Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Day Hardware company's payroll for November 2017 is summarized below: Amount Subject to Payroll Taxes Unemployment Tax Payroll Factory Sales Administrative Wages Due FICA

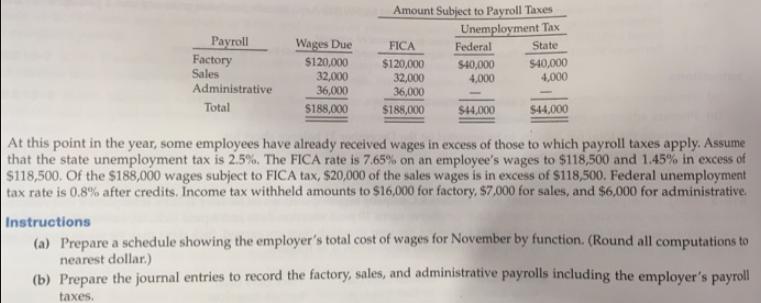

Green Day Hardware company's payroll for November 2017 is summarized below:

Amount Subject to Payroll Taxes Unemployment Tax Payroll Factory Sales Administrative Wages Due FICA Federal State $120,000 32,000 36,000 $120,000 32,000 36,000 $40,000 4,000 $40,000 4,000 Total $188,000 $188,000 $4.000 $44,000 At this point in the year, some employees have already received wages in excess of those to which payroll taxes apply. Assume that the state unemployment tax is 2.5%. The FICA rate is 7.65% on an employee's wages to $118,500 and 1.45% in excess of $118,500. Of the $188,000 wages subject to FICA tax, $20,000 of the sales wages is in excess of $118,500. Federal unemployment tax rate is 0.8% after credits. Income tax withheld amounts to $16,000 for factory, $7,000 for sales, and $6000 for administrative. Instructions (a) Prepare a schedule showing the employer's total cost of wages for November by function. (Round all computations to nearest dollar.) (b) Prepare the journal entries to record the factory, sales, and administrative payrolls including the employer's payroll taxes.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION PART1 Total Factory Sales Administrative Wages 188000 120000 32000 36000 FICA 13142 918...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started