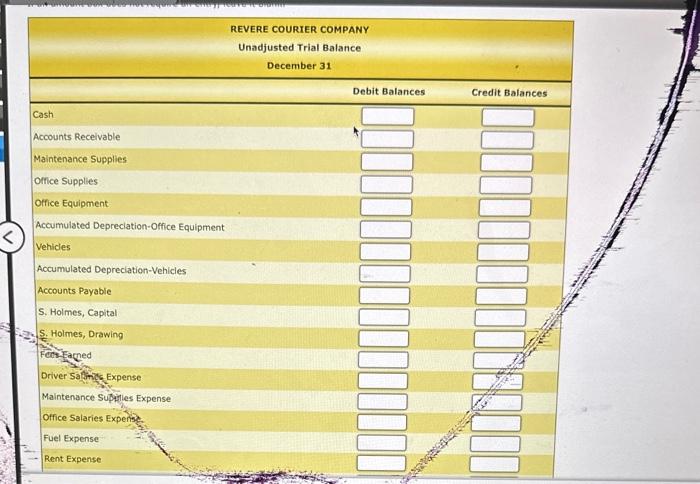

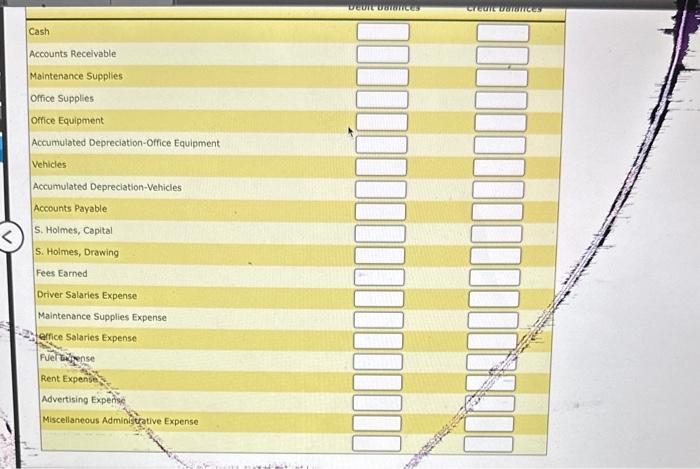

The transactions completed by Revere Courler Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No, 610 for December rent, $4,200. Dec. 2. Issued Invoice No, 940 to Cifford Co., $1,740 Dec. 3. Received check for $4,800 from Ryan Co. in payment of account. Dec, 5. Purchased a vehicle on account from Platinum Motors, $37,300. Dec. 6. Purchased office equipment on account from Austin Computer Co., $4,500. Dec. 6. Issued invoice No. 941 to Emesto Co., $3,870. Dec. 9. Issued Check No, 611 for fuel expense, $600. Dec, 10. Recelved check from Sing Co, in payment of 54,040 invoice. Dec. 10. Issued Check No, 612 for $330 to Office To Go Inc. In payment of involce. Dec. 10. Issued Involce No. 942 to Joy Co. $1,970. Dec. 11. issued Check No, 613 for $3,090 to Essential Supply Co, in payment of account. Dec. 11. Issued Check No. 614 for $500 to Porter Co. in payment of accourt. Dec. 12. Received check from Clifford Co. In payment of \$1,740 invoice of December 2 . Henc. 13. Issued Check No. 615 to Platinum Motors in payment of $37,300 balance of December 5 . Dec. 16\% Issued Check No. 616 for $39,800 for cash purchase of a vehicle. Dec. 16, Gayh fees earned for December 116,$20,300. Dec. 17. Issuedcheck No. 617 for miscellaneous administrative expense, $500. Dec. 18. Purchased'meintenance supplies on account from Essential Supply Co., $1,750 Dec. 19. Purchased the Vollowing on account from McClain Co,: maintenance supplies, 51,500; office supplies, $375. Dec. 20. Issued Check No, 618 in payment of advertising expense, 51,780 . Dec. 20. Used $3,200 maintenance supplies to repair delivery vehicies. Dec: 23. Purchased office supplies on account from Office to Go Inc. $400. Dec. 24. Issued tnvoice No, 943 to singCo4$6,100. Dec. 24. Issued Check No. 619 to 5 . Holmes as a personal withdrawal, $3,000. Dec. 25. Issued Invoice No. 944 to Ernesto Co. $5,530. Dec. 25. Received check for $4,100 from Ryan Co. in payment of balance. Dec. 26. Issued Check No. 620 to Austin Computer Co. in payment of $4,500 involce of December 6. Dec. 30. Issued Check No. 621 for monthly salaries as follows: driver salaries, $16,900; office salaries, $7,100. Dec -31. Cash fees earned for December 17-31, $18,900. Dec, 31. Issued Check No, 622 in payment for office supplies, $340. 2a. Journalize the transactions for December, using the purchases journal (with columns for Accounts Payable, Maintenance Supplies, Office Supplief ) fid Oth Accounts). Assume that the dally postings to the individual accounts in the accounts payable subsldiary ledger and the accounts receivable subsidiag made. If no entry is required, select "No entry required". If an amount box does not require an entry, leave it blank. 2b. Journalize the icansactions for December, using the cash receipts joumal, Assume that the daily foctings to the individual accounts in the accounts poyable. subsidiary ledger and the accounts recelyable subsidiary ledger have been made. If an amount boox does not rekulre an entry, leave it blank. 2b. Joumalize the transactions for December, using the cash recelpts journal. Assume that the dally postings to the individual accounts in the accou subsidiary ledger and the accounts recelvable subsidiary ledger have been made. If an amount box does not require an entry, leave it blank. 2c. Journalize the transactions for December, using the single-column revenue journal. Assume that the daily postings to the individual accounts fn subsidiary ledoer and the accounts recelvable subsidiary ledqer have been made. 2e. Joumalize the transactlons for December, using the two-column general journal. Assume that the dally postings to the individusf accounts in subsidiary ledger and the accounts receivable subsidiary ledger have been made. If an amount box does not require an entry, leave it blank. If an amount box does not require an entry, leave it blank. Account: Office Equibment =16 Account: Fees Earned $41 Account: Diver Salaries Expense #51 Account: Maintenance Supplies Expense $52 Account: Fuel Expense $53 Account: Orfice Salaries Expense #61 Account: Rent Expense 462 Dec. 1 Ferount: Advertising Expense at 63 Accounti Misotuaneous Administrative Expense \#64 REVERE COURIER COMPANY Unadjusted Trial Balance December 31 \begin{tabular}{|l} \hline Cash. \\ \hline Accounts Recelvable \\ \hline \end{tabular} Maintenance Supplies Orfice Supplies Office Equipment- Accumulated Depreciation-Office Equipment Vehicles Accumulated Depreciation-Vehicles Accounts Payable S. Holmes, Capital - 2.2. S. Holmes, Drawing FCct Eacred Driver Saftimis Expense Maintenance Suppities Expense Office Salaries Expens? Fuel Expense Rent Expense Cash Accounts Recelvable Maintenance Supplies Office Supplies Office Equipment Accumulated Depreciation-Office Equipment Vehicles Accumulated Depreclation-Vehicles Accounts Payable 5. Holmes, Capital S. Holmes, Drawing Fees Earned Driver Salaries Expense Maintenance Supplies Expense Eafice Salaries Expense Fuerthkense Rent Expense Advertising Expense Miscellaneous Adminstretive Expense