Question

Entrust, Inc., is a global provider of security software; it operates in one business segment involving the design, production, and sale of software products for

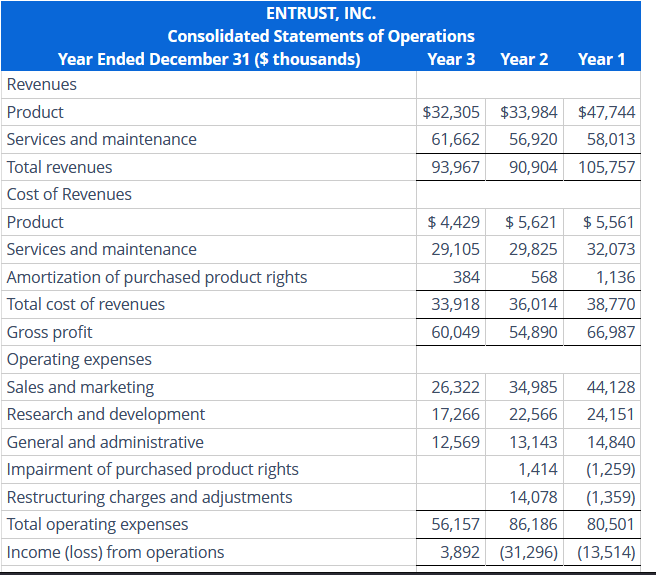

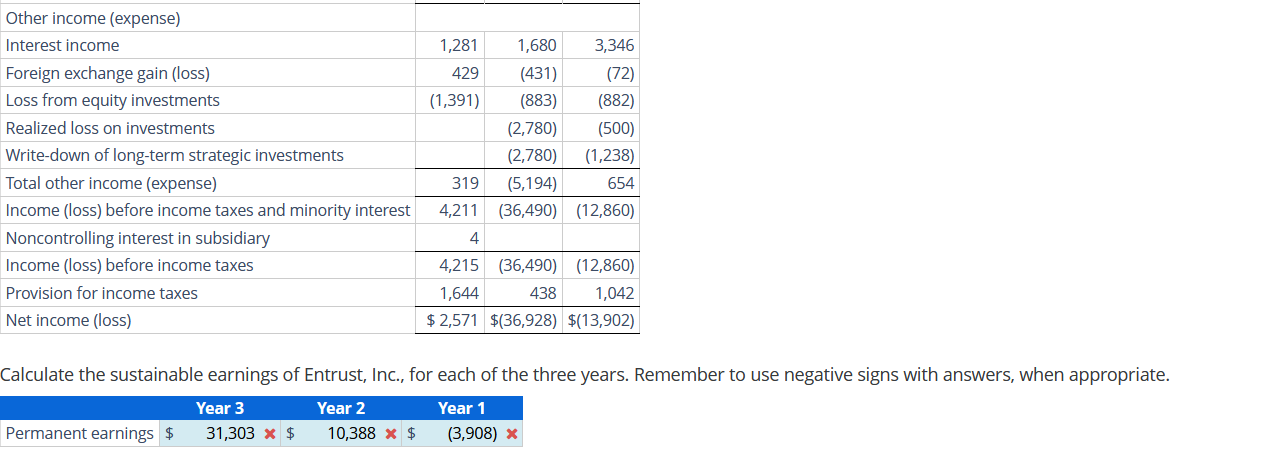

Entrust, Inc., is a global provider of security software; it operates in one business segment involving the design, production, and sale of software products for securing digital identities and information. The consolidated statements of operations for a three-year period (all values in thousands) follows. On January 1, Year 1, the Entrust common shares traded at $10.40 per share; by year end Year 3, the shares traded at $3.80 per share. The company's cash flow from operations was $(27,411), $(20,908), and $9,606, for Year 1, Year 2, and Year 3, respectively. Calculate the sustainable earnings of Entrust, Inc., for each of the three years. Compare the company's reported net income (loss) with its sustainable earnings. Does Entrust's share price at year-end Year 3 reflect the firm's apparent turn-around? Why or why not?

Year Ended December 31 ($thousands) ENTRUST, INC. Consolidated Statements of Operations Year 3 Revenues Product Services and maintenance Total revenues Cost of Revenues Product Services and maintenance Amortization of purchased product rights Total cost of revenues Gross profit Operating expenses Sales and marketing Research and development General and administrative Impairment of purchased product rights Restructuring charges and adjustments Total operating expenses Income (loss) from operations Year 2 $32,305 $33,984 61,662 56,920 93,967 90,904 Year 1 $47,744 58,013 105,757 $ 4,429 $ 5,621 $ 5,561 29,105 29,825 32,073 384 568 1,136 33,918 36,014 38,770 60,049 54,890 66,987 26,322 34,985 44,128 17,266 22,566 24,151 12,569 13,143 1,414 14,840 (1,259) 14,078 (1,359) 56,157 86,186 80,501 3,892 (31,296) (13,514)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Year 1 Cash flow from operations was 27411 Sustainable earnings Cash flow from operations Capitaliza...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started