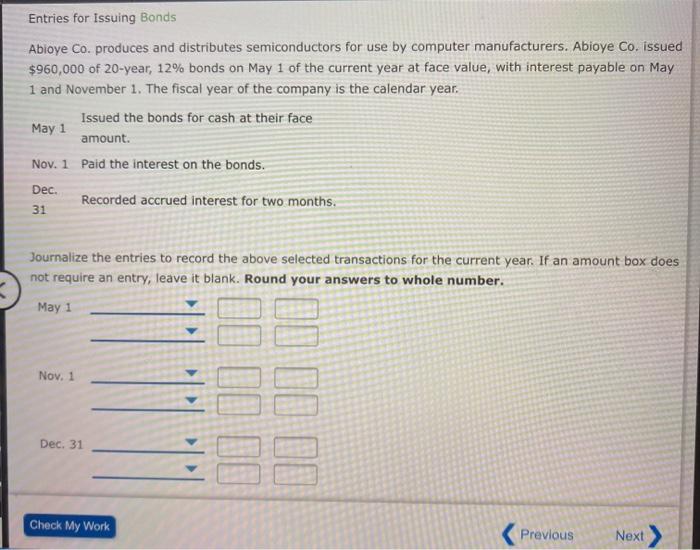

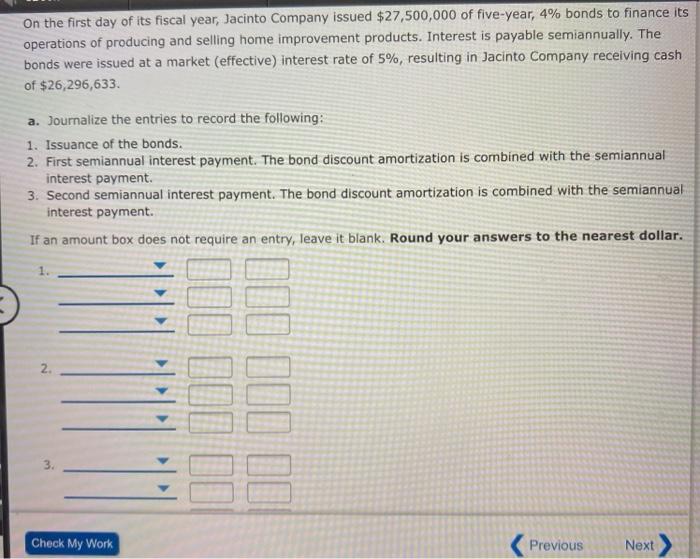

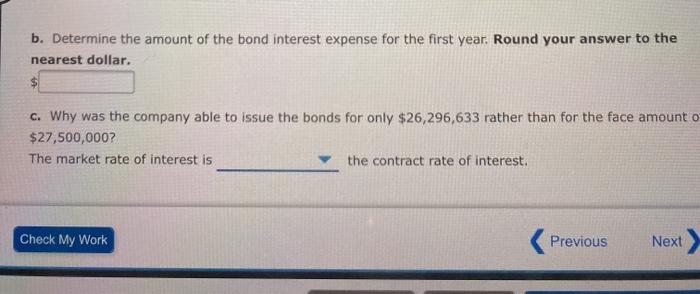

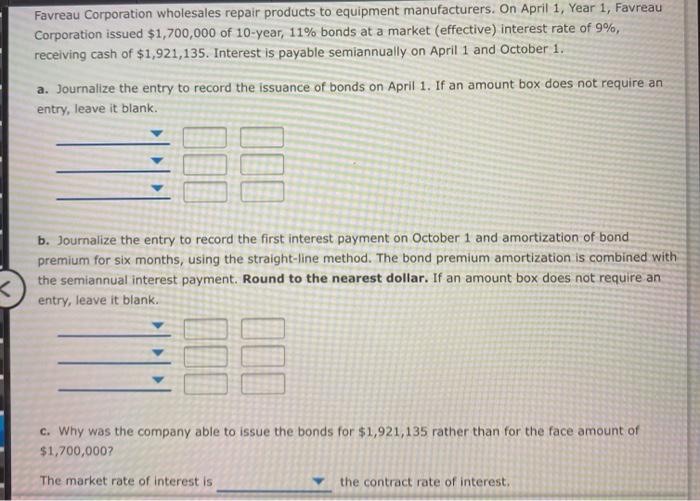

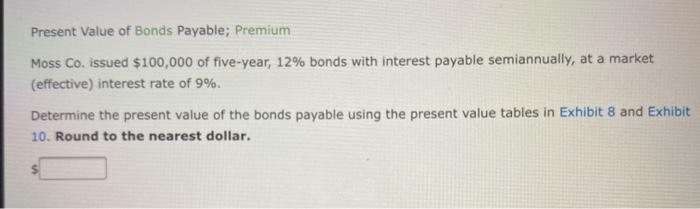

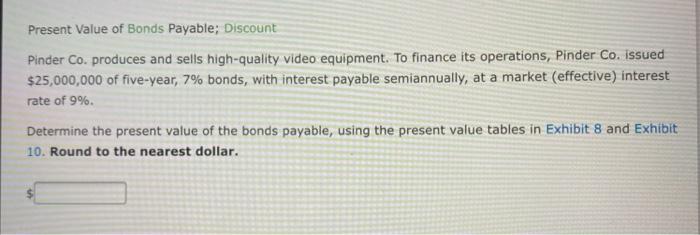

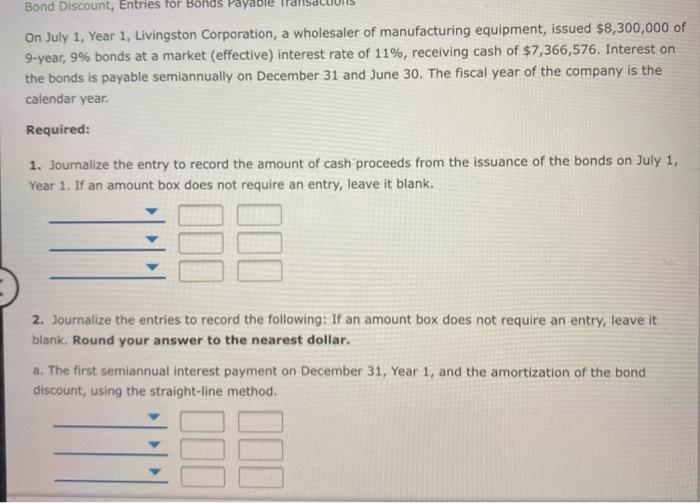

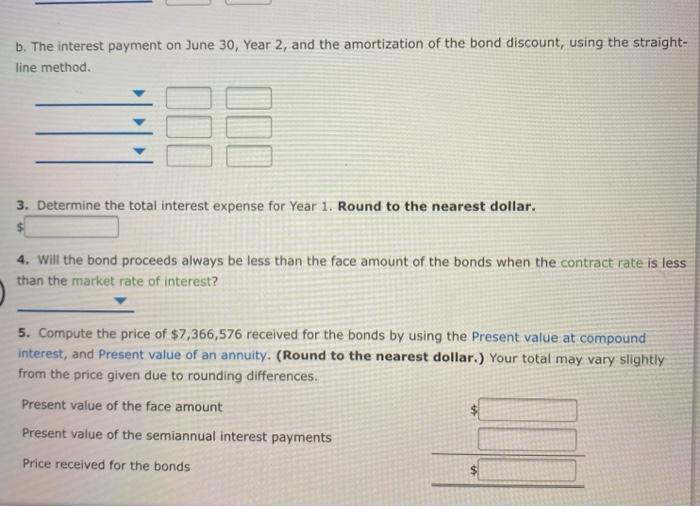

Entries for issuing Bonds Abloye Co. produces and distributes semiconductors for use by computer manufacturers. Abioye Co. issued $960,000 of 20-year, 12% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Issued the bonds for cash at their face May 1 amount. Nov. 1 Paid the interest on the bonds. Dec. Recorded accrued interest for two months. 31 Journalize the entries to record the above selected transactions for the current year. If an amount box does not require an entry, leave it blank. Round your answers to whole number. May 1 Nov. 1 Dec. 31 Check My Work Previous Next On the first day of its fiscal year, Jacinto Company issued $27,500,000 of five-year, 4% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 5%, resulting in Jacinto Company receiving cash of $26,296,633 a. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount amortization is combined with the semiannual interest payment. 3. Second semiannual interest payment. The bond discount amortization is combined with the semiannual interest payment. If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar. 1. 2. II. Check My Work Previous Next b. Determine the amount of the bond interest expense for the first year. Round your answer to the nearest dollar. c. Why was the company able to issue the bonds for only $26,296,633 rather than for the face amount o $27,500,000? The market rate of interest is the contract rate of interest. Check My Work Previous Next Favreau Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Favreau Corporation issued $1,700,000 of 10-year, 11% bonds at a market (effective) interest rate of 9%, receiving cash of $1,921,135. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1 and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $1,921,135 rather than for the face amount of $1,700,000? The market rate of interest is the contract rate of interest. Present Value of Bonds Payable; Premium Moss Co. issued $100,000 of five-year, 12% bonds with interest payable semiannually, at a market (effective) interest rate of 9%. Determine the present value of the bonds payable using the present value tables in Exhibit 8 and Exhibit 10. Round to the nearest dollar. Present Value of Bonds Payable; Discount Pinder Co. produces and sells high-quality video equipment. To finance its operations, Pinder Co. issued $25,000,000 of five-year, 7% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. Determine the present value of the bonds payable, using the present value tables in Exhibit 8 and Exhibit 10. Round to the nearest dollar. Bond Discount, Entries for Bonds Payable On July 1, Year 1, Livingston Corporation, a wholesaler of manufacturing equipment, issued $8,300,000 of 9-year, 9% bonds at a market (effective) interest rate of 11%, receiving cash of $7,366,576. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1. If an amount box does not require an entry, leave it blank. 2. Journalize the entries to record the following: If an amount box does not require an entry, leave it blank. Round your answer to the nearest dollar. a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond discount, using the straight-line method. 110 b. The interest payment on June 30, Year 2, and the amortization of the bond discount, using the straight- line method. dll III 3. Determine the total interest expense for Year 1. Round to the nearest dollar. 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? 5. Compute the price of $7,366,576 received for the bonds by using the Present value at compound interest, and Present value of an annuity. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences. Present value of the face amount Present value of the semiannual interest payments Price received for the bonds